Valuation Technology Solutions Designed to Fulfill the Demands of Modern Mortgage Lending

Embrace the valuation products, solutions and technology to empower the data-driven, customer-centric mortgage lending process of today and the future.

Valuation Technology Solutions Designed to Fulfill the Demands of Modern Mortgage Lending

Embrace the valuation products, solutions and technology to empower the data-driven, customer-centric mortgage lending process of today and the future.

The Right Valuation Solutions for Every Market Need.

Veros provides residential real estate valuation tools to handle needs ranging from valuation ordering platforms with the power to manage your appraiser panel at origination, to portfolio analytics assessing risk on managed servicing assets, or to forecasting and making decisions on loan pools in the secondary market. Find the right valuation solution for you.

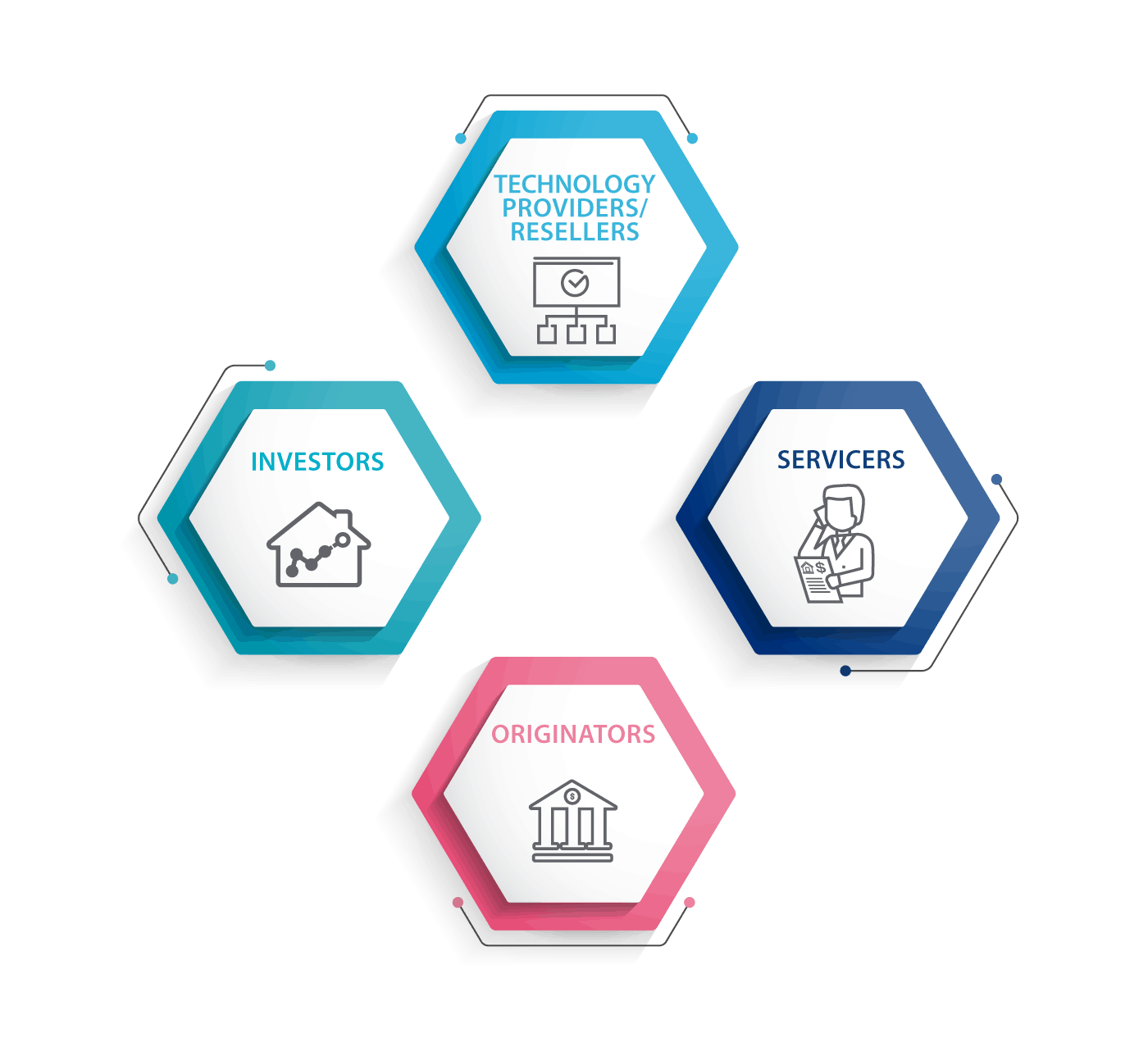

Industry Segments

Mortgage lenders concerned with accuracy in valuations and compliance choose Veros. Veros offers the systems that automate the valuation process from order and receipt to review and submission to UCDP, whether the loans are held in a portfolio or sold to the secondary market. Recognizing that credit unions and correspondent lenders have unique needs, Veros offers solutions designed to fit these distinct workflows and lending requirements.

In order to stay profitable, servicing professionals are focused on staying in sync with constantly evolving compliance requirements, while simultaneously responding to critical customer needs. Veros offers quick and powerful analytics to locate valuation risk, as well as the automated platform solutions that streamline workflows. These tools provide servicers the ability to stay on top on changes, be responsive to customers and manage overhead. Additionally, they allow servicers the ability to proactively monitor serviced loans to better manage assets and anticipate activity changes.

Investors need accuracy and precision when modeling risks and estimating collateral values. Veros’ suite of valuation and risk management products provide the tools investors need to isolate pre-distressed, at-risk credit exposures; estimate worst-case collateral values; and calculate net recoveries and losses on a portfolio basis. Finally, Veros’ forecasting products provide investors with the tools necessary to identify those neighborhoods across the nation, providing insights into the Zip codes, product types and price tiers that offer the greatest opportunities for value appreciation.

Technology companies provide the ecosystem that makes lending in today’s digital world possible. As the official technology provider for UCDP®, a MISMO workgroup member, CATC member, Mortgage Technology “Synergy” award-winner, and founder of the Predictive Methods Conference, Veros is committed to advancing the use and application of predictive analytics and mortgage technology. Contact us today to discuss integrations to UCDP, AVM reseller opportunities or the ability to add our powerful analytics alongside your own offerings.

In today’s regulatory environment, you can’t risk funding a loan on bad collateral or unreliable valuations. Mortgage professionals looking for transparency, superior data, high-level due diligence and a smart return on investment consistently turn to Veros for our premier data quality and our tools for automating or enhancing your quality control measures. From appraisal scoring tools to make your review and QC teams more efficient to Sapphire’s configurable rule sets and Veros’ close integration with UCDP for the ability to preview and resolve UAD errors with ease, Veros has your QC needs covered.

Veros’ Compliance and Audit Department (CAD) is prepared to assist current and prospective clients in the process of verifying, documenting and auditing the performance of models, data, security and technology surrounding each of our solutions. Veros’ CAD team is responsible for applying a compliance mindset toward each analytic and system we offer and continually raises the bar for the benefit of our clients.

Veros leverages technology and sophisticated modeling techniques to help uncover potential valuation risk. Whether your organization is looking to better manage risk in the appraisal acceptance and review process, on submission to the secondary market, or in benchmarking valuations, Veros has the tools for you.

When it comes to hands-on involvement with benchmarking, assessing test results, Veros remains one of the most active vendors in the industry. Veros embraces a hands-on approach with clients, identifying key operational goals, service-level requirements, documentation requirements, etc. and works diligently through its integrations managers, in-house customer support, compliance and audit personnel and others, to ensure a strong vendor-client relationship.

To Speak To Our Sales Team

866-458-3767 Option 2

Features

Improving Valuation for Mortgage Servicers and Investors in High-Risk Climate Zones

In this blog, learn how climate-related events affect valuation workflows and how Disaster Vision and ValINSPECT Disaster bring clarity to climate-driven uncertainty for lenders, servicers, and investors.

Veros and Valligent Appoint Industry Veteran Lora Helt as SVP of Sales

Veros and Valligent are proud to announce the appointment of Lora Helt as Senior Vice President of Sales. A recognized industry leader and 2023 HousingWire Woman of Influence, Helt brings over 20 years of experience in valuation and mortgage technology to lead the companies’ national sales strategy and revenue growth initiatives.

Can Washington Fix Housing Affordability?

As housing affordability remains strained, policymakers are turning to two high-profile ideas: limiting large institutional investors from buying single-family homes and using government-backed purchases of mortgage-backed securities to lower mortgage rates. This article examines whether these policies can meaningfully improve affordability or whether their impact will be limited without addressing the deeper housing supply shortage.