As 2022 winds down and we enter 2023, there are many predictions going around with respect to what will happen to the housing market in the next year. 2022 has been a turbulent year for the housing market. In Jan 2022, y-o-y growth in HPI was over 18%, sellers were ruling the market, and buyers were paying much more than the list price to get their dream home. But all that changed suddenly – the Fed started raising rates, mortgage rates doubled in a short time, effectively putting brakes on the housing market. Here is a recap of 2022 and what we can expect going forward

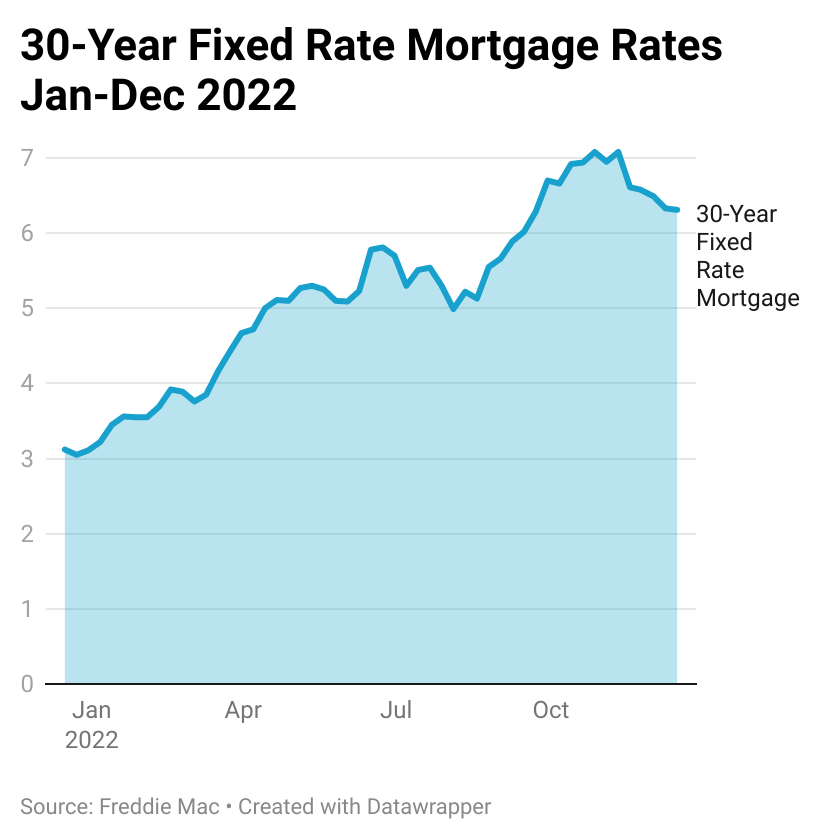

Mortgage Rates

As the Fed started raising rates to combat inflation, the 30-year fixed rate mortgage jumped from 3.22% in January to 5% in April and 7% in October. However, since mid-November, rates have declined a bit, as it appears inflation has peaked. While this is good for stabilizing demand, housing affordability remains a big concern and will continue to keep demand in check. Some potential homebuyers are back in the market, but many have been priced out. At its last meeting in December, the Fed raised rates by 50 basis points, the 7th rate hike in 2022, and indicated it would continue to rein in inflation. We expect that mortgage rates will stay in the 6-7% range next year, so affordability will continue to overshadow the housing market.

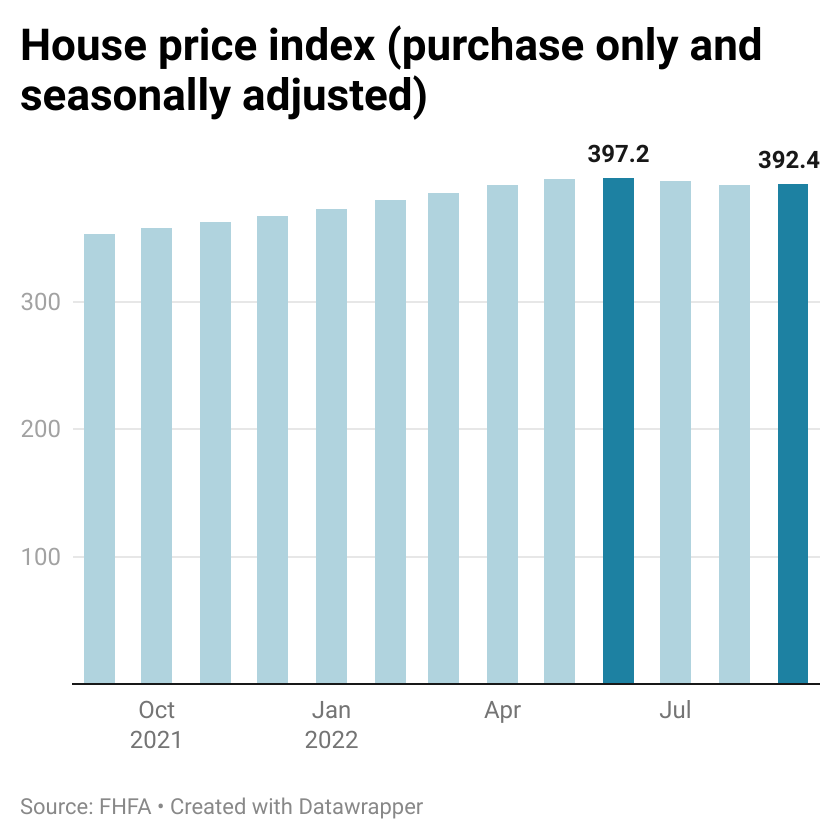

House Price Index

House prices increased by 11% y-o-y in September 2022 but were up just 0.1% compared to August. Average US house prices largely remained flat during the third quarter of 2022, with the HPI peaking in June 2022 and trending slightly lower since then (a 1.2% decline from June to September). While higher mortgage rates will continue to curtail demand, lower inventory and supply will ensure that house prices will post only single digit declines in 2023.

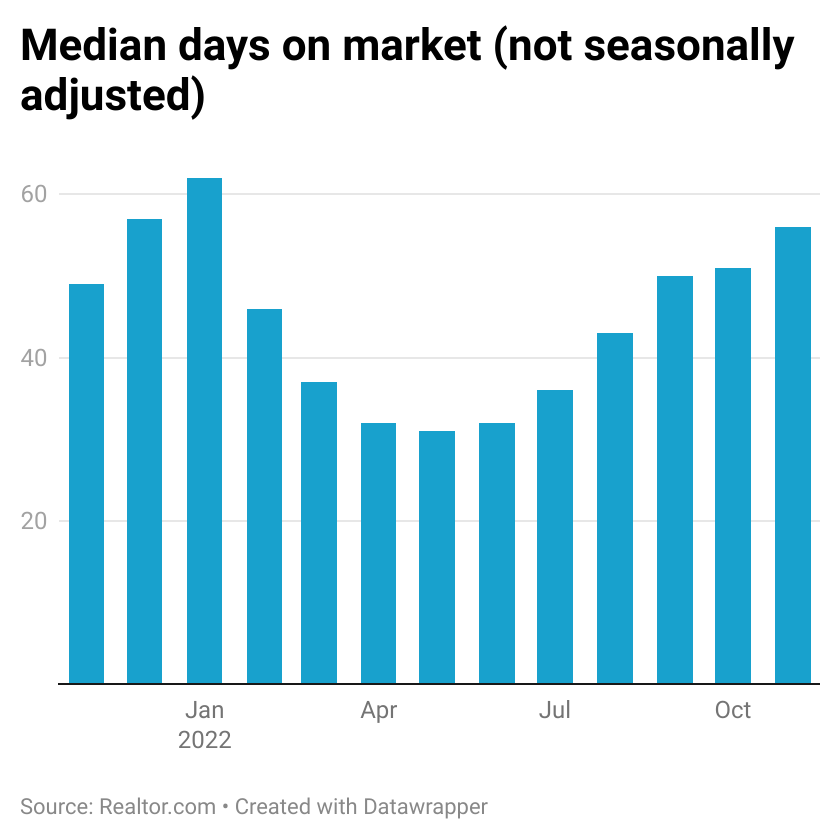

Days on Market

A slowdown in demand is also evident from the median number of days homes are on the market; days on market was 56 in November 2022 compared to 49 a year ago. The employment situation is strong at present, though Veros forecasts predict it to weaken over the course of 2023 as the Fed continues to raise rates. However, demand is not going away in a major way because there are many potential buyers looking to buy homes. Homes that are priced right are getting sold, even though they are staying on the market a little longer due to reduced competition from buyers. This trend will likely continue into 2023.

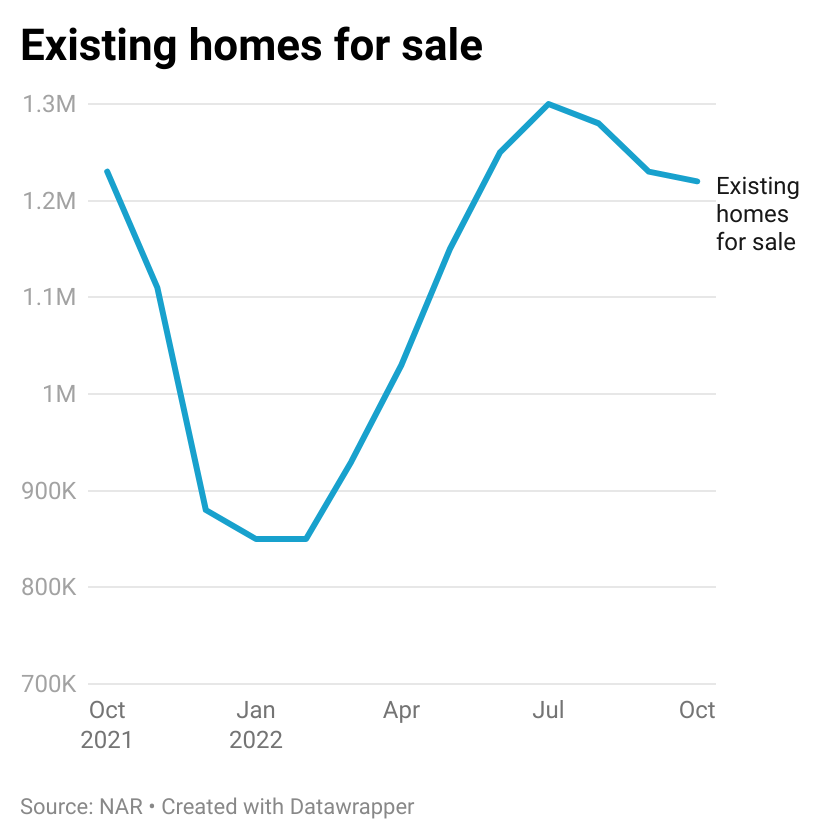

Inventory for Sale

The inventory of homes that was available for sale in October 2022 was at 1.22 million, comparable to 1.23 million in October 2021. This low inventory level is what is preventing prices from falling sharply. The decline in mortgage rates since November has brought back some home buyers to the market, which has also been knocking-off some of the inventory. Existing homeowners are locked into low mortgage rates and are unlikely to trade those in for higher rates. We can expect to see this same pattern of low-demand and low-supply in 2023.

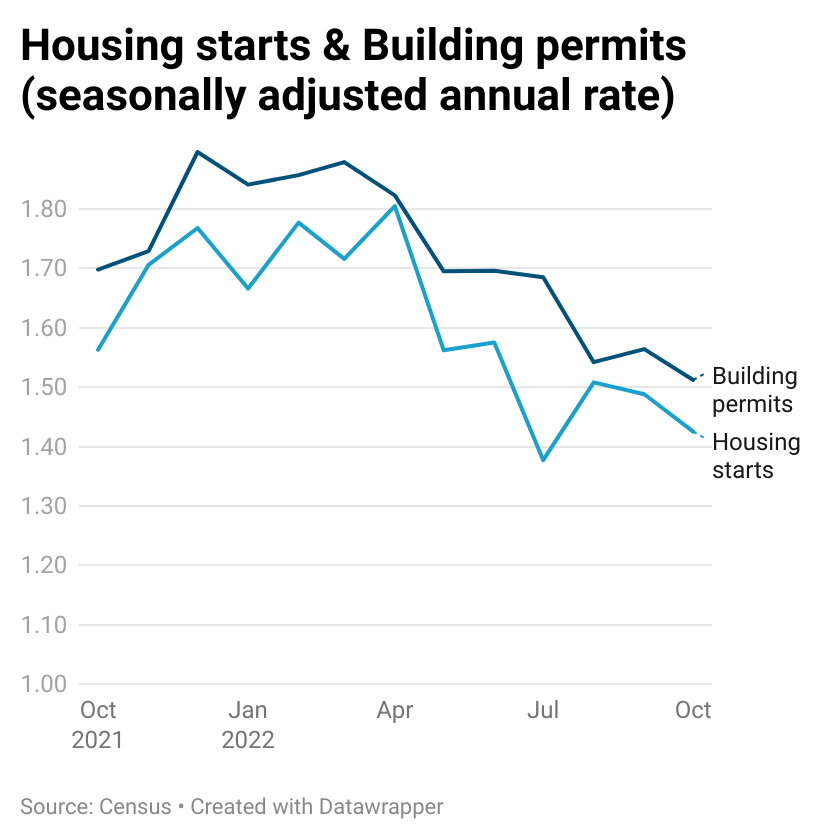

Housing starts and permits

Privately‐owned housing permits were at 1,526,000 in October, 2.4% below the September level of 1,564,000 and 10.1% lower than the year ago level of 1,698,000. Privately‐owned housing starts in October (1,425,000) were 8.8% percent below the October 2021 level (1,563,000). Housing starts and permits fell in response to lower demand as affordability concerns priced out many homeowners. A lower supply of new homes will widen the demand-supply gap further.

Foreclosures

Foreclosure starts, when lenders start the foreclosure process on a property for the first time, were at 28,500 in Q3 2022, down from 35,120 in Q2 2022 and much lower than the pre-pandemic rates (74,860 in Q1 2020). Foreclosures are much higher than the levels in 2021, but that is because of the government moratorium during the pandemic. The current rates are way lower than the 400,000+ levels seen during each quarter of 2008 and the high of 566,180 in Q2 2009. It is unlikely that we will witness any significant supply from foreclosures over the coming months as the consumer credit profile is strong and unemployment is at historic low rates.

So, is this a good time to buy or sell a house? For a buyer, even though options are few in terms of inventory, there is less competition, and rates or house prices are not expected to decline in a significant way. Hence, if the buyer has the necessary funds, it is a good time to buy. Similarly, for a seller, since homes for sale are few, it is a good time to sell, if they are comfortable paying the additional mortgage costs for a new house. For either buyer or seller, it is finances that will ultimately determine if it’s the right time to transact in the housing market. Veros predicts that the average house price across the US will post a small decline over the next year, but the US economy is in a state of flux right now and any surprises vis-à-vis inflation, interest rates, and unemployment might alter these predictions.

About Reena Agrawal, Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.