Economic Insights

Insights and Perspectives on U.S. Housing Economies and Property Markets

Veros Economic Insights provides our recent forecasts, analysis, and articles for an up-to-date picture of the U.S. housing market.

Economic Indicators

Mortgage Rate

March 2024

6.82%

Inflation

March 2024

3.5%

Housing Starts

March 2024

1.321 million

Housing Inventory

March 2024

1.11 million

Unemployment Rate

March 2024

3.8%

Hourly Earnings

March 2024

34.57

Housing Outlook

VeroFORECAST Points to Slowing Market, Resilient Pockets of Growth

Veros Real Estate Solutions releases the Q2 2025 VeroFORECAST report with projections indicating an average nationwide home price appreciation of 2.2% over the next 12 months, signaling a national slowing ahead. The housing market in 2025 will likely continue to see a divergence between regions.

Watch The Latest RiskWire Webcast

FeaturES

Where did all the workers go?

The 15.6% Increase in Housing Starts Won’t Cool Prices in 2022

Should Zillow’s iBuyer Home Flipping Collapse Be of Concern for the Real Estate Market?

Top 5 Reasons Why today’s hot housing market is not the same as the 2006 bubble

Does affordability impact house prices? Not as much as you’d think

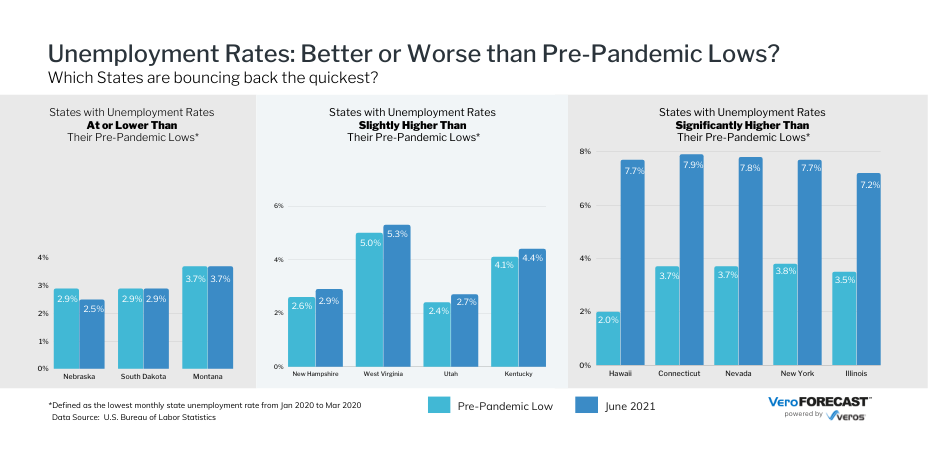

Unemployment Rates: Better or Worse than Pre-Pandemic Lows?

When is the right time to buy?

Date: February 15, 2023

People discover at a party that I’m a Chief Economist working at Veros specializing in housing prices and forecasts and immediately, someone is placed in front of me asking, “When is the right time to buy?” Well, you might be surprised at my answer. I say, “Now!” Why would I be saying this if everyone can see that the housing market has softened over what it was a year or two ago?

First and foremost, I always say that housing is a great LONG-TERM investment. Get in and 20 or 30 years down the road, things will look great for you. Don’t worry about whether things will go up or down in the next 6 months.

Second, though prices have softened a bit over the past few months in many markets, the fundamentals of housing are still very strong. This is not a 2008-style decline. It is a “cooling down” of an overheated market exacerbated by a pandemic. Though interest rates are much higher now at 6% instead of 3%, they are dropping from 7% just a quarter ago, and we see them getting into the mid 5% range by year’s end. These are historically low rates! Inflation is coming down from its 9% peak down to 6.4% now with our forecast showing values in the high 4% range by the end of the year. Despite the headlines of mass layoffs at some companies, unemployment continues to fall from 4.0% a year ago to a very low 3.4% today. Though we see this creeping up into the low 4% range by year end, the jobs situation will be strong. And the housing stock in the U.S. is still fundamentally low with Millennials now in their prime house buying years.

Our official house price forecast from VeroFORECAST is showing depreciation of only one-half of one percent (-0.5%) for all of 2023. The best performing markets are expected to appreciate around 6% with the worst performers down nearly 7%. But most markets are expected to be fairly flat overall. We, in fact, see slight depreciation through the first half of the year with a slight rebound in the latter half of the year which gives us an overall -0.5% depreciation for 2023.

What is happening now? Many buyers are sitting on the sidelines and are in a “wait and see” attitude. That means that there are a few more houses on the market in most places, and buyers don’t have to write a crazy no-contingency over-asking-price contract the same day the property went on the market. They can view several properties, think about it, make a competitive offer, and get their offer accepted.

When is traditionally the time of year when there are lots of buyers and sellers in the market? That would be the spring and early summer. That’s when many people want to move. That’s just a couple of months away from now. My feeling is that once buyers realize that the market is pretty strong, a 2008 collapse isn’t happening, interest rates are still pretty low, the economy is still pretty strong, everyone is going to realize at the same time in the spring and early summer that they are going to pull the trigger and buy that house after all. When that happens, bidding wars will return, prices will start going up again, and a less than desirable situation will return for buyers.

So my advice, if you are in the market for a house, “now” is the time to be buying.