Originators

Valuation Technology Solutions Designed to Fulfill the Demands of Modern Mortgage Lending

Embrace the valuation products, solutions and technology to empower the data-driven, customer-centric mortgage lending process of today and the future

Originators

Valuation Technology Solutions Designed to Fulfill the Demands of Modern Mortgage Lending

Embrace the valuation products, solutions and technology to empower the data-driven, customer-centric mortgage lending process of today and the future

Automated Valuation

Solutions

Collateral Risk

Analysis

Appraisal Data

Delivery

Home Price Trends

& Forecasts

Valuation Management

System

Explore the Valuation Data & Technology Solutions that Mortgage Loan Originators Depend On For Accurate Collateral Valuation and Safer Loans

Smart lending decisions result from data. Veros provides mortgage lenders with the automated, data-fueled collateral valuation tools to make solid decisions to close safer loans. Through Veros’ analytic tools and valuation solutions, you’ll gain a 360-degree perspective on a subject property including the home’s past, present and future value as well as the expected risk of the subject property, neighborhood and market. When the loan’s collateral doesn’t equate to a smart lending decision, Veros tools will let you know at the point of sale, when there is still time to salvage the transaction without the risk of originating a bad loan. Now that’s smart mortgage lending!

Complete Collateral Risk

Assessment & Management

VeroSELECT Collateral Risk and Valuation Management Platform offers a complete suite of home valuation solutions and alternative valuation services for data-driven investing. You’ll be able to identify collateral risk and determine the true home value all-in-one collateral risk assessment and management system. VeroSELECT is simply a smarter approach to managing valuation risk for investments at the property and portfolio levels.

Flexible Property Valuation

Solutions to Meet Your Needs

Leverage this proprietary, on-demand automated valuation model (AVM) offering national coverage, consistent accuracy with the most meaningful confidence scores.

Generate, analyze, rank, and report the multiple AVMs required for PACE lending in California.

Gain absolute control of your AVM workflow to implement simple, or highly sophisticated cascades.

Collateral Risk Management Solutions for Mortgage Origination

Collateral valuation during the loan origination process, requires the most accurate data, technology and collateral risk solutions. With the Veros empowering your collateral valuation process during loan origination, you will be able to instantly assess the risk of a potential loan or identify potential problems with appraisals and much more.

When disaster strikes – be prepared with the parcel-level information on how much – if at all – a specific property was impacted by a hurricane, wildfire, earthquake, flood or other disaster. Veros Disaster Vision data is available as an add on when you choose VeroVALUE AVMs.

You’ll be able to make faster, more insightful and virtually instantaneous analysis of appraisal reports and their associated risk. VeroSCORE delivers concise, easy-to-apply corrective actions, replacing the complex, time-consuming manual appraisal review with immediate automated analysis and scoring. This significantly simplifies the review process and enables users to identify high-risk appraisals before they result in rejections or repurchase requests.

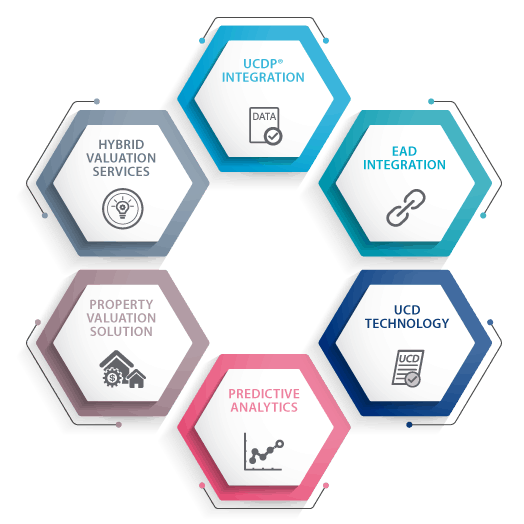

Mortgage Loan Appraisal Management & Loan Data Delivery

Veros offers systems to automate the management of your appraiser panels and appraisals, including the data delivery system to ensure your appraisal data files are delivered directly to both the Uniform Collateral Data Portal® (UCDP®) and Electronic Appraisal Delivery (EAD) portals, seamlessly.

PATHWAY provides you with a seamless submission solution to Fannie Mae®, Freddie Mac® and FHA’s appraisal delivery portals — all with minimal integration effort required. PATHWAY is an ideal solution for volumes too large for manual upload to UCDP or EAD’s web interfaces.

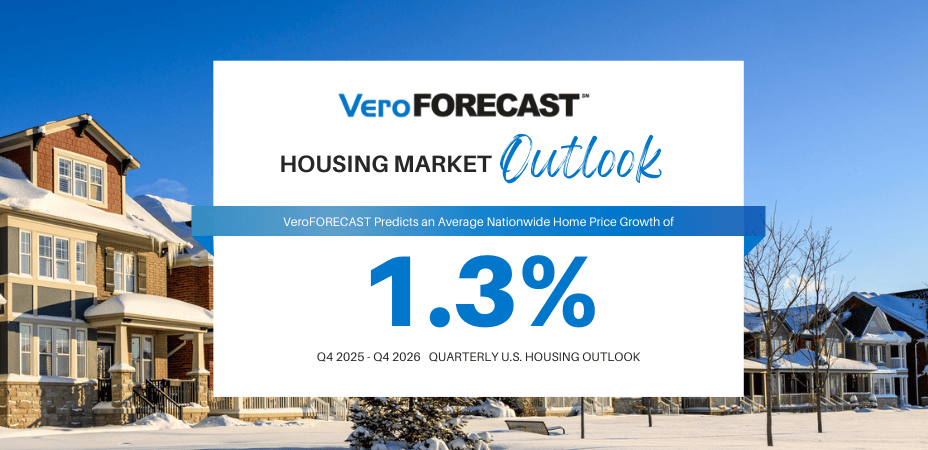

Home Price Trends & Forecast

Stay current on the latest insights in home prices wherever you originate loans across the nation. Veros gives you first look into the home price trends–historical home values and the projection of home prices—using our data-rich HPI, VeroFORECAST, and other economic variables to provide you with clear movements of home values. No matter if it is a volatile or dynamic market, Veros provides insight into the overall housing economy, showing you where home values are falling or appreciating, and providing you with reliable real estate data and analytics.

A key resource for forecasting and strategic planning, you’ll gain pinpoint accuracy to spot specific percentage value changes down to the zip code level and segmented by price tier and property type.large for manual upload to UCDP or EAD’s web interfaces.

VeroHPI provides you with direct access to robust trending home price logic. The index offers national coverage and is available at the CBSA (county-based statistical area) or FIPS (Federal Information Processing Standard) levels.