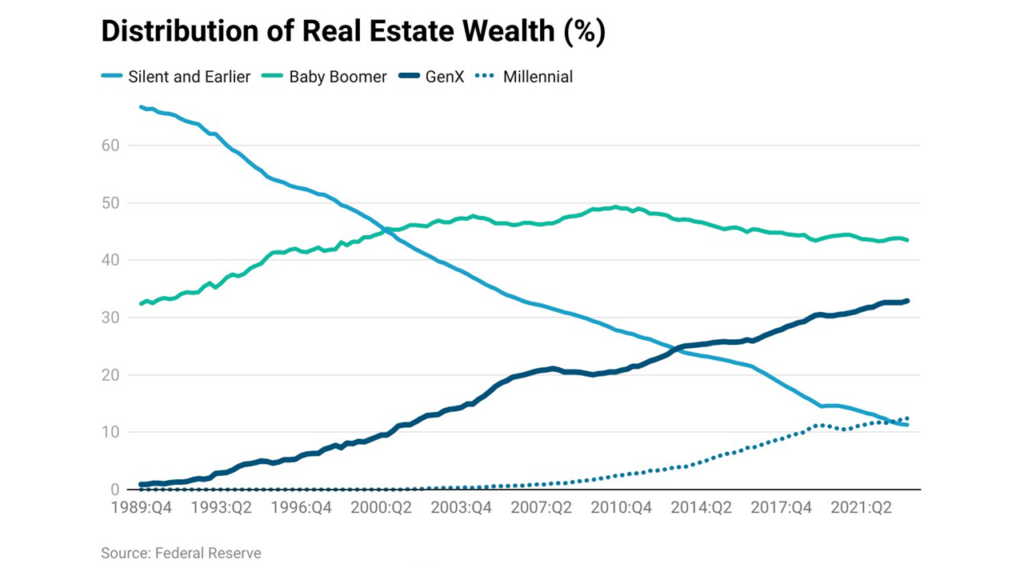

Baby boomers’ share of real estate wealth was 43.5% in Q2 2023. The boomers own the largest share of real estate wealth and overtook the Silent generation in 2000 and have maintained their top spot since then. And they are in no hurry to relinquish their top spot, opting to stay in their current homes rather than embrace the downsizing trend. This decision is underscored by telling statistics: a mere 6% of younger Boomers (ages 57-66) and 10% of older Boomers (ages 67 to 75) listed the desire for a smaller home as their primary motivation for purchasing a property in 2022 (source: NAR Home Buyers and Sellers Generational Trends). The rationale behind this choice is a blend of several factors, including the challenges of high mortgage rates, soaring home prices, ongoing supply shortages, and the looming specter of taxes.

Picture this: families and individuals who’ve been living in their homes mortgage-free for several years find themselves sitting on a potential gold mine of real estate wealth. But here’s the plot twist – it’s a different story when they consider selling and moving on. For couples with capital gains exceeding $500,000, it’s tax time. For single homeowners, the capital gains tax kicks in at $250,000. Even though the gains from the real estate price appreciation would offset those taxes, for retirees on fixed incomes, the prospect of shelling out substantial capital gains taxes might be a tough pill to swallow. Consider the case of the Smith family in Orange County, CA. They purchased their home for a humble $260,000 back in 1998, and it’s now worth a staggering $1,050,000. With capital gains surpassing $500,000, they’re facing a tax bill of approximately $43,500 at a 15% tax rate. Not only are such homeowners faced with a tax dilemma, should they decide to sell, a new challenge arises – the scarce supply of suitable homes.

Homeowners that are looking to downsize and move from colder regions to a warmer climate area, may find that home prices have increased so much in the sun belt that they may end up buying a smaller home for the same or higher price than the sale price of their existing home. Add to this the cost of moving and the emotional attachment people have formed to their homes and communities.

There is a flip side to this real estate coin! For those families still in the mortgage-paying game and contemplating a downsizing adventure, the story takes on a different twist. They do not want to relinquish their low mortgage rates. They’ve done the math, and it doesn’t quite add up in favor of downsizing. In their quest to downsize, they might find themselves with a smaller house but a mortgage that’s nearly equivalent, or even higher, than their current one. This is highlighted by the fact that a $400,000 home loan at a 4% rate results in the same monthly payment as a $275,000 loan at a 7.5% rate.

In the present housing market landscape, characterized by rising prices, the anticipation of sustained high mortgage rates at approximately 7%, and a pronounced scarcity of available homes, the decision between maintaining the status quo and pursuing a downsizing venture has grown considerably intricate.

About Reena Agrawal, Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.