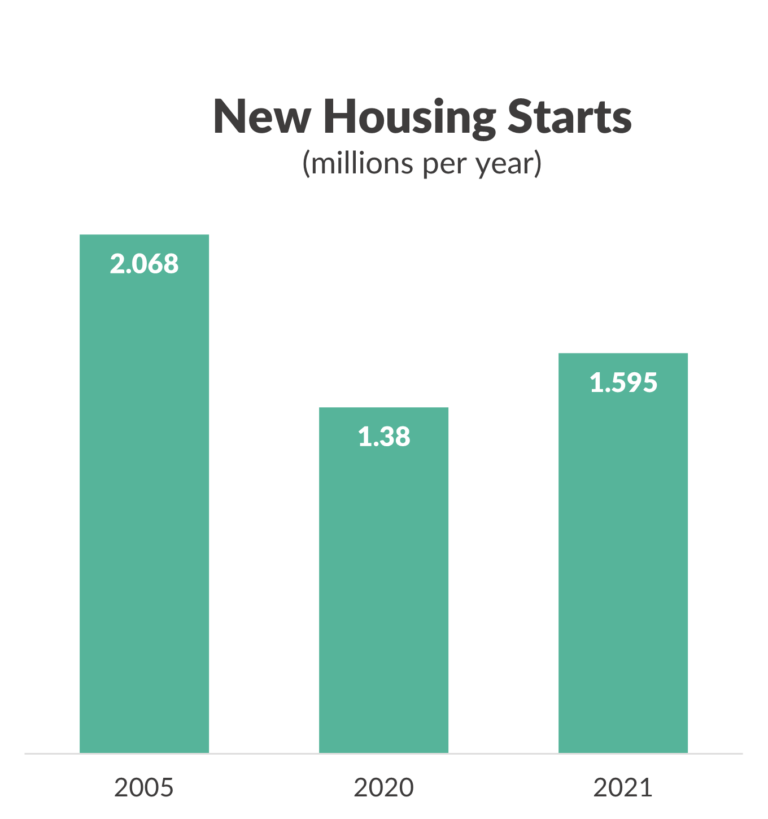

The latest data on residential construction from the US Census Bureau and the US Department of Housing and Urban Development shows that annual housing starts increased 15.6% from 1.38 million in 2020 to 1.6 million in 2021 but were 23% lower compared to 2.07 million in 2005, when the last housing bubble took place. 70% of the housing starts in 2021 were for single family homes versus 62% in 2020, reflecting the pandemic trend of people investing in larger living spaces as they are work out of their homes and move out of apartments and condos away from big metros.

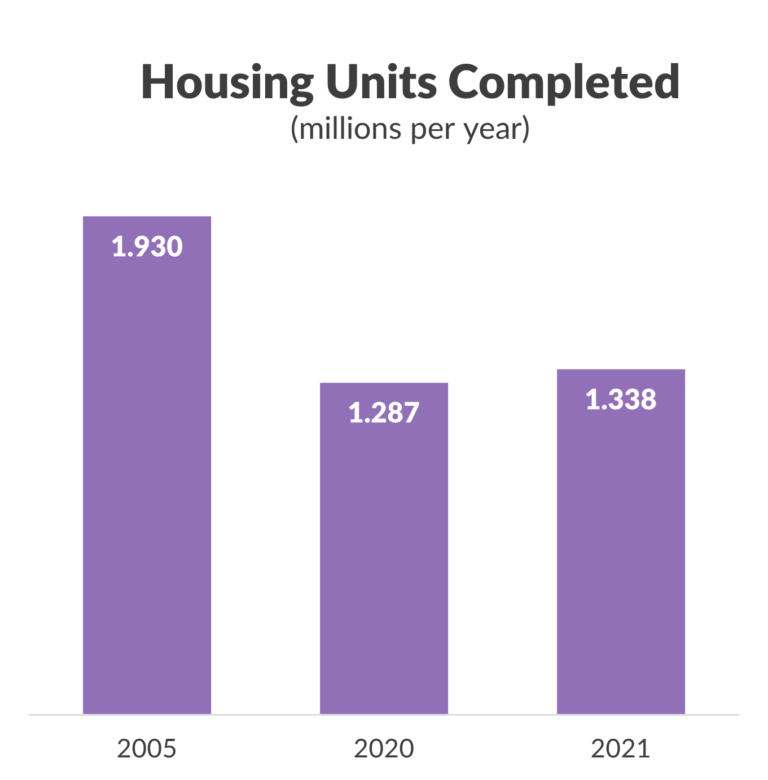

The data also shows that 1.34 million housing units were completed in 2021, which is 4% higher than in 2020, but 31% lower than in 2005. 72% of the housing units completed were single family homes. Though new homes supply is rising in response to low inventories of existing homes, many residential builders are finding it difficult to complete homes on time due to supply chain disruptions, tight labor markets and rising input costs.

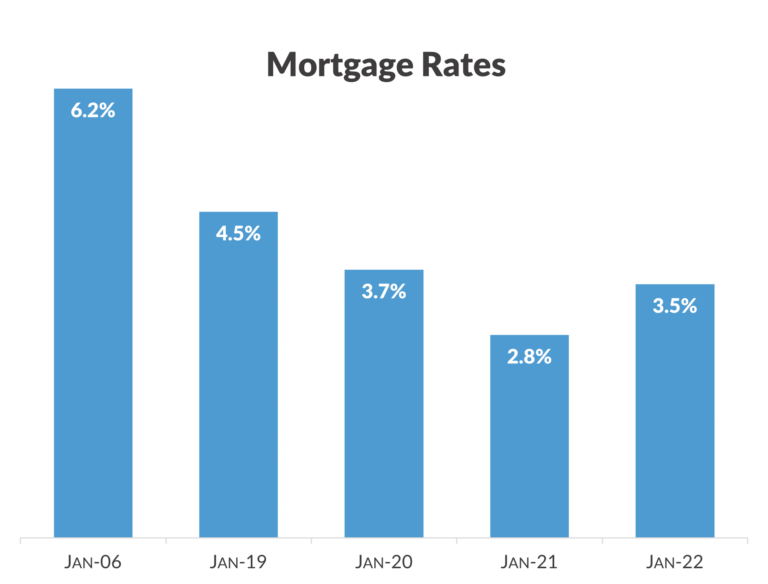

On the demand side, mortgage rates have gone up from 2.8% in mid-January 2021 to 3.5% in mid-January 2022 following the Federal Reserve’s announcement of a tighter monetary policy in response to persistent inflationary pressures. First, the Fed has indicated that it will raise interest rates three times this year, with the first hike expected as early as March. Second, the central bank plans to end its pandemic economic stimulus by tapering bond purchases – it started cutting back bond purchases by $15 billion a month in November 2021 from $120 billion in October 2021 and will cut back purchases by $30 billion a month starting January 2022.

Low mortgage rates in 2020-2021 boosted demand by enabling first time buyers to enter the market sooner and existing homeowners to purchase more expensive properties or homes with higher square footage. Mortgage rates have already surged to over 3.5%, and before they rise further, home buyers are trying to take advantage of the current rates. According to Mortgage Bankers Association, the number of mortgage applications to buy a home increased by 8% for the week ending Jan 14, 2022, compared to the previous week. While mortgage rates are expected to go up, they are not likely to impact housing demand in a big way since they will remain much lower than the 6% seen during the previous housing bubble and near the 4% levels before the pandemic.

Additionally, prospective homebuyers in some parts of the country where rents have risen sharply, may prefer to buy a house and pay a steady mortgage even at the higher rates. For instance, in Santa Ana, CA, the average rent of a one-bedroom apartment increased by 34% from a year ago to $2,900 in November 2021, while the average rent of a two-bedroom apartment increased by 32% to $3,700. In comparison, the median sale price of a condo in Santa Ana in December 2021 was $410,000, which translates to a mortgage payment of around $2,800 per month at the current rate (including taxes, PMI, insurance and HOA dues) on a 30-year loan. Hence, a potential homebuyer could pay a smaller mortgage than rent, while earning equity.

As the supply of new homes is being ramped up and mortgage rates are expected to go up, the frenzied home buying witnessed over the last two years will likely slow down only marginally as demand remains strong and inventory of existing homes is still low. This is in alignment with the Q4 2021 VeroFORECASTSM that predicts home prices will appreciate on average 6.8% for the next twelve months.

About Reena Agrawal, Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.