After two years of rapidly rising prices, the housing market seems to have lost steam. There is widespread expectation that the U. S. will fall into recession as the Fed continues to raise interest rates. The following indicators also confirm that the trend in the housing market has shifted. The sales of existing homes declined to 5.4 million in May 2022 from 5.9 million a year ago. As a result, inventory increased from 0.85 million to 1.16 million over the same period.

The 38% rise in the house price index (HPI) over the 2-year period from April 2020 to April 2022, was aided by rock-bottom mortgage rates. However, inflation rose too during this period, hitting 40-year highs. In response, the Federal Reserve raised its benchmark interest rate by 75 basis points on June 15th following a 50 basis points hike in May to control inflation. More hikes are on the table as inflation numbers stay high. The rise in interest rate has pushed up the 30-year fixed mortgage rate from 3.2% earlier this year to near 6% in June, faster than at any point in history, and it is likely to go up further as the Fed continues to push up interest rates.

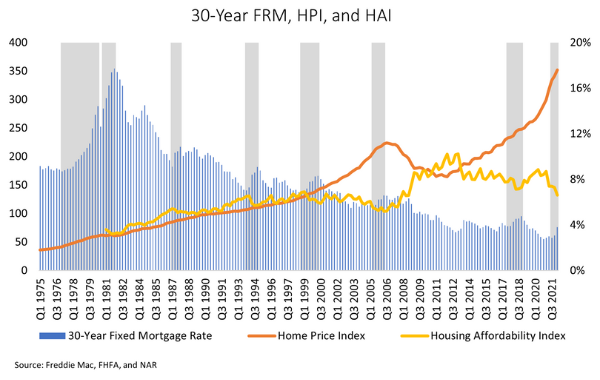

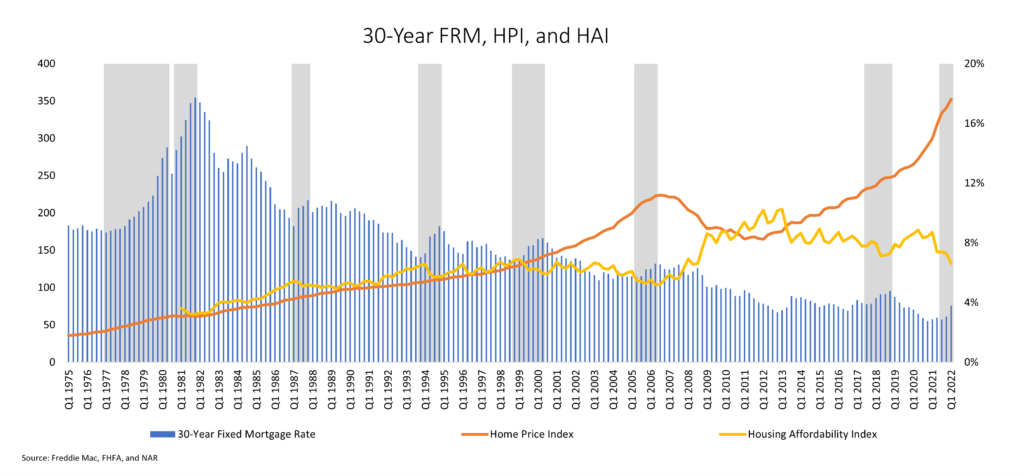

The double whammy from the increase in house prices and doubling of mortgage rates has made housing unaffordable for many. Historically, the only time when the mortgage rate increased as sharply as the increase in H1 2022 was during 1979-1981, when it increased from 10.4% in Q1 1979 to 17.7% in Q4 1981. Then too, the Federal Funds Rate was rising because the Fed was combating high inflation. There were two back-to-back recessions in this period: a six-month recession in early 1980 and another lasting from mid-1981 to late 1982. Despite the recessions and inflation, the HPI mostly increased or remained steady and dipped only marginally in Q1 and Q4 of 1981. Additionally, the housing affordability index (HAI) was at a low of 64.6 in Q4 1981 (a number above 100 implies more affordability). In comparison, it stood at 132.5 in Q1 2022 meaning that affordability is much better currently. Looking at it in terms of mortgage payment as a percentage of income, buyers were paying 37.2% of their incomes in mortgages in 1981, compared to 24.4% in May 2022. Further, if we look at the current mortgage rate, it is still below any level seen prior to 2002 and much lower than the rates seen during 1979-1981. Hence, past episodes of rising mortgage rates do not suggest a steep fall in house prices given that affordability is better. But how does the current scenario compare with the housing market of 2006 – 2008?

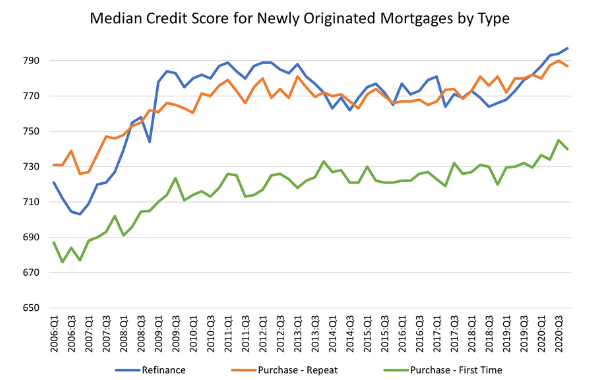

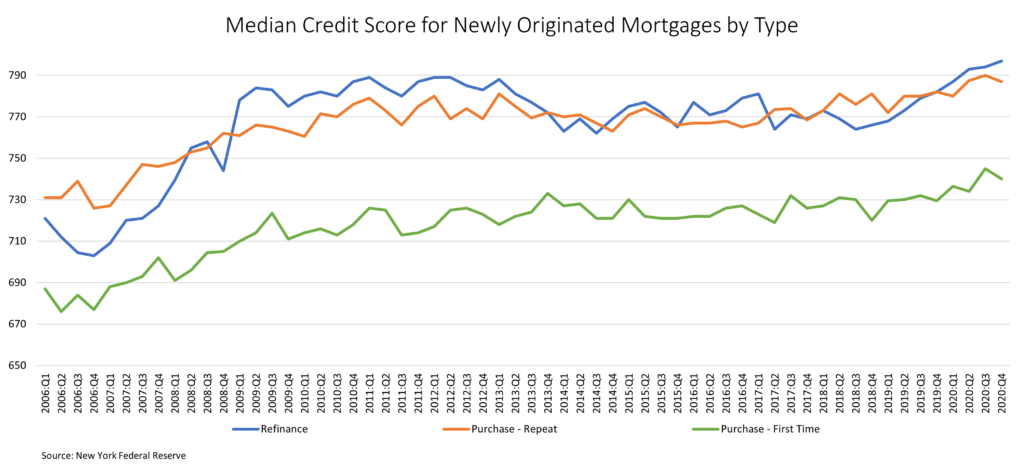

Lending was not very prudent prior to the crash of 2008 as suggested by the trend in the median credit score (FICO), a measure for credit worthiness; for newly originated first-time purchase mortgages the median FICO score was 686 in Q1 2006 versus 740 in Q4 2020. According to the New York Fed, “there was $859 billion in newly originated mortgage debt in Q1 2022, with 68% of it originated to borrowers with credit scores over 760. Two percent of newly originated mortgages were originated to subprime borrowers, a sharp contrast to the 12% average seen between 2003-2007.” Also, household debt to GDP ratio was above 95% for most of 2006-08, compared to around 80% in 2021. Hence, consumer finances are much stronger now than they were during 2006-08. Further, the months’ supply of existing homes was 6.5 in 2006, 8.9 in 2007, and 10.4 in 2008, compared to just 2.3 in 2021 and around 2.0 in 2022. Therefore, while demand has been impacted by reduced affordability, the market remains supported by low supply.

As housing demand wanes due to rising mortgage rates and high home prices, the housing market has likely started to balance out. While some buyers cannot afford the higher mortgage payments, other are choosing to stay on the sidelines in the face of heightened uncertainty in the stock market and the economy in general. Lower demand does not mean that prices will crash; it’s just that the frenzied rise in the prices that was observed over the past two years will slow down considerably. It is possible that some markets might even experience a slight decline in prices. The market is shifting from a sellers’ paradise to one where buyers can now start making a few demands of their own. This is in line with the VeroFORECASTSM which predicts that home prices will rise by an average of 4.5% over the next 12 months, which is much lower than the forecast made a quarter ago.

About Reena Agrawal, Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.