It was one of the fastest growing markets in 2021 and is now expected to be one of the worst performers in 2023.

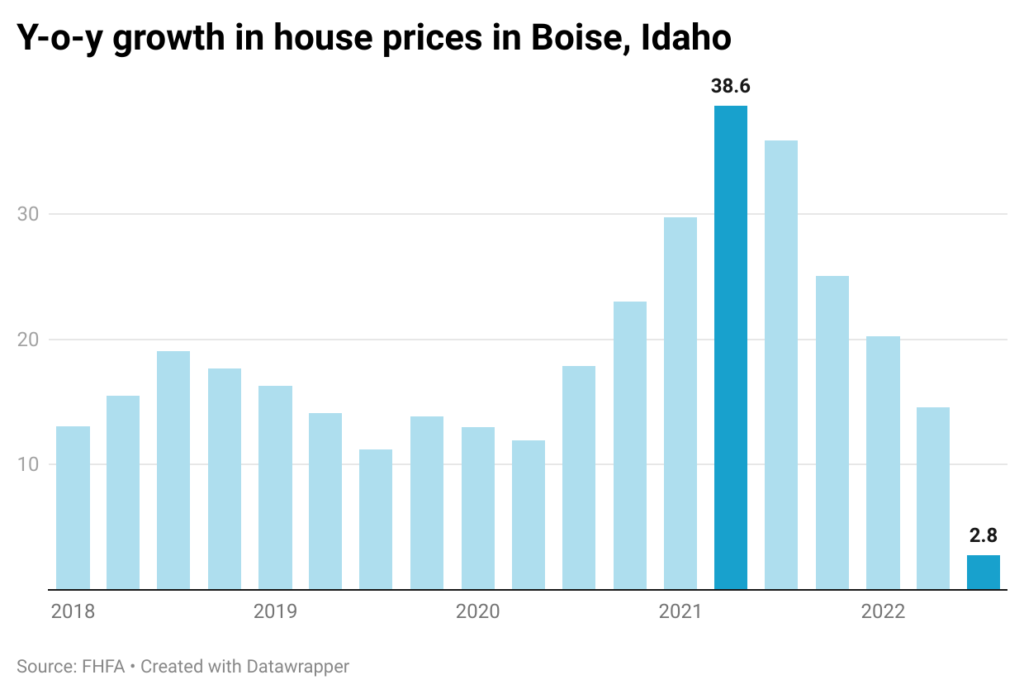

Home prices in Boise, Idaho rose rapidly after the pandemic hit, climbing 38.6% y-o-y from Q2 2020 to Q2 2021. Remote work fueled demand from families wanting to move out of high housing cost states such as California to smaller cities providing cheaper housing, lower taxes, more space, and great outdoors. The sharp growth in the housing market in Boise in 2020-2021 was due to high demand and limited inventory. The high growth in home prices in 2021 was mirrored by a rapid deceleration in 2022, with price growth slowing down to just 2.8% y-o-y from Q3 2021 to Q3 2022.

What changed in Boise?

The sharp rise in prices in 2020 and 2021 dimmed the attractiveness of Boise as a low-cost destination, turning it into one of the most unaffordable markets relative to its median income. The rise in prices was not only due to the high demand, but also because of limited supply. Demand was high due to rock bottom mortgage rates and high in-migration because real estate was very affordable in Boise. Homes sold fast and way above the asking price. A study by Oxford Economics (2021) that looked at whether a city’s median income household could afford a median-priced home, found that the Boise median priced home ($534,950) was 72% above what a median income household (single person median household income was $52,700 and two-person median income was $60,200) could afford. Following Boise, the other least affordable housing markets in the U.S. in 2021 were Portland, Las Vegas, San Jose, and Los Angeles. On the other end of the spectrum, the most affordable markets were Chicago, Columbus, Atlanta, Raleigh, Dallas, and Nashville.

Fitch ratings estimated Boise City to be the most overvalued Metropolitan Statistical Area (MSA) among the top 100 most populated MSAs in Q4 2021. According to a report by Boise Regional Realtors “Boise metro’s price growth was the highest in the country over the past four years.” Many first-time buyers and locals were priced out of the market in the face of intense competition and started moving out.

With rising unaffordability, even the number of out of state buyers has diminished as many can no longer afford the high-cost homes at the high mortgage rates. As a result, people have started seeking other destinations to buy homes, such as Texas, Florida, Tennessee, and the Carolinas. In 2021 according to northAmerican moving company, Idaho was the number-two top inbound state, but in 2022 it did not feature in the top ten. According to moveBuddha data “interest in Idaho has waned.” In 2020 there were 320 moves into Idaho for every 100 moves out. That inflow has since dropped significantly; in 2022 there were 123 moves into Idaho for every 100 out — a 61.6% decrease in inflow, the largest drop in the nation.

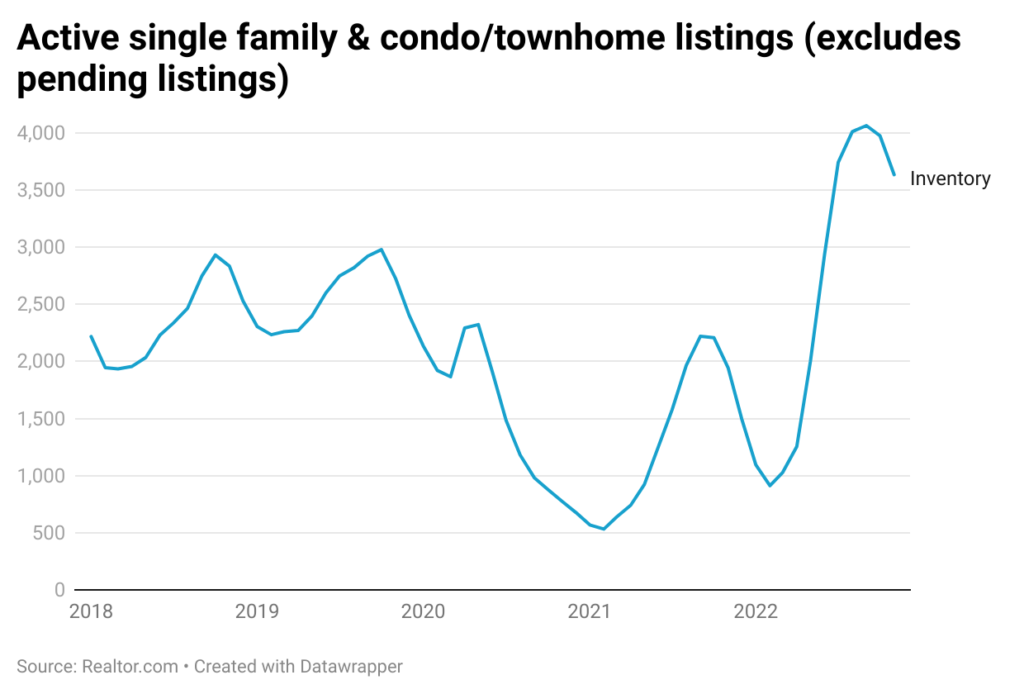

Due to the sharp tapering-off in demand, the supply situation has improved. This has eased competition in the market. The market is witnessing a significant shift. Inventory in Boise was just 532 in February 2021 at the height of demand, but since then has increased and was at 3,633 in November 2022. Buyers are now able to negotiate contingencies and closing costs. So, “Not even the billionaire Kardashians can keep the Idaho housing bubble from popping” (Forbes, Jan 6, 2023) because of waning demand and rising unaffordability; the VeroFORECAST predicts that Boise will be the 6th worst performing city over the next 12 months, with home prices expected to depreciate by 5.8% from Q4 2022 to Q4 2023.

About Reena Agrawal, Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.