The recent hot housing market has led to a sharp rise in single-family home investor purchases. The large increases experienced in the housing market have made single-family homes a quality investment that can produce yearly returns higher than those seen in the stock market.

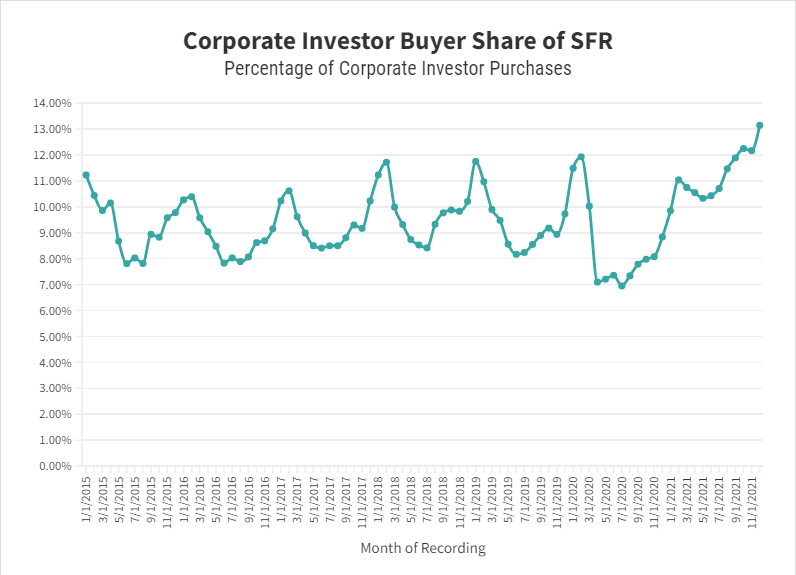

Investor Purchase Percentage usually hits its peak from December to February, in the months when personal home buying is at its lowest (corporate investor purchase percentage is at its lowest in spring because of higher competition from personal home buyers). From 2017 to 2020, Corporate Investor Purchase Percentage would reach a yearly high between 10.5% and 12%. January 2022 saw a Corporate Investor Purchase Percentage significantly higher at 14.1%.

The percentage of investor purchases over the past 3 months has reached the highest levels in the past decade and has been one of the driving forces behind the hot housing market today.

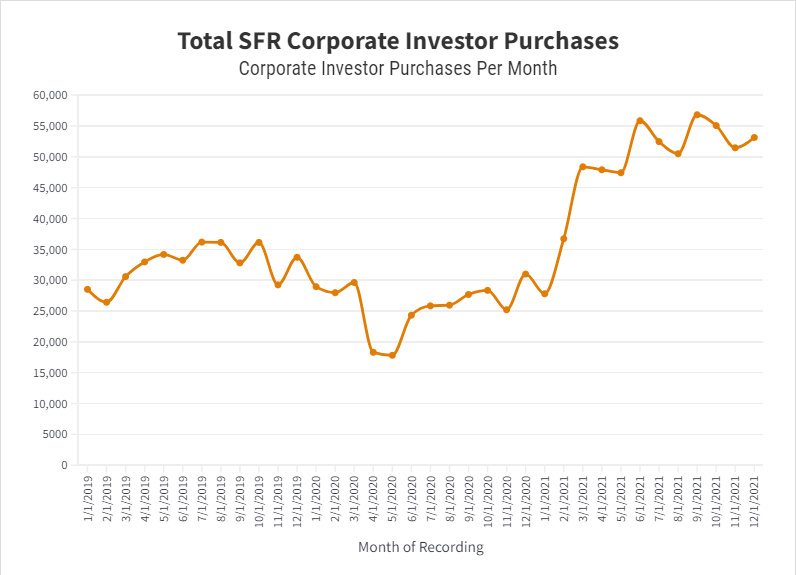

The raw number of corporate investor purchases has also sky-rocketed to the highest amounts in the past decade. The average monthly corporate investor purchases increased 88% from 2020 to 2021, from an average of 26,000 to 49,000. Compared to pre-pandemic conditions, the average monthly corporate investor purchases increased 50% from 2019 to 2021.

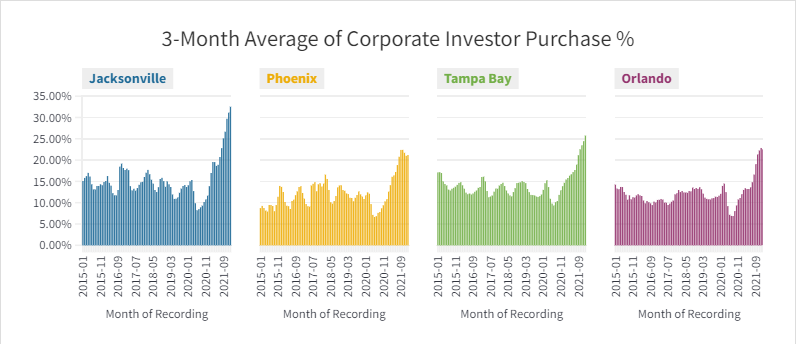

The increase of corporate investor buyer share has not been even in all housing markets. Certain cities are experiencing higher increases than others. Some of the highest levels seen are in Jacksonville, Phoenix, Tampa Bay, and Orlando. While the US average corporate investor buyer share for 2021 increased by 1.9% compared to the 2019, markets such as Jacksonville saw an increase of 9.0% in that same time period. Other markets saw increases substantially larger than the US average as well. Phoenix had an increase of 6.2% from 2019 to 2021. Tampa Bay experienced an increase of 6.0%, while Orlando saw an increase of 4.2%.

Endnotes

- A 3 Month running average is used for the corporate investor purchases of each city to account for significant peaks and troughs on a month-to-month basis

- All numbers shown are only representative of the single-family home market and do not account for multi-family homes (condos, townhouses, etc.)

- We definecorporate investor purchases as a buyer or seller that was/is an absentee-owner and that has a name which includes the following: LLC, LLP, CORP, LP, GP, INC, LLLP, LTD, RLLLP. In addition to the corporate investor definition, we excluded owners relating to home builders, local municipalities, schools, non-profits, government bodies and financial institutions

- Total Qualifying transactions are designated as Single-Family Detached properties, excluding condos and townhomes.

Authors:

Drew Rumfola, Economist Intern

Frederick Heigold , Director, Data & Analytics