U.S. Inflation Picks Up in August, Driven by Tariffs and Shelter Costs

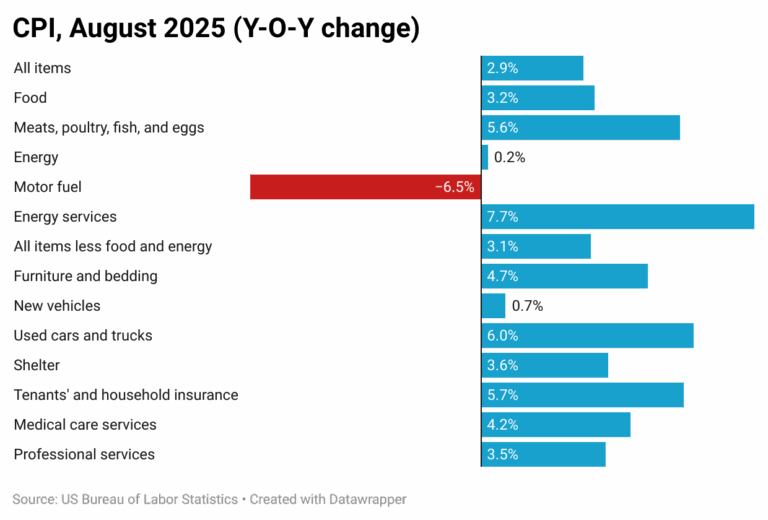

Consumer prices in the United States rose 2.9% in August 2025 compared with the same month a year earlier, and up slightly from July’s 2.7% increase. A broad set of import tariffs likely contributed to the acceleration in inflation, particularly for goods sourced from overseas. Imported consumer products showed some of the largest price gains. Coffee prices jumped 20.9% y-o-y, while furniture costs rose 4.7%. Everyday expenses also climbed, with overall food prices up 3.2%, largely due to higher restaurant prices. Among grocery staples, egg prices surged 10.9%, and apples were up 9.6% from last year.

Energy costs were mixed. The overall energy index edged up just 0.2%, but motor fuel prices declined by 6.5%, helping offset broader cost increases. However, energy services, which include electricity and natural gas, rose sharply by 7.7%. Excluding volatile food and energy categories, core inflation registered 3.1% in August. Within this index, shelter costs climbed 3.6%, while tenants’ and household insurance premiums increased by 5.7%.

Although inflation remains above the Federal Reserve’s 2% target, officials took some reassurance from the limited rise in prices. This provided room for a September rate cut, aimed at supporting a labor market showing early signs of weakness.

With the federal government shutdown temporarily halting official data collection, the release of the September CPI report will be delayed. Because policymakers and investors rely heavily on official inflation metrics, any interruption adds to market uncertainty. Private-sector indicators have provided early clues about September’s trends. The Institute for Supply Management reported that both its manufacturing and services Purchasing Managers’ Indexes (PMIs) pointed to rising input costs, signaling persistent inflationary pressures. Conversely, data from the American Automobile Association (AAA) showed that average gas prices fell about 3% nationwide during the month, suggesting that headline inflation could moderate slightly if this trend holds.

U.S. Labor Market Weakens as Job Growth Slows in August 2025

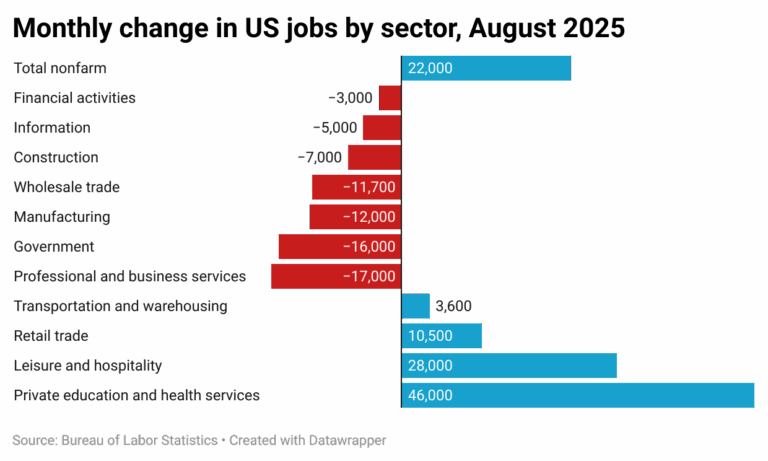

The U.S. unemployment rate rose to 4.3% in August 2025, marking a clear sign of cooling in the labor market. Employers added just 22,000 nonfarm jobs during the month, which was far below economists’ projections of about 76,500. Revisions to earlier data also painted a weaker picture, with June’s payrolls revised down by 27,000, resulting in a net job loss of 13,000 for that month. A broader measure of labor underutilization, which includes discouraged job seekers and individuals working part-time for economic reasons, increased to 8.1%, the highest level since October 2021. The labor market is showing signs of continued softening, and Veros projects the unemployment rate to rise gradually to 4.5% by the second half of 2026.

Most of August’s employment gains came from the healthcare sector, which added 31,000 jobs. However, even this key industry showed signs of moderation, as the increase was well below its 12-month average gain of 42,000 positions. The social assistance sector contributed an additional 16,000 jobs, though recent government data indicates that job openings in both healthcare and social assistance have fallen sharply for two consecutive months. Employment in the federal government declined by 15,000, extending cumulative losses to 97,000 positions since January, reflecting the impact of spending reductions at the federal level. Meanwhile, the manufacturing industry lost jobs for the fourth straight month, weighed down by ongoing tariff pressures. Additional declines were reported in wholesale trade, information, financial activities, construction, and professional and business services, underscoring a broad-based slowdown in hiring across multiple sectors.

Private-sector employment contracted in September, according to data from ADP, which reported a loss of 32,000 jobs for the month. The company also revised August’s figures sharply downward, from an initially estimated gain of 54,000 positions to a decline of 3,000. The September downturn was driven largely by small businesses, with job cuts spread across multiple sectors. The steepest reductions occurred in professional and business services as well as leisure and hospitality, signaling broader weakness in labor demand across the private economy.

Mortgage Rates Ease Slightly but Offer Limited Relief to Homebuyers

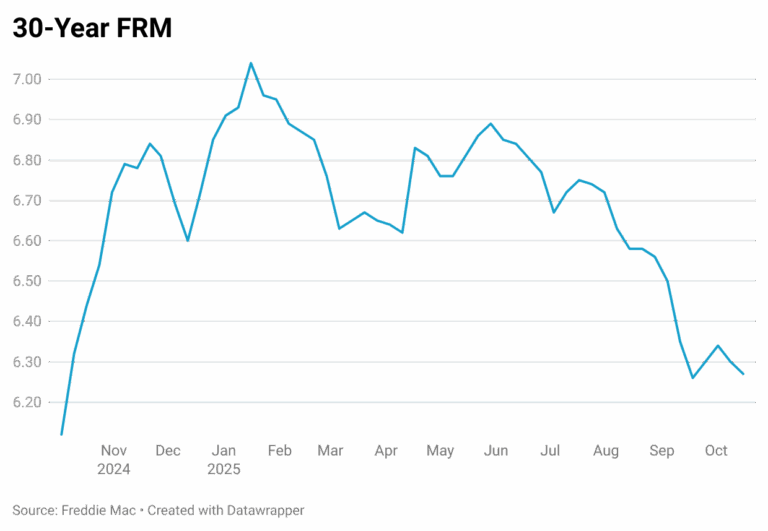

The 30-year fixed mortgage rate averaged 6.27% as of October 16, 2025, according to Freddie Mac, roughly 20 basis points lower than the 6.44% recorded a year earlier. While this marks one of the lowest levels of the year, the modest decline offers little meaningful relief to potential buyers. With the median U.S. home price rising from $414,000 in August 2024 to $422,000 in August 2025, the benefit of lower rates is largely offset by higher property values. For buyers making a 20% down payment, estimated monthly mortgage payments remain nearly unchanged.

Economic uncertainty further complicates the picture. Persistent inflation pressures and a softening labor market continue to weigh on consumer confidence, leaving many would-be buyers hesitant to take on large financial commitments.

Mortgage rates began to edge lower in July, ahead of the Federal Reserve’s September decision to cut its benchmark rate for the first time in a year amid rising concerns about employment. Policymakers signaled two additional cuts before the end of 2025 and one more in 2026. However, further Fed rate reductions may not directly translate into lower mortgage rates, since long-term borrowing costs are influenced more by movements in the 10-year Treasury yield than by short-term policy adjustments.

Homebuilding Activity Weakens as Oversupply Weighs on Construction

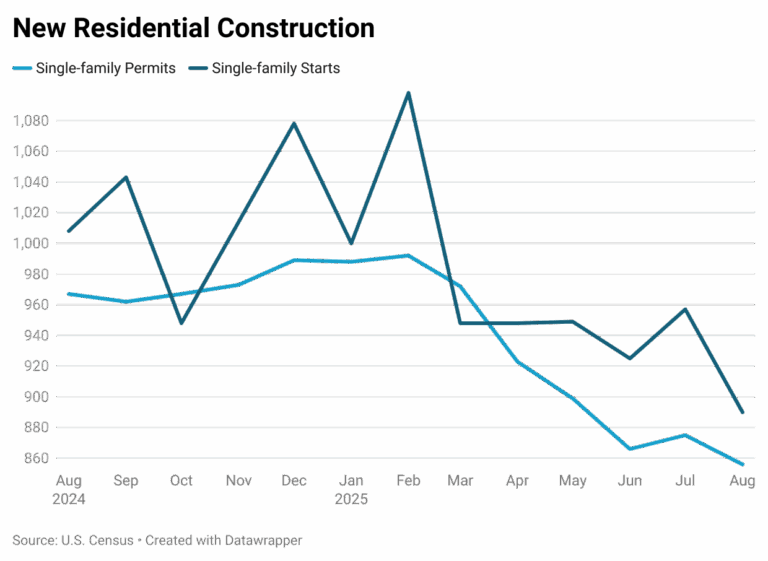

U.S. single-family housing starts fell 11.7% year-over-year in August 2025, reaching their lowest level in roughly two and a half years, according to government data. The decline reflects a growing inventory of unsold new homes, signaling that residential construction may continue to act as a drag on the broader economy in the third quarter.

Building permits, a leading indicator of future construction, also declined, dropping 11.5% from a year earlier to their lowest point in more than two years. This pullback is partly intentional, as builders work to rebalance supply amid high inventories.

Home construction has been losing momentum over the past few years as developers face an oversupply of newly built homes. Even though borrowing costs have eased modestly in recent months, analysts expect construction activity to remain subdued until the excess inventory clears.

In contrast, new single-family home sales surged in August to their highest level in more than three and a half years. However, many view this jump as anomalous rather than a sign of renewed strength. The Commerce Department, which released the data, cautioned that housing figures tend to be highly volatile and subject to revisions. Moreover, the uptick in sales diverged from persistently weak homebuilder sentiment and came amid a softening labor market, which could limit any sustained rebound in demand.

Midwest Strength, Sunbelt Struggles in Veros Forecast

Veros’ Q3 2025 VeroFORECAST℠ projects a 1.8% rise in U.S. home prices over the next year as the housing market faces forces of high prices, tight supply, and weaker demand. The report highlights strong growth in affordable Midwest and Northeast metros and continued softness in Sunbelt markets weighed down by affordability and oversupply.

Discover which markets are poised to lead and which could struggle in the year ahead.

About Reena Agrawal, Senior Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.