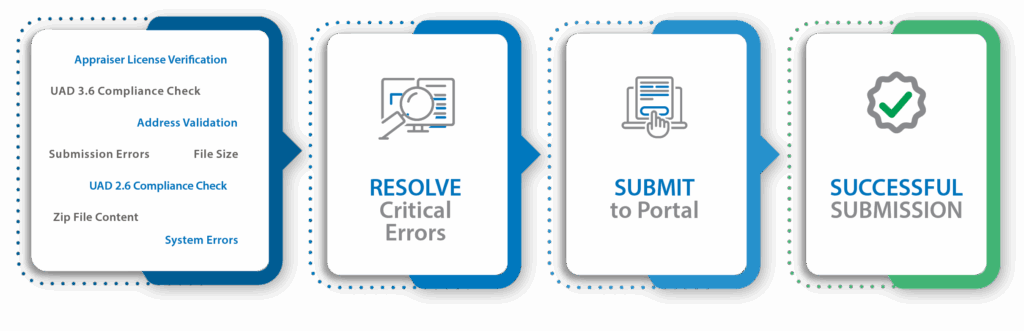

Identify and Resolve Appraisal Errors Earlier in the Appraisal Workflow

Submission Preview is a powerful pre-submission tool that allows lenders, Appraisal Management Companies, and Appraisers to preview their appraisal submissions before they are sent to the government-sponsored enterprises (GSEs) via the Uniform Collateral Data Portal® (UCDP®) or Federal Housing Administration (FHA) via the Electronic Appraisal Delivery (EAD) Portal.

By simulating the submission process, users can identify and correct potential errors or data quality issues upfront—saving time, reducing revision cycles, and ensuring smoother delivery.

The Submission Preview Product Helps You Focus On Quality

Improve quality by returning proactive, detailed quality control findings based on anticipated EAD and UCDP warnings and fatal errors.

Gain competitive advantage by helping you take control of potential appraisal errors early on, reducing turnaround times.

Save time & money through better controlled turnaround times, streamlined operational processes and by limiting unnecessary revisions.

Mitigate quality risk by helping lenders align with the GSE and FHA standards for appraisal portal acceptance.

Boost reputation management with the assurance you retain a clean “bill of health” regarding EAD and UCDP submissions.

What’s Included: Comprehensive Validations

Submission Preview runs a comprehensive set of validations to help you get it right the first time:

Appraiser license verification:

confirm license is active and valid.

Address validation:

ensure property addresses are standardized and correct.

UAD 3.6 compliance check:

validate against the latest dataset requirements.

Zip file extraction:

securely validate package contents and formatting.

Submission errors:

identify fatal issues or warnings prior to submission.

System errors:

flag technical issues that could block acceptance.

File size review:

check for oversized files that may fail at delivery.

Trusted Experience Building Powerful Products & Services

Veros built and maintains UCDP® and EAD and has its own direct integration with the largest submission volume. no other company understands the appraisal submission portals better.

Veros’ UCDP and EAD Preview solution is always up to date with all the latest UCDP and EAD known critical errors and warnings.

Veros is the first technology provider to offer a UCDP and EAD Submission Preview through its proprietary system integrations.

Veros’ dedicated, in-house integration and customer support teams ensure your integration is set-up for delivery that is fast, efficient and reliable.

Reach out for more information or to test out Submission Preview.

Disclaimer: Veros and Submission Preview do not guarantee GSE acceptance of submitted loans. All UCDP® and EAD participants should review official GSE and FHA requirements.