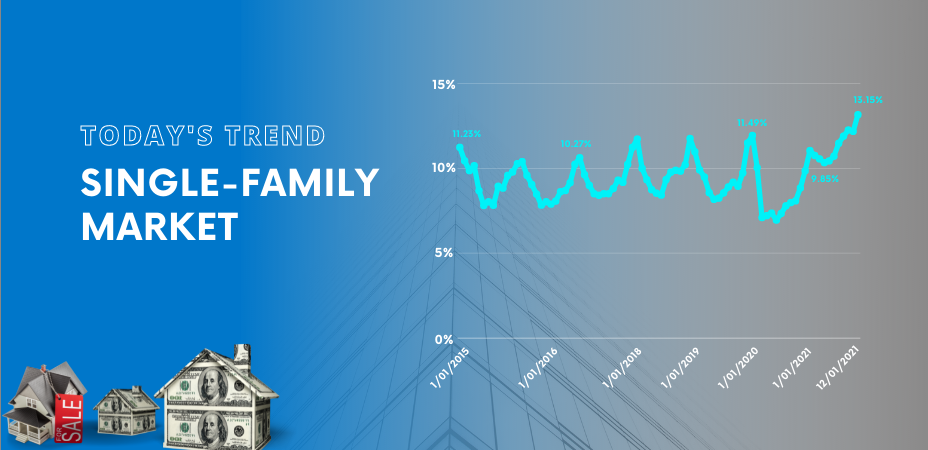

Buy now or later? A prospective homebuyers’ dilemma

The real estate market is rebalancing as supply and demand are adjusting to the higher mortgage rate environment. An increasing number of prospective homebuyers have found that their dream homes have been pulled out of reach as mortgage rates climb…

Buy now or later? A prospective homebuyers’ dilemma Read More »