Can Washington Fix Housing Affordability?

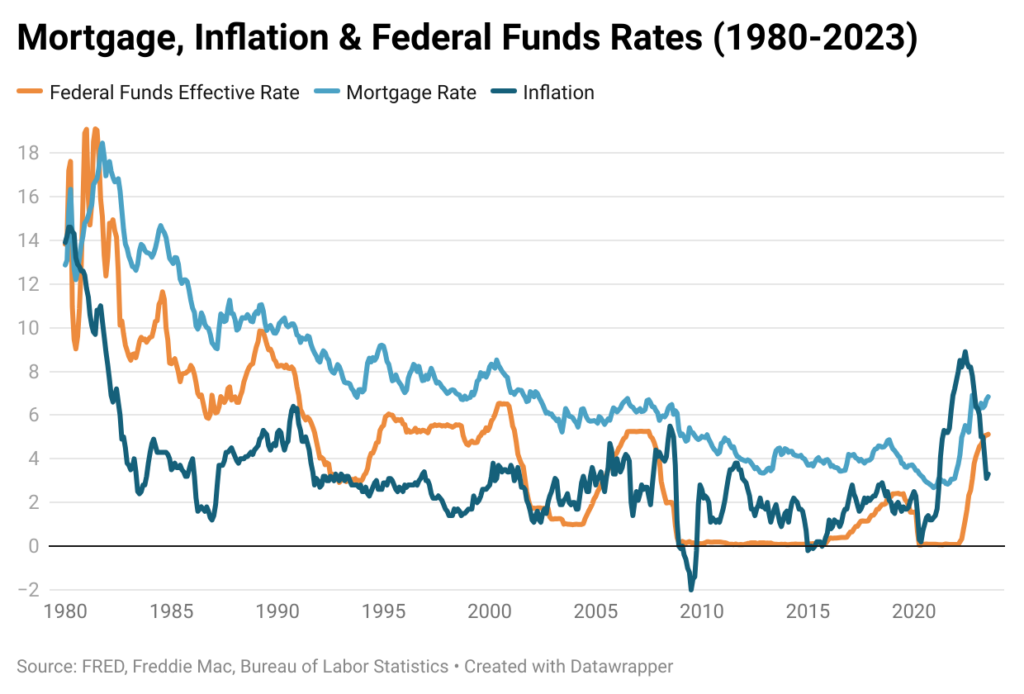

As housing affordability remains strained, policymakers are turning to two high-profile ideas: limiting large institutional investors from buying single-family homes and using government-backed purchases of mortgage-backed securities to lower mortgage rates. This article examines whether these policies can meaningfully improve affordability or whether their impact will be limited without addressing the deeper housing supply shortage.

Can Washington Fix Housing Affordability? Read More »