San Francisco has long been a hub for technology, innovation, and a thriving arts scene, but it has also been a city with high housing costs. Lately its housing market has been making the news headlines as one of the worst performers in the U.S., registering sharp declines in prices. But will the technology sector, led by its hottest new trend – AI, once again beckon people to the Golden Gate city?

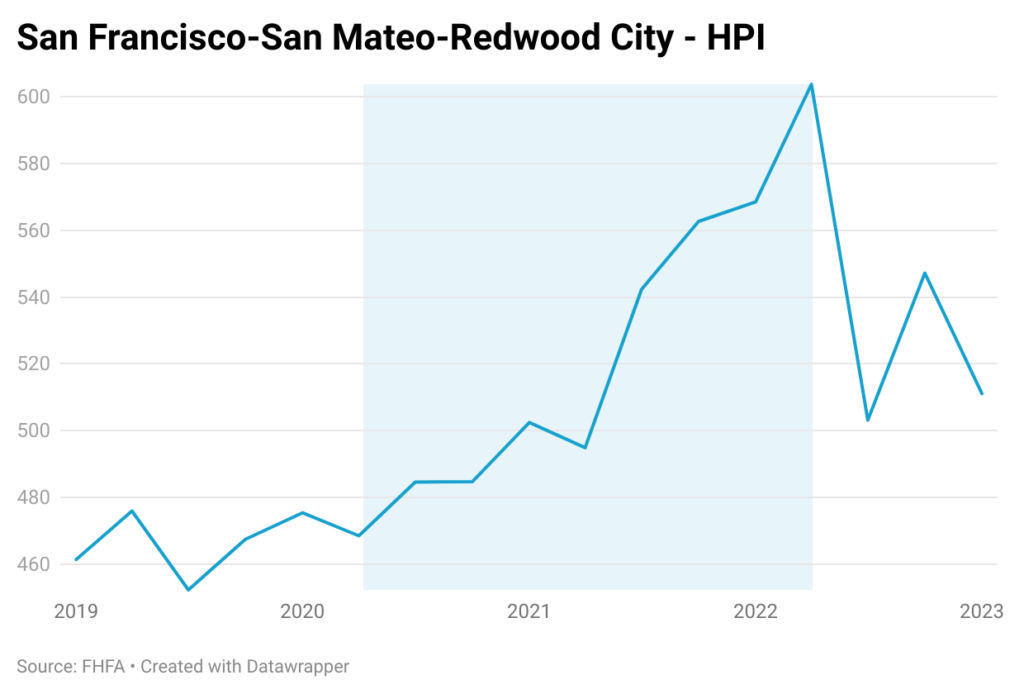

Prices in San Francisco’s housing sector had skyrocketed 29% from Q2 2020 to Q2 2022. Then the downturn hit the market. Prices plummeted 17% from Q2 2022 to Q3 2022. The hike in mortgage rates that started in early 2022, in combination with the already steep prices, made it increasingly difficult for many people to afford homes in the city.

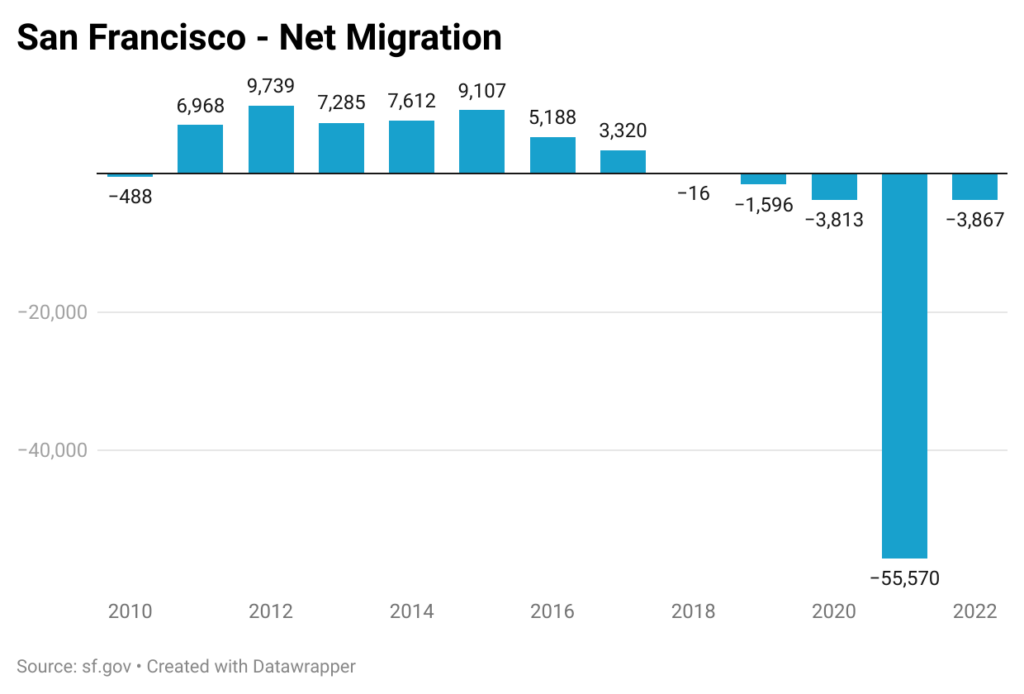

As prices rose in 2020 and 2021, families started moving out of San Francisco due to its expensive housing. The COVID-19 pandemic accelerated the trend of remote work, allowing people to work from anywhere. The allure of San Francisco, with its pricey living and densely populated urban environment, started losing its appeal. In 2021 alone, the city experienced a net loss of 55,570 people. The impact of the pandemic on the job market has been one of the key factors contributing to this shift in migration patterns. With businesses forced to make difficult decisions to survive during lockdowns and restrictions, many workers in San Francisco lost their jobs due to layoffs and business closures. The economic uncertainty and lack of employment prospects prompted some individuals and families to seek greener pastures elsewhere. While many services sectors, especially leisure and hospitality, were cutting jobs at the start of the pandemic, the tech sector was hiring away.

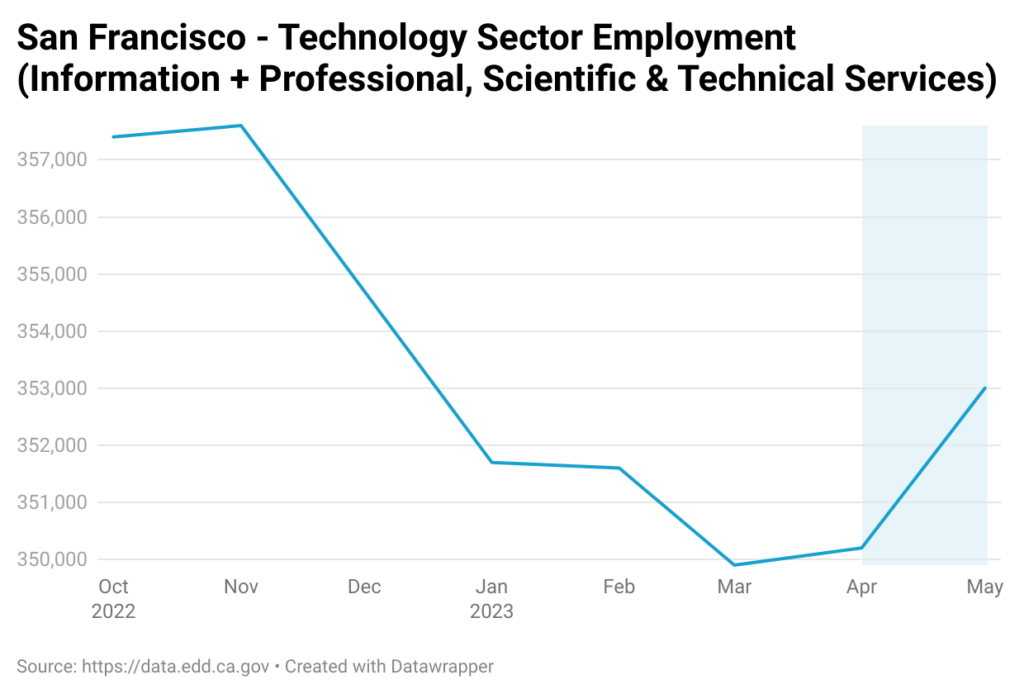

Then in the second half of 2022, the technology sector, too, started announcing mass layoffs. From November 2022 to March 2023, this sector (information and professional, scientific & technical services) lost 7,700 jobs. However, the tech sector seems to be turning around; it added 2,800 new positions in May 2023. The buzz in the media is that the latest round of hiring is led by AI jobs.

The fast-growing AI world and the supporting systems are expected to drive real estate demand. While growth in tech sector jobs is positive news for the city, this may not translate into housing demand because of the trend to work remotely. There is also the threat that AI will disrupt many jobs across a wide spectrum of industries. The question then is whether AI will create more jobs than it destroys. It is difficult to assess how the AI revolution will play out. So, I turned to an AI bot (ChatGPT) to shed light on this topic. It responded, “…while AI has the potential to disrupt certain job roles, it can also create new opportunities and lead to the emergence of different types of jobs. The net impact on employment will depend on various factors, including how societies and economies adapt to the changes brought about by AI.” Claude, another AI bot, had a similar response. The AI bots failed to provide a definite answer.

However, the decline in San Francisco’s housing market is not solely a result of job losses. The current level of house prices remains unaffordable for many. San Francisco has a significant homelessness issue, which has been a concern for residents. Crime has also been a persistent issue in the city, which can contribute to a sense of insecurity. The accelerated net migration out of San Francisco implies a recalibration of priorities and choices prompted by the unique circumstances of the pandemic. It has also presented an opportunity for other regions and cities to attract talented individuals who are seeking a change of scenery and a fresh start. While a rebound in employment in the tech sector is a positive sign, it may or may not turn around the housing market in a big way. Meanwhile, forecasts generated by humans at Veros predict that house prices in San Francisco will decline by 3.6% over the next 12 months.

About Reena Agrawal, Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.