The real estate market is rebalancing as supply and demand are adjusting to the higher mortgage rate environment. An increasing number of prospective homebuyers have found that their dream homes have been pulled out of reach as mortgage rates climbed to 7% and in many regions of the country home prices appreciated by around 30% on average over a 2-year period beginning March 2020. While buying a home has become unaffordable for many, others are choosing to wait out until mortgage rates decline and or prices fall significantly. However, neither of the two scenarios is expected to materialize in a big way any time soon. Inflation remains stubborn in the US economy even though it has declined somewhat from the highs seen earlier this year. As long as inflation remains high, the Fed intends to push the fed funds rate higher, maybe at a slower rate going forward, but further rate hikes are expected. Mortgage rates did decline by 0.5% in the third week of November due to a lower-than-expected inflation reading. This might propel some buyers to get back into the market. But some may now wait for rates to drop even further.

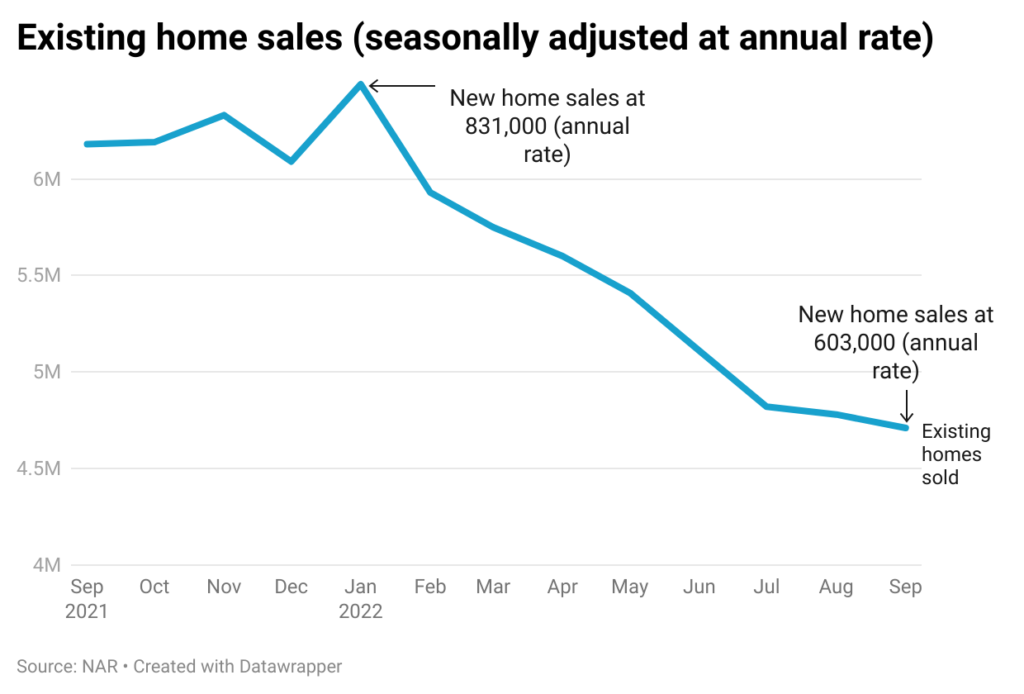

Will home prices crash? That is not a likely scenario. It is true that fewer people are buying homes so home demand has dropped significantly. The number of existing homes sold declined by 24% from 6.18 million (annual rate) in September 2021 to 4.71 million (annual rate) in September 2022. As a result, prices have declined in some regions, and expected to decline further. In other regions, prices are likely to remain flat. But, if rates or home prices fall in a significant manner, then all those buyers waiting at the sidelines would jump in to snap up their dream homes. This would again bid up prices.

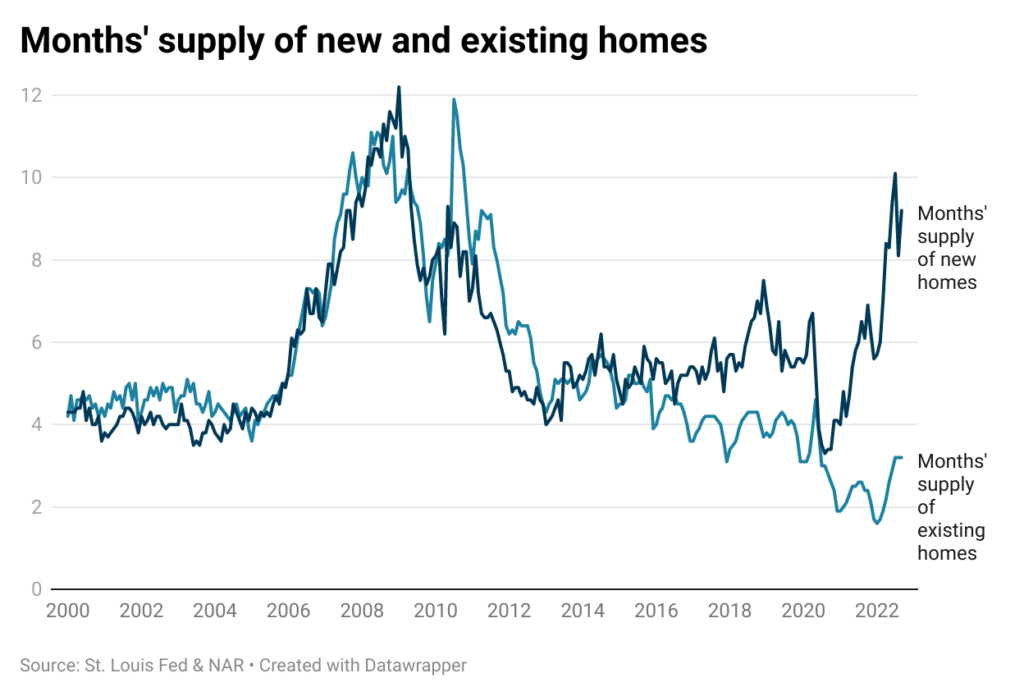

Providing support to home prices is the supply side. While supply has eased relative to what we saw earlier in the year, it remains low. In terms of months of supply, there has been an upswing since the beginning of the year for both existing homes (1.6 months in Jan 2022 to 3.2 in Sep 2022) and new homes (5.7 months in Jan 2022 to 9.2 months in Sep 2022). The months’ supply of new homes has gone up more sharply since builders started constructing new homes in the face of heightened demand, and now find themselves with some inventory to sell. However, like home buyers, many home sellers are choosing to stay on the sidelines and are reluctant to put their homes for sale because they do not want to swap their existing low-rate mortgage payments for one with a higher-rate. Additionally, some sellers are pricing their homes too high, expecting to receive multiple offers for their homes. When they do not get their asking price, they remove their listings from the market.

It appears that since the market has shown some balancing, it might be a good time to buy a home because buyers are now in a position to add in more contingencies in their offers and do not have to compete in a multiple-offer environment. Also, since homes are staying on the market longer, buyers can take some time to decide about their purchase. This of course holds true if the buyer can afford the down payment and has the necessary funds to make the mortgage payments. Trying to time the market with respect to mortgage rates will likely be a tricky prospect over the next few months. Trends in inflation, unemployment and the Fed’s actions will all play an important role in determining where the economy is headed. While it might be a good time to buy for some, risk averse buyers who are concerned about economic uncertainty will likely sit out and wait and watch.

About Reena Agrawal, Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.