CPI Relief... Except for Housing?

Consumer Price Index (CPI) data for March 2025 indicates a further easing of inflation, with the all items index increasing by 2.4% year-over-year, down from the previous month’s 2.8%. Despite the overall cooling of inflation, the shelter category within the CPI remains a significant contributor to the overall price increase. In March, shelter costs rose by 0.2 percent month-over-month and 4.0 percent over the past year. While the pace of housing cost growth is moderating, the substantial price surges of the preceding years continue to strain household budgets, making housing affordability a major concern for many Americans.

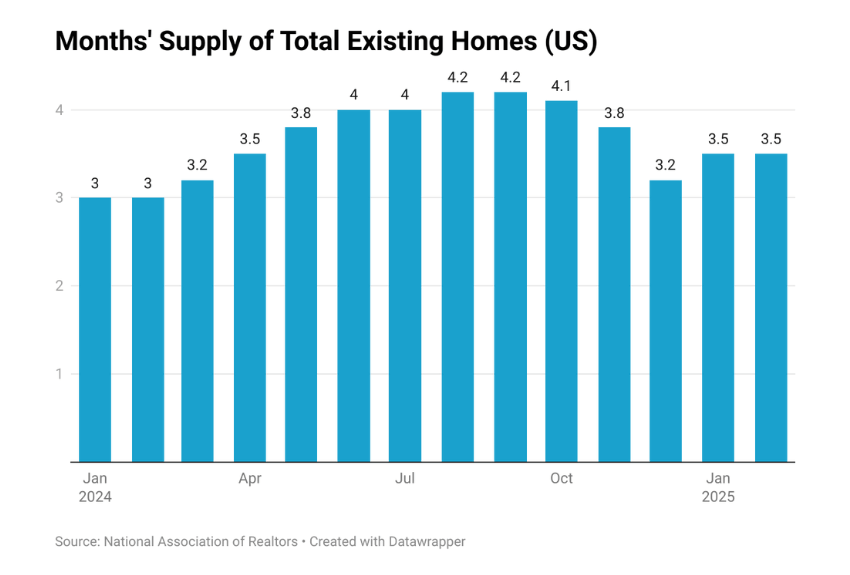

For potential homebuyers, the market presents a complex picture. Inflation is easing, but mortgage rates remain elevated, and housing inventory remains constrained, with only a 3.5-month supply nationally in February, well below the 5 to 6 months considered a balanced market.

Simultaneously, home prices continue to rise, with the Case-Shiller national home price index reporting a 4.1% year-over-year increase in January 2025.

For homeowners considering selling, the persistent housing shortage may offer an advantage in securing a better price. However, sellers who then need to purchase a new home will face the same challenges of limited inventory and potentially high mortgage rates as other buyers. Furthermore, regional market variations are significant, with the South experiencing much lower year-over-year price increases compared to the West, Midwest, and Northeast.

Signs of a Slowing US Job Market Emerge in March

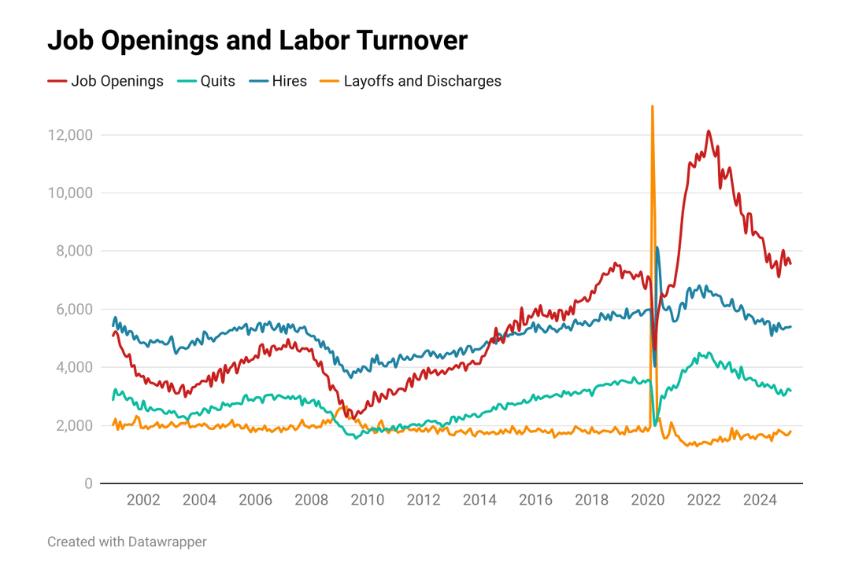

Despite a slight uptick in the unemployment rate to 4.2% in March 2025 from February’s 4.1%, the US labor market demonstrated continued resilience by adding a robust 228,000 jobs, exceeding expectations and rising from the previous month’s 117,000 (Bureau of Labor Statistics). However, beneath this apparent strength, emerging signs of cooling are evident. Recent JOLTS (Job Openings and Labor Turnover Survey) data revealed an increase in layoffs of 116,000 in February compared to January, while quits continued their downward trend, falling to 3.195 million in February, reflecting reduced worker confidence and employment flexibility. Adding to these indicators, job openings experienced a larger-than-anticipated drop to 7.568 million from January’s revised 7.762 million, generally signaling a decrease in available opportunities and a cooling labor market.

Mortgage Rates Jump Amid Bond Market Jitters

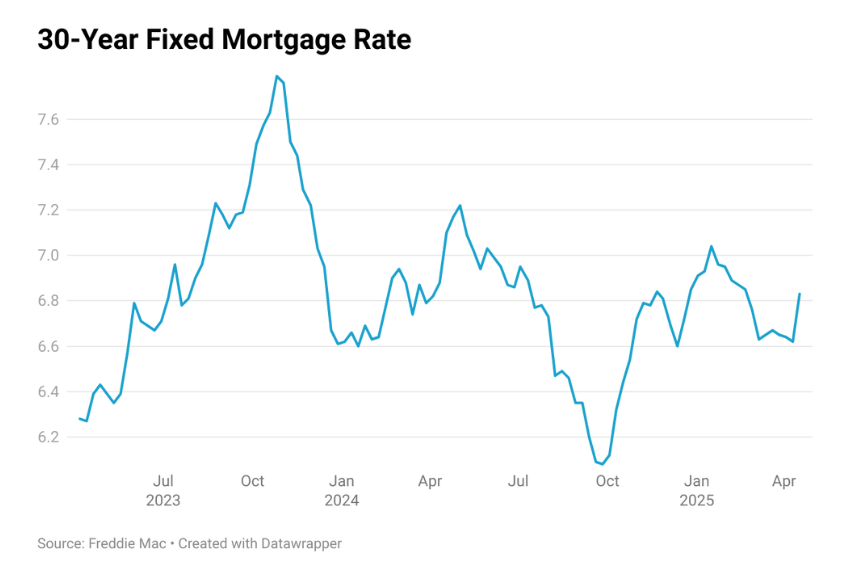

The 30-year fixed mortgage rate averaged 6.8% on April 17, 2025, increasing from 6.6% the previous week (Freddie Mac®). This rise tracked higher 10-year Treasury yields, influenced by bond market volatility and expectations of tariff-induced inflation, though the latter’s impact is still unclear. For homebuyers, focusing on their personal financial circumstances is more prudent than attempting to time the market. While Veros forecasts suggest a slight dip in mortgage rates by year-end, the extent of this decrease will hinge on inflation, the implementation and effects of tariffs, and the overall health of the US economy.

New Construction: Builders See Higher Costs, Uncertainty Ahead

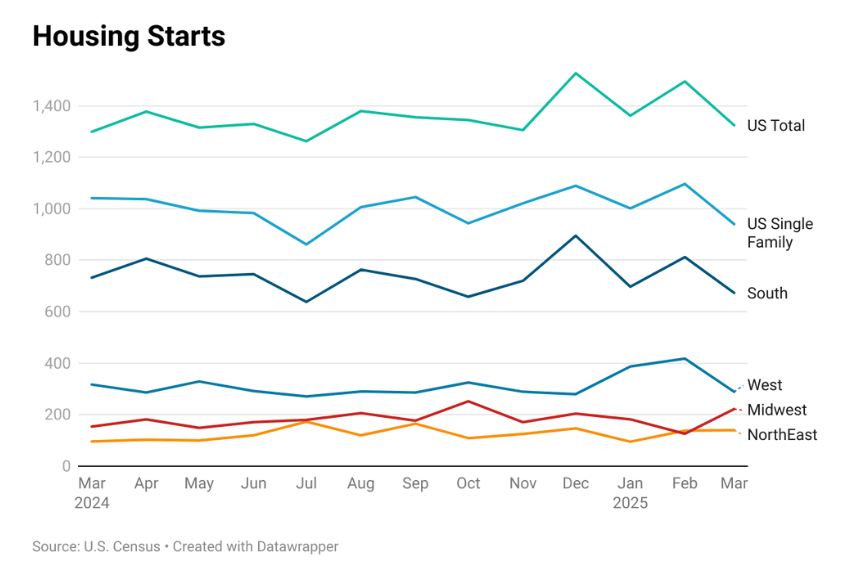

US housing starts dropped by 11.4% in March compared to the previous month, primarily driven by a sharp 14.2% drop in single-family construction that reached an eight-month low. The West and South regions led this contraction, with the South’s decline being particularly noteworthy due to its position as the largest market for new home construction and its influence on the national trend. The decline in single-family starts is attributed to persistently high mortgage rates compounded by increasing insurance and real estate taxes, that are eroding affordability. Furthermore, a recent surge in consumer uncertainty and concern is likely causing potential homebuyers to postpone significant purchases like homes.

The overall sentiment in the newly built single-family home market remained negative at 40 in April, according to the National Association of Home Builders (NAHB)/Wells Fargo HMI. This negativity is largely attributed to growing economic uncertainty stemming from tariff concerns and elevated building material costs. NAHB noted that builders are increasingly uncertain due to tariff-induced price volatility for building materials, which compounds existing challenges like labor shortages and a lack of buildable lots. NAHB also emphasized that policy uncertainty, particularly tariffs, is hindering builders’ ability to price homes accurately and make business decisions, with 60% reporting supplier price increases averaging 6.3% due to tariffs, translating to an estimated $10,900 cost increase per home. In response to these pressures, 29% of builders continued to cut prices by an average of 5% in April, while the use of

Housing Forecast: Slow and Steady... Mostly

The Q1 2025 VeroFORECASTSM projects a slight slowdown in national home price appreciation to 2.4%, amidst persistent high mortgage rates and inflation concerns, suggesting a cautious outlook for buyers and sellers navigating the spring season. However, this national stability masks significant regional divergences, with surprising strength persisting in the Northeast and Midwest while the Sunbelt faces headwinds from increased inventory and affordability challenges. Discover the top 10 hottest and coldest housing markets predicted for the next year.

Rates, Tariffs and Sentiment: Why Homebuyers Are Hesitant in 2025?

As the spring 2025 housing market unfolds, we see increasing supply met with subdued buyer demand. While the inventory of homes available for sale has seen a positive uptick, growth remains incremental. Nationally, the current 3.5 months’ supply (February 2025) offers more options than the tight 3-month inventory seen at this time last year, yet it still falls considerably short of the 5-6 months considered indicative of a balanced market where neither buyers nor sellers hold excessive leverage.

This slight expansion in choice, however, hasn’t translated into a surge of eager homebuyers. Many potential buyers, already grappling with affordability concerns, have retreated to the sidelines as mortgage rates experienced further elevation. Starting the season around 6.6%, the average 30-year fixed mortgage rate sharply jumped to 6.8% by April 17th (Freddie Mac). This increase was largely triggered by rising Treasury yields, a consequence of investors reacting to the US announcement of tariffs by selling US bonds and the anticipation of escalating prices. This added layer of cost has amplified the existing affordability challenges, pushing homeownership further out of reach for some.

Compounding this situation is a significant decline in consumer sentiment, casting a shadow of uncertainty over buyer confidence. The University of Michigan’s mid-April survey revealed a stark drop in consumer sentiment to 50.8, a substantial 10.9% decrease from March’s 57.0 and a staggering 34.2% lower than the reading a year prior. This marks the second-lowest point in the survey’s extensive history dating back to 1952, with negative sentiment spreading across all demographic groups. Further, the proportion of respondents anticipating a rise in unemployment over the coming months has been steadily increasing for the past five months, now reaching its highest level since the Great Recession in 2009. This growing unease about job security further contributes to the hesitancy observed among potential homebuyers in the spring 2025 housing market.

More homes on the market means that there is no intense upward pressure on prices, suggesting that overall home price growth will likely be modest nationwide. While the pace of price appreciation is slowing, this national average masks significant variations at the local level. Markets in the Northeast and Midwest are exhibiting considerably more strength compared to those in the South, particularly in states like Florida and Texas. In these southern regions, substantial new construction has significantly boosted the housing supply, but this influx of homes is struggling to find sufficient buyers. Reinforcing these trend, D.R. Horton, the nation’s largest homebuilder, recently stated that “This year’s spring selling season started slower than expected, as potential homebuyers have been more cautious due to continued affordability constraints and declining consumer confidence.” This cautious buyer sentiment, coupled with the increased supply in certain regions, points to a more tempered housing market for the spring of 2025.

About Reena Agrawal, Senior Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.