The Consumer Price Index increased 0.6% in January 2022 from December 2021 and 7.5% from a year earlier. This is the largest annual increase since February 1982. In response, the Federal Reserve has indicated that it might hike interest rates by 100 basis points over the course of three policy meetings, which is leading many to believe that interest rates will rise by 50 basis points as soon as March at the first policy meeting.

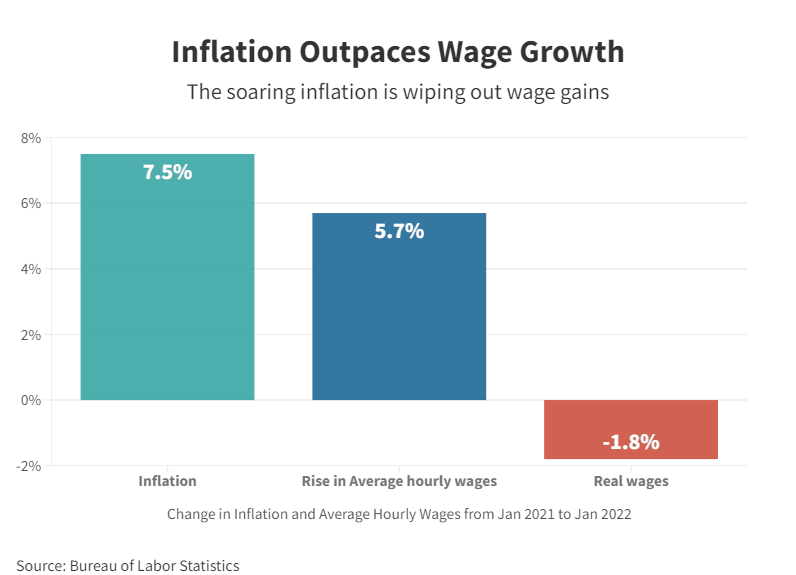

Surging inflation is cutting into the wage increases that workers have received over the last year. Average hourly wages increased 5.7% in January compared to a year ago as employers have been offering higher paychecks to attract workers; however, the high inflation implies that in real terms workers got a pay cut of 1.8%. Only workers in the Leisure and Hospitality sector were able to beat inflation as they received a wage increase of 13%. Wage increases in the Leisure and Hospitality sector can be attributed to extremely low labor supply since the sector dropped almost 50% of its workers during the early onset of the pandemic. As supply shortages continue and spending remains strong, many consumers are feeling the impact with a 7.0% rise in food prices and a 40% hike in gasoline prices over the past one year.

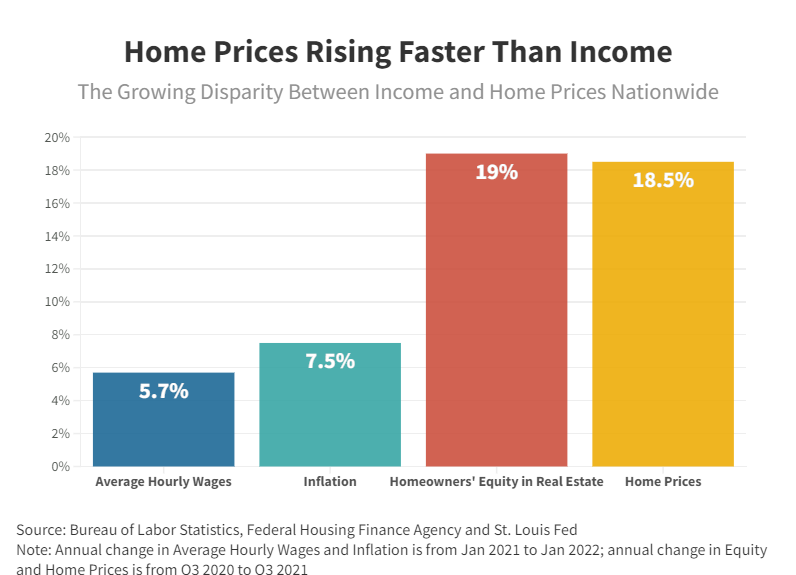

It is expected that inflation for commodities will ease as supply ramps up, but inflation in the shelter component is expected to continue to last longer. ‘Rent of shelter’ comprises almost a third of the CPI basket, indicating its importance in a households’ budget with respect to mortgage and rent payments; this component increased 3.8% over the last year. However, this is much smaller than the rental and house price surges seen across the country; house prices increased 18.5% from Q32020 to Q32021, and rents increased almost 18% in January 2022 from a year earlier. This is because rentals increase for only a subset of the population in any given month, for people who sign new leases or contracts, while it remains unchanged for those who signed a contract in prior months or for those who have bought a home and are paying a steady mortgage.

While average hourly wages increased 5.7%, home prices have been increasing at double-digit rates. But for those who already own homes, they have seen a huge jump in their real estate equity – owners’ equity (households) in real estate in Q3 2021 increased by 19% from a year earlier. In dollar terms this amounted to $4 trillion. Even with current inflation rates, there is a real gain in equity at double-digit rates, which translates to higher household wealth.

This is good news for homeowners, but how will it impact first time home buyers? For those whose purchasing power has been impacted by inflation and face higher down payments with rising house prices, will likely defer their home purchases and continue to rent. However, this is not likely to impact first time home buyers who have managed to save for a down payment and have enough to pay for a mortgage; they will be encouraged to lock into current mortgage rates to avoid paying increasingly higher rents or higher mortgage payments in the future. Even though this will impact housing demand to some extent, overall current demand is much higher than the current inventory of homes. So, home prices will continue to rise, although at a reduced pace than what was observed last year. This aligns with the VeroFORECASTSM data that anticipates home prices will appreciate on average 6.8% for the next twelve months.

About Reena Agrawal, Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.