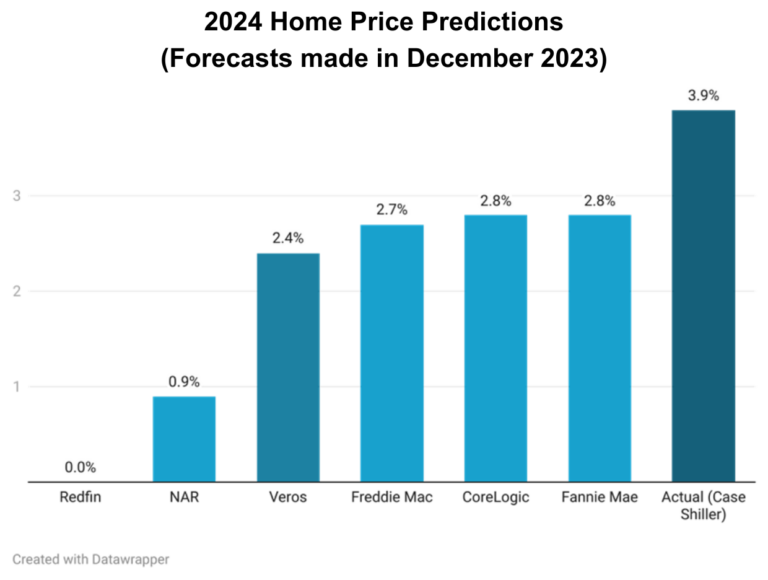

According to the Case Shiller index, U.S. home prices saw a 5.6% increase between December 2022 and December 2023. Veros Real Estate Solutions (Veros®) anticipated a deceleration in this trend for 2024, forecasting a 2.4% rise from Q4 2023 to Q4 2024. This projection was based on the expectation of sustained elevated mortgage rates, which would maintain the “lock-in effect” limiting supply and simultaneously dampen demand due to affordability constraints. However, the housing market demonstrated greater resilience than initially projected, with the Case Shiller index indicating an actual price growth of 3.9% in 2024.

Veros’ prediction of a slowing housing market was not unique. Freddie Mac® shared a similar forecast at 2.7% growth, while Fannie Mae® and CotalityTM anticipated a slightly higher 2.8% increase. Redfin® presented the most pessimistic outlook, projecting a flat market, with the National Association of REALTORS® slightly more optimistic at 0.9%.

Veros projected a 2.4% home price growth for 2024 based on the assumption that mortgage rates would remain elevated, ending the year at 7.1% compared to the actual of 6.8% for December 2024 as reported by Freddie Mac. This contrasted with the prevailing forecasts at the beginning of 2024, which anticipated rates falling below 6% due to expectations of significant Fed rate cuts. However, Veros anticipated fewer rate cuts due to persistent inflation concerns, leading to a more accurate prediction of mortgage rates staying around 7%. Ultimately, the Fed cut rates only three times later in the year (2024), and mortgage rates remained high.

Veros’ home price growth forecast accurately anticipated persistent inflation, with the Consumer Price Index (CPI) reaching 2.9% in December 2024. Key inflation drivers, such as gas, food, vehicle, and shelter costs, continue to exert upward pressure on prices. Housing costs, in particular, have been stubbornly high since the pandemic, with significant increases in home prices, rents, and mortgage rates. Additionally, robust wage growth exceeding inflation has sustained consumer spending, further contributing to inflationary pressures.

However, Veros’ unemployment forecast of 4.7% for December 2024 proved to be more pessimistic than the actual 4.1% rate. The labor market has proved to be resilient despite cooling off across several sectors. This could be because the unemployment rate only measures those actively seeking work, potentially excluding discouraged workers or those who have left the workforce. It also does not account for people who are underemployed, that is, working part-time when they would rather be working full-time.

In conclusion, Veros correctly identified the prevailing headwinds of elevated mortgage rates and persistent inflation that would temper the house price growth seen in 2023. This underscores the complex interplay of macroeconomic factors influencing the housing sector. While Veros’ forecasts for mortgage rates and inflation proved largely accurate, the underestimation of the labor market’s strength highlights the challenges in predicting all economic variables with precision. Ultimately, the 2024 housing market demonstrated a greater ability to navigate affordability challenges and the lock-in effect than many anticipated, resulting in a more robust level of price appreciation than initially expected.

Want to gain deeper insights into future housing market trends? VeroFORECAST has demonstrated consistent strength and accuracy for over ten years, providing economists, statisticians, and business leaders across the mortgage industry with pinpoint accuracy on percentage value changes down to the zip code level, segmented by price tier and property type. Analyze residential home values up to 24 months into the future at the local level, understand market opportunities and risks, mitigate risk, and enhance overall risk management. Learn more about the power of VeroFORECAST today!