Mortgage Quality Control and Analytics

The One Valuation SaaS for all your Property Valuation Needs

VeroSelect is the only property valuation solution you may ever need, providing instant access to a complete suite of valuation solutions and services.

Mortgage Quality Control and Analytics

Veros offers the most accurate automated tools available to show lenders exactly how much risk is involved in every deal in the pipeline.

These fast, affordable solutions are not subject to the pressures that plague human appraisers and they never, ever take a day off. Lenders know sooner which loans to fund; investors buy with confidence. Lenders cannot afford to miss a single instance of mortgage fraud and they can’t waste valuable time investigating false positives. They need to know at a glance whether fraud is present in the transaction and where it is most likely to be found. When combined with the other tools in the Veros Quality Control Solution family, lenders are effectively insulated from collateral fraud.

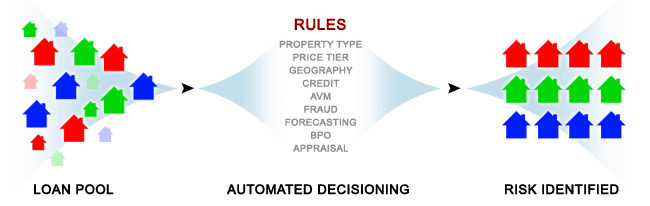

One Loan or the Whole Pool

Veros offers a suite of tools for mortgage lending quality control and lenders are able to choose what they need to manage the risks they face. Whether desk reviewers need to quickly assess the suitability of comparable properties or see a complete market analysis, Veros makes it possible to drill down through a wealth of data to see how this property stacks up to others in the same zip code, price tier and property type. Veros’ valuation management platforms combine these tools – including property data both inside and outside of the company- into a single platform for enterprise decision management, risk mitigation and fraud control. The platform works regardless of the collateral valuation used, from AVM to full appraisal.