Resellers/Technology Providers

Valuation Technology Solutions for Growth Focused Technology Innovators & Settlement Service Providers

Accelerate your business with the valuation products, solutions and technology to fuel your company's growth engine.

Valuation Technology Solutions for Growth Focused Technology Innovators & Settlement Service Providers

Accelerate your business with the valuation products, solutions and technology to fuel your company’s growth engine.

Automated Valuation

Solutions

Collateral Risk

Analysis

Appraisal Data

Delivery

Home Price Trends

& Forecasts

Valuation Management

System

Discover the Valuation Data & Technology Solutions to Empower Your Business

When it comes to leveraging technology, data and analytics solutions from another vendor, you need to trust that vendor to deliver at the quality and service level your business demands. That’s why settlement service innovators choose Veros. Veros can help you meet the demands of compliance and cost with trusted market analytics, reliable appraisal data delivery, and superior valuation and risk management solutions. Choosing Veros, you’ll benefit from accurate home valuation solutions that increase efficiency by reducing churn times while ensuring the highest level of quality, consistency and regulatory compliance.

All-in-one Collateral Risk

Assessment & Management

VeroSELECT offers a complete suite of home valuation solutions and alternative valuation services for data-driven investing. You’ll be able to identify collateral risk and determine the true home value all-in-one collateral risk assessment and management system. VeroSELECT is simply a smarter approach to managing valuation risk for investments at the property and portfolio levels.

Flexible Property Valuation

Solutions to Meet Your Needs

Automated Valuation Solutions

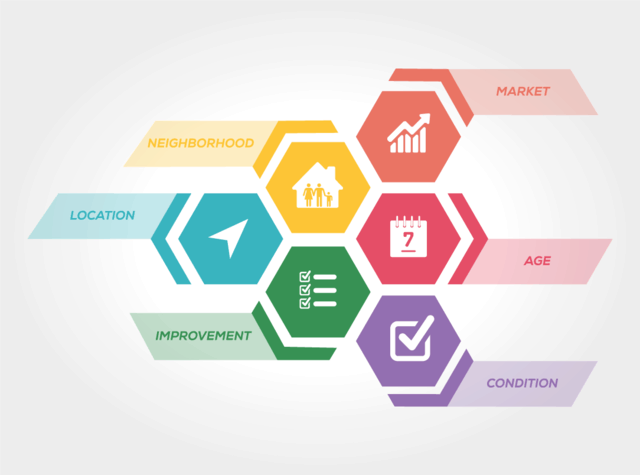

When you need to provide predictive property analytics, these solutions provide a truly transparent, 360-degree view of collateral risk.

Leverage this proprietary, on-demand automated valuation model (AVM) offering national coverage, consistent accuracy with the most meaningful confidence scores.

Gain absolute control of your AVM workflow to implement simple, or highly sophisticated cascades, or resell these AVM services to end-users with specific business needs.

Choose this industry-leading residential property valuation tool for fast, accurate, and realistic results, even in rapidly changing markets. It’s your ideal solution for frequent access to current estimates of value across a whole portfolio of properties.

Leverage this index-only based automated valuation solution when you need time-based residential property valuations derived from advanced analysis of local and regional market trends.

Generate, analyze, rank, and report the multiple AVMs required for PACE lending in California.

Dealing with distressed properties? VeroVALUE REO is the must-have tool for shortening REO disposition timelines and optimizing less-than-ideal recoveries. VeroVALUE REO addresses the challenges resulting from distressed assets, increased foreclosure rates, and expanding REO portfolios.

Collateral Risk Management Solutions

As a reseller of collateral valuation technology, you need absolute confidence in the risk management products and systems you provide. Gain the analytics and insights to spot risks quickly, act on opportunities and turn the insights into action. Easily monitor your portfolio of properties, instantly assess a loan’s risk, or identify problematic appraisals beforehand. Veros provides the vital analysis to positively impact your organization’s bottom line.

Collateral Risk Analysis

Understanding, detecting and measuring the risk of mortgage collateral is essential to your business. With the collateral risk solutions from Veros, you will have the insight to understand the risk and severity of collateral-related loss events from market changes to the impact of disasters.

When disaster strikes – be prepared with the parcel-level information on how much – if at all – a specific property was impacted by a hurricane, wildfire, earthquake, flood or other disaster. Veros Disaster Vision data is available as an add VeroVALUE AVMs.

You’ll be able to make faster, more insightful and virtually instantaneous analysis of appraisal reports and their associated risk. VeroSCORE delivers concise, easy-to-apply corrective actions, replacing the complex, time-consuming manual appraisal review with immediate automated analysis and scoring. This significantly simplifies the review process and enables users to identify high-risk appraisals before they result in rejections or repurchase requests.

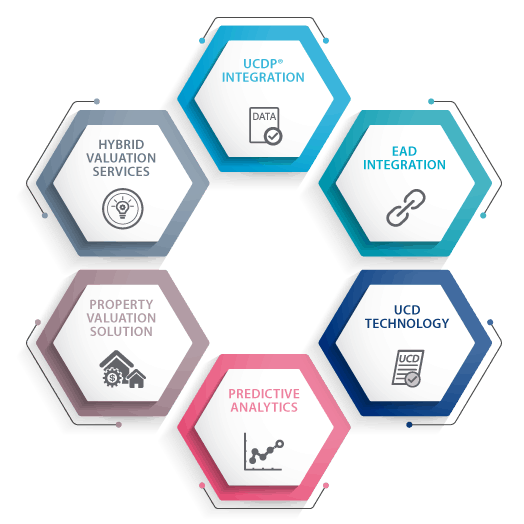

Appraisal Management & Data Delivery

Veros offers systems to automate the management of your appraiser panels and appraisals, including the data delivery system to ensure your appraisal data files are delivered directly to both the Uniform Collateral Data Portal® (UCDP®) and Electronic Appraisal Delivery (EAD) portals, seamlessly.

PATHWAY provides you with a seamless submission solution to Fannie Mae®, Freddie Mac® and FHA’s appraisal delivery portals — all with minimal integration effort required. PATHWAY is an ideal solution for volumes too large for manual upload to UCDP or EAD’s web interfaces.

Home Price Trends & Forecast

Stay current on the latest insights in home prices across the nation. Veros gives you a first look into the home price trends–historical home values and the projection of home prices—using the data-rich HPI, VeroFORECAST, and other economic variables to provide you with clear movements of home values. No matter if it is a volatile or dynamic market, Veros provides insight into the overall housing economy, showing you where home values are falling or appreciating, and providing you with reliable real estate data and analytics.

A key resource for forecasting and strategic planning, you’ll gain pinpoint accuracy to spot specific percentage value changes down to the zip code level and segmented by price tier and property type.large for manual upload to UCDP or EAD’s web interfaces.

VeroHPI provides you with direct access to robust trending home price logic. The index offers national coverage and is available at the CBSA (county-based statistical area) or FIPS (Federal Information Processing Standard) levels.

Become a Reseller

TO SPEAK TO OUR SALES TEAM