Housing market forecasts for 2023 have varied predictions, with some expecting gains of around 5% to others expecting a deterioration of over 5%. What is clear is that the era of low mortgage rates, buying frenzy, and double-digit price growths is over. However, the expected decline in the housing market is not the same as that of 2008 due to several reasons.

On the supply side, inventory and months’ supply of homes remain low. Existing homeowners are locked into low mortgage rates and are unlikely to trade those in for higher rates, so less supply will be coming to the market. The current levels of both inventory (1.14 million in Nov 2022) and months’ supply (3.3 in Nov 2022) are below their pre-pandemic levels (1.28 million and 3.7 months respectively in Nov 2019) and much lower than the figures observed in 2006-08 (over 3 million and 5-12 months respectively). This suggests that a price decline of the magnitude seen in 2006-08 is unlikely. Additionally, new housing construction (housing starts and permits) has slowed down in response to lower demand as affordability concerns priced out many homeowners. A lower supply of new homes will widen the demand-supply gap further.

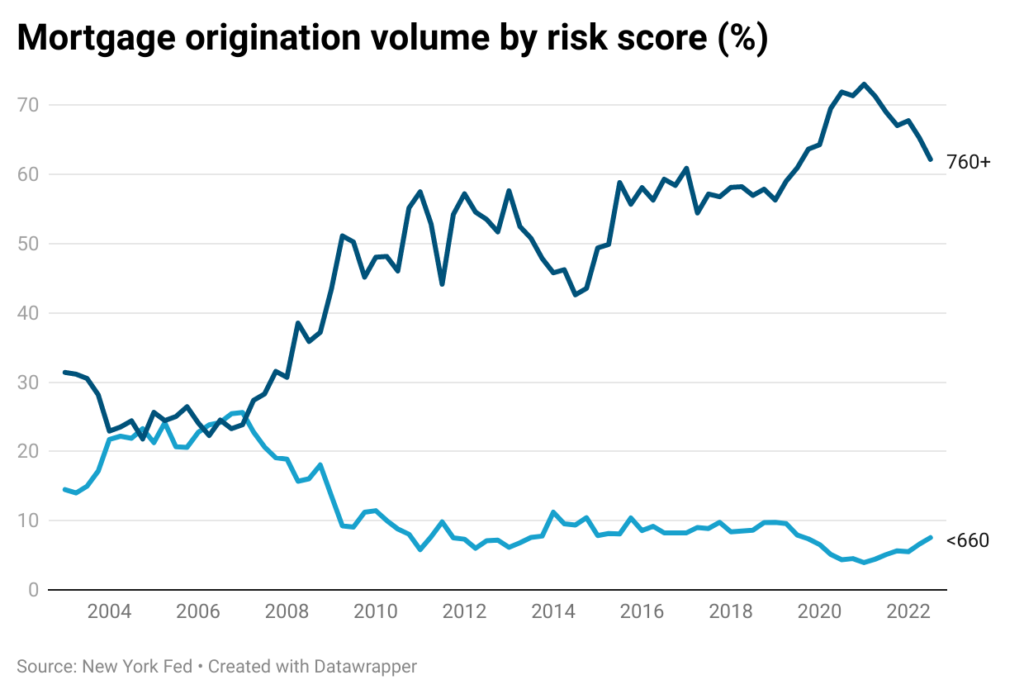

On the demand side, home buyers have a stronger financial position relative to that in 2008. 62% of mortgage originations by value in Q3 2022 were to consumers with a credit score of 760 or more, while just 7.5% were to consumers with a credit score of less than 660. In comparison, around 36% of homebuyers had a credit score of 760 or more in 2008 and 17% had a credit score of less than 660.

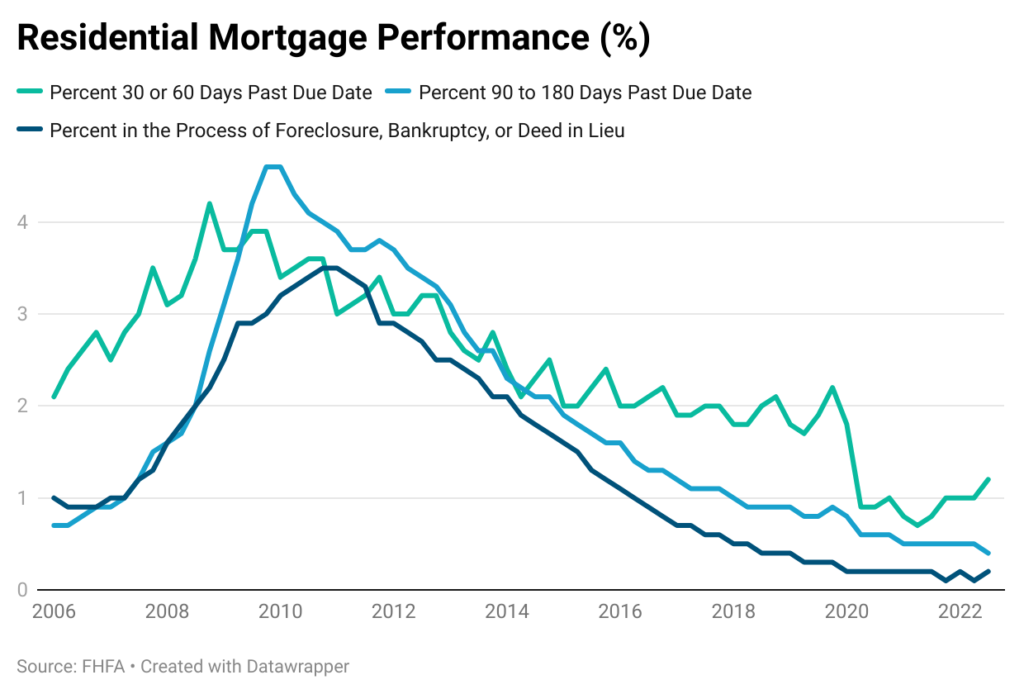

Further, a look at the percentage of mortgages underwater shows that the levels are well below what was observed during in 2008. In the wake of the financial crisis of 2008, the foreclosure rate was around 3.5% (share of housing units with a foreclosure filing, bankruptcy, or deed in lieu). In comparison, the foreclosure rate was 0.2% or less in 2022. Additionally, according to the New York Fed, the number of new foreclosures was around 28,500 in Q3 2022, which is much lower than the pre-pandemic level of 74,860 in Q1 2020 and only a fraction of the level seen during the height of the financial crisis (560,000 in Q2 2009).

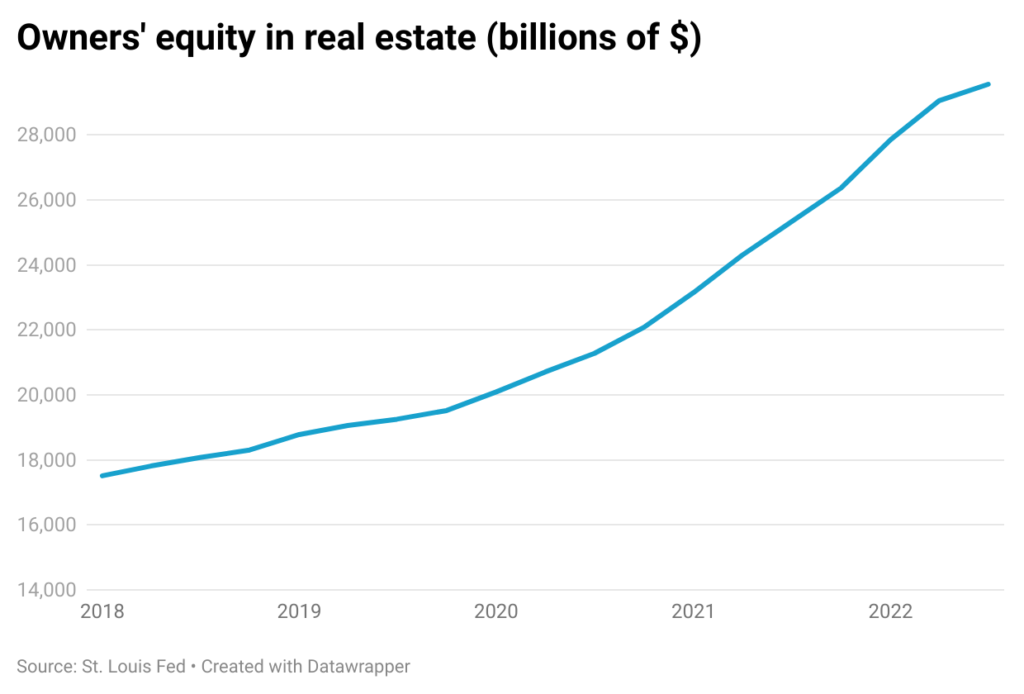

Finally, due to the large increase in home prices during 2020-2022, a large number of homeowners have built sizeable equity in their homes so that they can sell their homes rather than face foreclosure. Homeowners’ equity increased 16.7% from $25.3 trillion in Q3 2021 to $29.6 trillion in Q3 2022, while the gain was only 1.7% from Q2 2022 to Q3 2022 as home price growth slowed down considerably during this time period.

So even though many markets are experiencing slowdowns in price or even some depreciation, given the strong financial position of homeowners for now, we do not anticipate a crash in the housing market. Despite waning demand, the housing market is not likely to become a buyers’ market because inventory remains low. As inflation has started edging lower, mortgage rates have also eased, bringing back some buyers back to the market. On the other hand, the labor market remains resilient despite the steep hike in rates. This means that the Fed will keep rates elevated. Based on our forecasts of unemployment, rates, and inflation, the VeroFORECAST predicts that house prices will depreciate modestly by 0.5%.

About Reena Agrawal, Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.