In this short article, we look at three different consumer mortgage metrics when comparing the economic conditions today to the Great Recession over a decade ago. We will show that even with higher inflation and rising mortgage rates, consumers today are in materially better financial shape.

Credit Quality

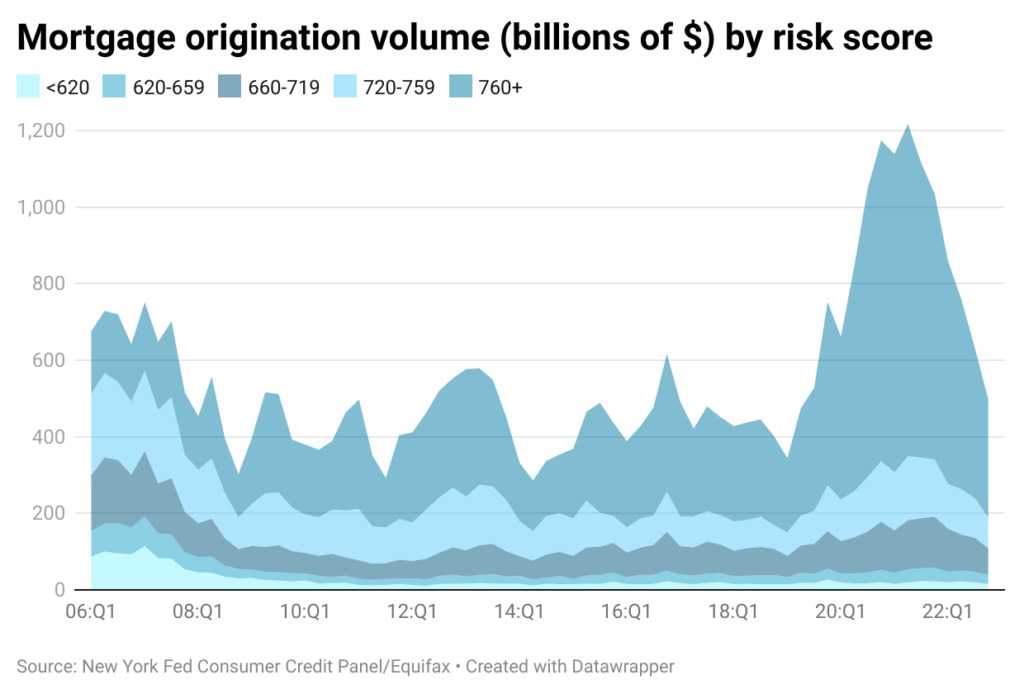

During the COVID-19 pandemic, mortgage origination volumes surged, crossing $4 trillion in 2021. Record low rates incentivized current homeowners to refinance their existing mortgages (both cash-out and rate/term) and others to purchase homes. In Q1 2021, consumers were in a strong credit position with 73% of mortgage loans going to borrowers with a credit score of 760 or higher. For the same time period, only 4% of borrowers had a credit score of less than 660.

In response to high inflation, the Fed started raising rates, leading to a more than doubling of mortgage rates from 3.1% to over 7% in 2022. As a result, the refi market plummeted while the purchase money market experienced a drastic slowdown. Mortgage originations fell from $4.5 trillion in 2021 to $2.7 trillion in 2022 (New York Fed data). Currently, new mortgage borrowers are facing higher monthly mortgage payments, and because of higher inflation, are taking on more debt to finance other expenditures. This is leading to a decline in consumer credit scores. The percentage of mortgage borrowers with the highest credit rating of 760 or more has declined to 62% in Q4 2022, while those with a score of less than 660 has increased to 8%.

Although consumers’ financial situation has shown some deterioration from 2021 to 2022, it remains very healthy compared to the market crash of 2006-2008. During the crash, the percentage of mortgage borrowers with a risk score of 760+ was less than 40%. Conversely, borrowers with a score of <660 peaked at 25% in Q1 2007.

Foreclosure Rates

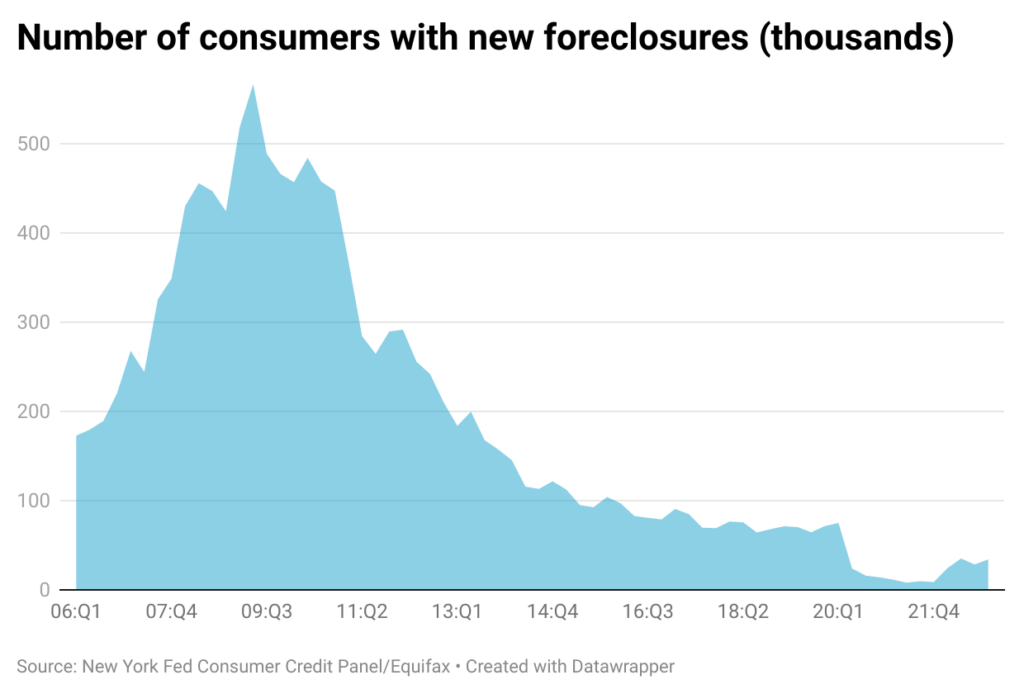

Today, financial pressures due to high inflation and larger loan balances are resulting in an uptick in the number of foreclosures. However, these figures are well below the levels seen over a decade ago. In response to the sharp economic downturn and surge in unemployment when the pandemic hit, the government had put in place a moratorium on foreclosures. Once the moratorium was lifted in July 2022, the number of foreclosures started rising, climbing to over 34,000 in Q4 2022. However, these numbers are much lower than what the housing market experienced following the crash of 2008. In Q2 2009, the number of new foreclosures surged over 566,000.

Delinquencies

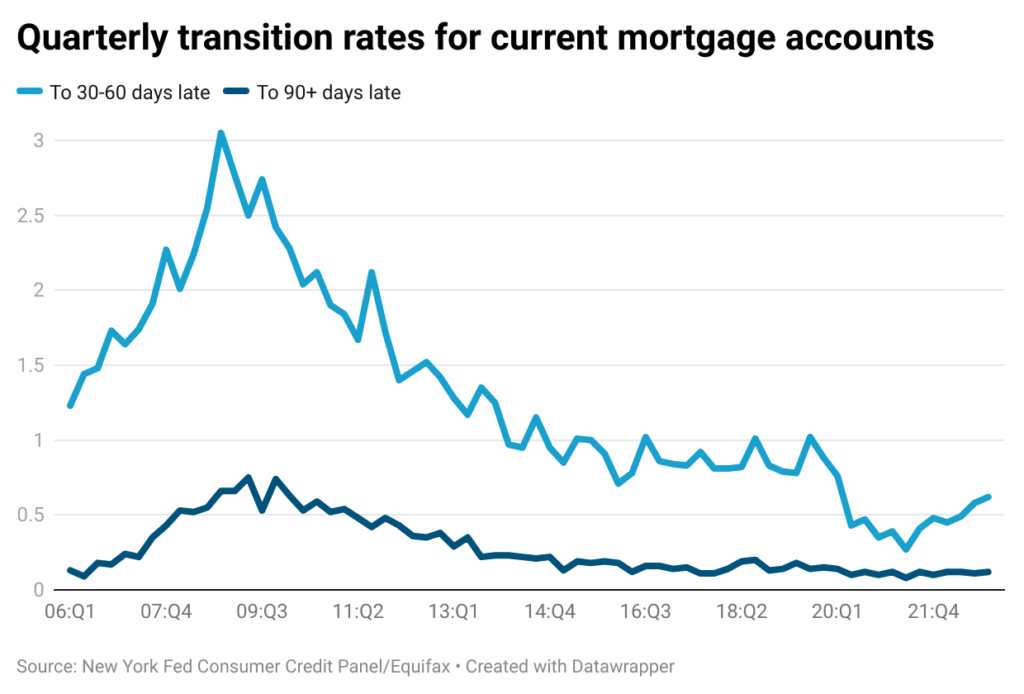

A look at the transition rates to 30-60 days late and 90+ days late for mortgage payments shows a similar trend. Current rates (0.62% for 30-60 days late and 0.12% for 90+ days late in Q4 2022) are much lower than the rates observed after the 2008 housing market crash (3.05% for 30-60 days late and 0.66% for 90+ days late in Q4 2008).

Currently, even with foreclosures rising and more households falling behind on their mortgage payments due to higher mortgage rates and persistent inflation, delinquencies are still relatively low.

Conclusion

The current strong employment situation is certainly helping the finances for many homeowners. By the end of 2023, we expect unemployment to rise slightly from 4.0% to 4.5%. We don’t anticipate the slight rise in unemployment to have a material effect on the economy. In terms of mortgage rates, we’ve seen some decline in January, but a steady tick-up in February as inflation numbers are showing resistance to the Fed’s increase in rates. Given this, we expect both elevated mortgage rates to persist in 2023 at around 6% and the Fed to continue to raise rates. This will continue to dampen the overall housing market and the mortgage industry. There is little doubt that higher mortgage rates and inflation will continue to put pressure on America’s households. This pressure will result in rising delinquencies and foreclosures. However, with a strong economy, healthy consumer credit, and tight housing supply (house prices are expected to decline by less than a percentage point from Q4 2022 to Q4 2023 according to VeroFORECASTSM), the current market is in a fundamentally different place than it was in 2008.

About Reena Agrawal, Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.