There’s Good News and Bad News

Eric P. Fox – Chief Economist, Veros Real Estate Solutions

Drew Rumfola – Economics Intern, Veros Real Estate Solutions

Today the Bureau of Labor Statistics released the June Consumer Price Index (CPI) report. The June report shows that increases in inflation are accelerating with the year-over-year CPI reported at 5.4%. In the past couple of months, the FED has been quick to reassure that the overall price increases that have been witnessed will not last for an extended period of time. A report released by the FED this past Friday illustrates that many of the price increases are due to prices simply catching up to their pre-pandemic levels as well as supply-chain bottlenecks that the FED says will dissipate when the economy fully returns to its pre-pandemic efficiency. Consumers are less optimistic. Yesterday, the Federal Reserve Bank of New York published the Consumer Expectations report for June stating that, over the next 12 months, consumer expectations for inflation are at 4.8%, 0.8% higher than the previous month. No matter which hypothesis is correct, one thing is clear – inflation is here.

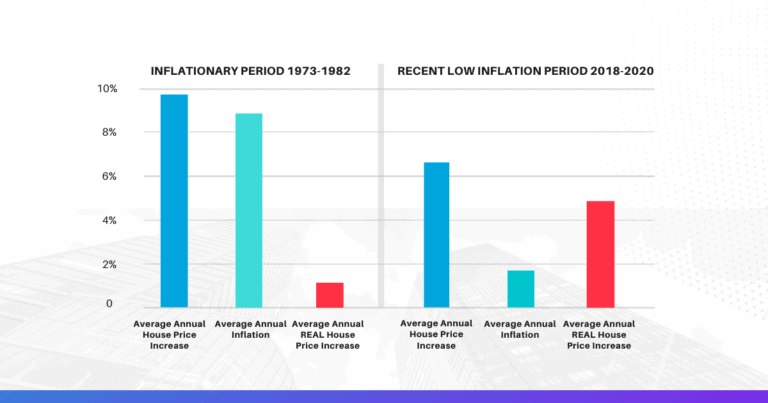

So whether short-term or long-term, a big question that naturally arises is how will a period of inflation affect house prices? Clearly, more than just inflation impacts the price of houses with factors such as interest rates, unemployment, and migration trends having effects as well. However, historical data show that since 1969, there have been 13 years that inflation has been significant and risen over 5% annually. In fact, 10 of those 13 years were the decade from 1973 to 1982 where the average inflation rate was 8.8% annually. During that time, house prices rose by an average of 9.8% per year! High inflation means rising prices for raw materials such as lumber, concrete, and labor, which drive the values of houses higher from builders passing along those costs to consumers. So it would seem that higher house prices are good news for existing homeowners in terms of house price appreciation.

However, if house prices are adjusted for inflation, a different trend emerges. Looking at the same decade from 1973 to 1982, real house prices rose just 1.0% annually. That is to say, the 9.8% nominal annual price increase was mostly eaten away by inflation leaving homeowners just a 1.0% real return in the value of their homes during this inflationary decade. So homeowners during this time period may have seen the price of their most valuable asset increasing dramatically but didn’t necessarily “feel rich.” That then is the bad news that may be in store for current homeowners.

How does this compare to how homeowners have felt during the past 3 years from 2018 to 2020? Annual house price increases averaged 6.5% while inflation averaged just 1.8%. That means current homeowners will have seen a real return of 4.7% during this recent window of time where inflation has been relatively tame. In the very near future, with inflation likely to rise, homeowners may be longing for these “good old days.”

Data Sources:

World Bank CPI for USA

USCB New Residential Sales

FHFA House Price Index