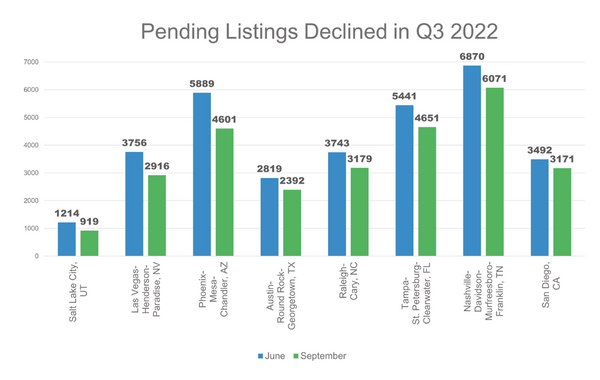

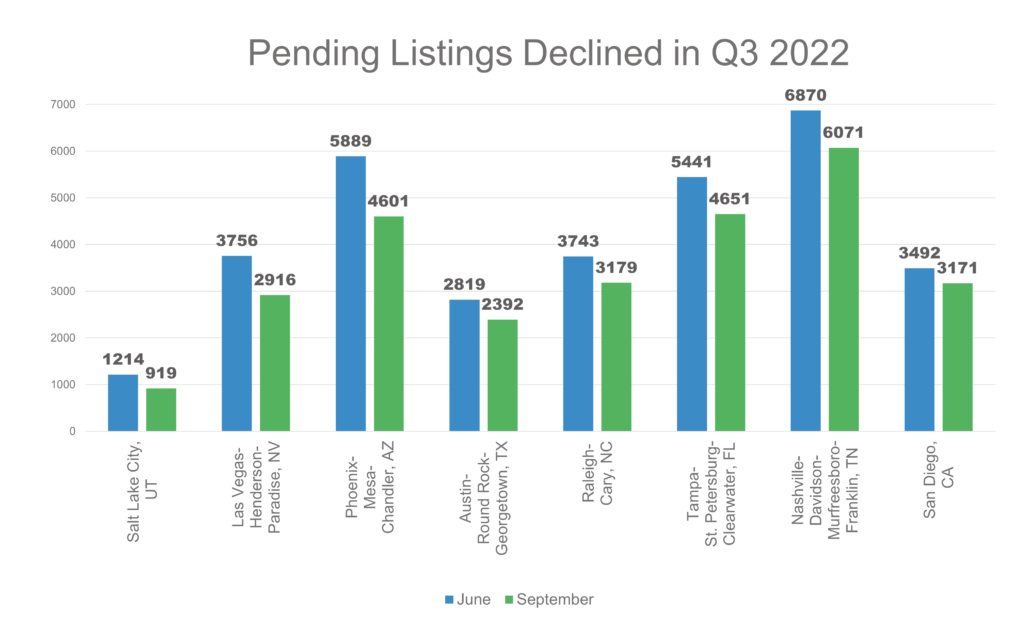

Pending listings declined over Q3 2022 in the highlighted markets, but the extent of the decline varied regionally. Salt Lake City, UT and Las Vegas, NV witnessed the sharpest declines of 24.3% and 22.4% respectively from June to September, while in San Diego, CA the decline was less than 10%.

Pending listings, a measure of signed real estate contracts on existing homes, are viewed as a leading indicator (a variable that predicts a change or movement in another data before it occurs) of housing activity. Most pending sales translate into final home sale transactions, typically 4-8 weeks later. Hence, analysis of trends in pending home sales can provide useful insights into the future state of the housing market or the level of sales to expect in upcoming periods.

The residential real estate market surged during 2020 and 2021 due to soaring demand and short supply of homes. Since the beginning of 2022, rising inflation and interest rates paired with high home prices have cooled down the market significantly as affordability has become a challenge. Mortgage rates have doubled from around 2.9% in January to over 6% in September, slowing down price appreciation and pushing some would-be buyers out of the housing market. While price growth has slowed, it has not reversed, implying that the cost of buying a house is still rising.

The number of pending listings declined from June to September in all the highlighted metros, indicating that prospective homebuyers are taking a pause and the housing market is cooling. Each of these metros had witnessed y-o-y home price increases of 20% or more in Q2 2022. Additionally, the proportion of pending listings as a percentage of total listings was the smallest in Phoenix-Mesa-Chandler, AZ, and Austin-Round Rock-Georgetown, TX at 19.5% and 20.5% respectively, suggesting demand has slowed down more in these markets compared to Raleigh-Cary, NC where pending listings as a proportion of total listings was at 51.5%. The total number of listings grew in Q3 2022 in each of these markets except in San Diego, CA during Q3 2022; by as much as 23.4% in Las Vegas-Henderson-Paradise, 16.1% in Austin-Round Rock-Georgetown, and 16.1% in Phoenix-Mesa-Chandler.

The decline in pending listings paired with a rise in total listings probably provided relief to homebuyers during the summer months of 2022, since they had more homes to choose from, in addition to reduced competition for homes. It remains to be seen whether the housing market has bottomed out and will start to grow back again or will pending listings decline further. A lot depends on the other aspects of the economy as well – unemployment is expected to tick up and inflation is here to stay for a while. The Fed is expected to keep raising rates to bring down inflation, which will not only keep mortgage rates elevated but also reduce purchasing power. If growth in consumer income is not able to keep up pace with rising mortgages and home prices, it will impact demand further.

About Reena Agrawal, Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.