Is Inflation Back on the Rise?

Overall inflation increased by 2.7% from a year ago in June 2025, up from 2.4% in the previous month, according to data released by the Bureau of Labor Statistics. Core inflation, that excludes food and energy prices, came in at 2.9% in June, the highest reading for this metric since February 2025. This reversal in trend for core inflation substantially diminished expectations for a Fed rate cut in July. Before considering a rate cut, the Fed would be looking for evidence of either that inflation is under control with no risk of resurgence or a significant weakening of the labor market. Since neither of these conditions has materialized, there appears to be little urgency among Fed officials to adjust its rate policy despite significant external pressure for cuts as deep as 3%.

The strong inflation reading for June was largely due to higher shelter and food prices, as well as goods that are more prone to higher tariffs, such as clothing and furniture. Food prices are not going the way Americans want them to, increasing by 3% y-o-y, and by 0.3% m-o-m. While energy prices overall decreased by -0.8% y-o-y, energy services (electricity and utility gas service) increased by 7.5% y-o-y. Inflation pressure is likely to persist over the next few months if tariffs are imposed on a host of countries starting August 1st.

The shelter category of the CPI (Consumer Price Index), which includes housing costs, continued to be a significant and persistent driver of overall inflation. The shelter index increased 3.8% over the last year. However, there are emerging indicators that housing cost pressures may be easing. A recent surge in multifamily housing construction has contributed to relatively flat asking rents across much of the country over the last year, and home price appreciation is decelerating from the elevated levels observed in previous years. Even as home price growth moderates, the impact of the substantial housing cost increases from recent years is still acutely felt by many Americans. Consequently, housing affordability remains a significant challenge for prospective homebuyers.

The U.S. Job Market: What's Really Happening?

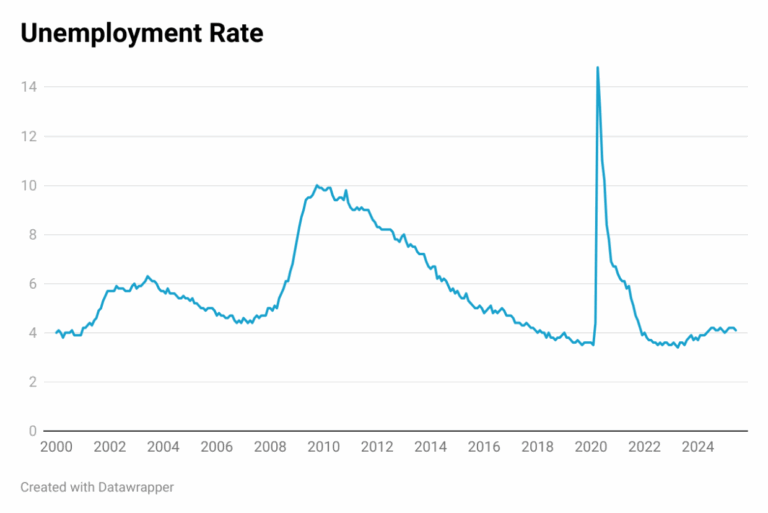

The U.S. unemployment rate saw a slight dip from 4.2% in May to 4.1% in June 2025, as employers unexpectedly added 147,000 jobs. However, a closer look at these headline figures reveals underlying weaknesses within the labor market.

The private sector contributed only 74,000 of the 147,000 jobs gained, which is approximately half the number hired in May. The primary boost to overall employment came from state and local government hiring. Within the private sector, job additions were primarily driven by private education and health services (51,000 jobs), followed by leisure and hospitality (20,000 jobs), and construction (15,000 jobs). Conversely, professional and business services shed 7,000 jobs, a trend also seen in manufacturing, which continues to struggle due to tariffs. Retail added a modest 2,400 positions. These overall solid job gains offer the Federal Reserve little incentive to reduce its key interest rate at the upcoming July meeting.

Despite the job gains, the share of Americans working or actively seeking jobs declined by 130,000 in June, compounding a significant 625,000 drop in May. This decrease in labor force participation has contributed to the lower unemployment rate. One contributing factor to this trend is the ongoing retirement of baby boomers. Additionally, hiring has cooled over the past couple of years, making it more challenging for young individuals and those re-entering the workforce to secure employment. This has resulted in longer job searches or extended periods of unemployment. Data from the Job Openings and Labor Turnover Survey (JOLTS) indicates that hiring decreased by 112,000 in May. Furthermore, the number of discouraged workers—individuals who believe no jobs are available for them—rose by 256,000 last month, reaching a total of 637,000.

Mortgage Rates Still High? What's Keeping the Housing Market Stalled.

The 30-year fixed mortgage rate averaged 6.75% on July 17, 2025, consistently staying above 6.6% since October 2024, according to Freddie Mac. This sustained level of rates continues to stall the U.S. housing market, as affordability challenges deter potential buyers.

Mortgage rates are shaped by several factors, including the Federal Reserve’s interest rate policy and bond market investors’ expectations for the economy and inflation. The primary indicator for pricing home loans is the 10-year Treasury yield. This yield is expected to remain in a tight range over the coming months, largely due to uncertainty in trade policy and mounting concerns over the nation’s increasing debt load, both of which contribute to elevated Treasury yields. Consequently, Veros’s forecast predicts that mortgage rates will remain high over the next 12 months, edging only slightly lower to 6.5% by June 2026.

New Home Construction Hits Lowest Point in Nearly a Year

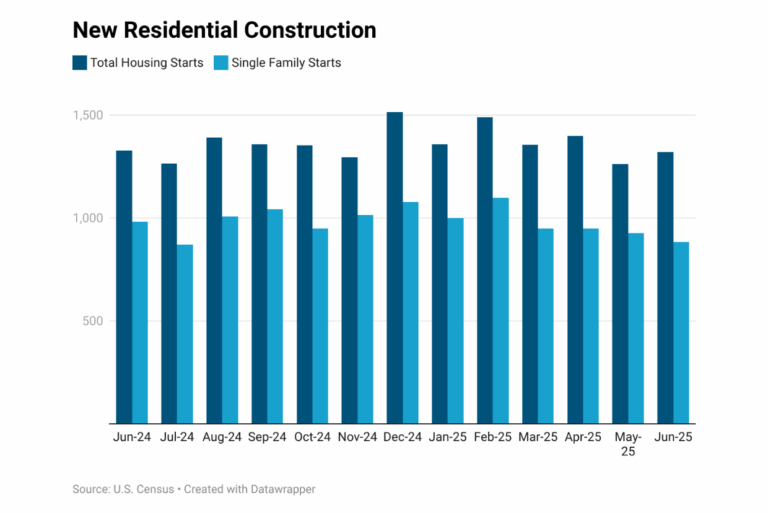

Single-family housing starts declined in June 2025, reaching their lowest rate since July 2024. This slowdown, with starts at a seasonally adjusted annual rate of 1,321,000 (0.5% below June 2024), reflects persistent challenges for the housing sector. Elevated interest rates, rising inventories, and ongoing supply-side issues continue to act as headwinds.

Permits for future single-family home construction also tumbled last month to a more than two-year low, aligning with dampened sentiment among homebuilders. While sharp drops were observed in the South, Midwest, and West, single-family homebuilding permits did rise in the Northeast, though this region represents only a small portion of the overall housing market. The general slump in demand has led to an increased supply of homes for sale, which in turn discourages builders from initiating new housing projects.

U.S. Housing Market Hits "Pause Button": What's Next for Home Prices?

Veros’s Q2 2025 VeroFORECAST™ projects average nationwide home price appreciation of 2.2% over the next year. Our latest analysis reveals the housing market is stalled, with high mortgage rates (still above 6.6%), stubbornly high prices, and growing economic uncertainty creating tough conditions for buyers and sellers. While inventory is slowly increasing in some areas, sellers are holding firm, creating a “frozen state” where affordability remains a major hurdle.

Curious where home prices will still climb, and which markets are facing declines? Discover the top 10 projected strongest and weakest markets, and what’s driving these regional shifts

About Reena Agrawal, Senior Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.