Evaluation and Virtual Inspection Delivered With a 4-Hour Turn Time

How does home evaluation with virtual inspection work?

Discover the Value of a Home in Just 4 Hours with Our Expert Evaluation Service

The eVAL 4 Hour turn-time Virtual Inspection combines our inhouse evaluation and virtual inspection services, which includes interior and exterior photos, and are completed in a 4-hour timeframe to meet your efficient, reliable valuation needs. The evaluation and virtual inspection process uses inhouse, highly trained real estate analysts to connect directly with homeowners to virtually inspect the property to determine the most accurate valuation of the property. This approach provides a more cost-effective and readily available solution for lenders, especially those looking to streamline home equity lending.

Home Equity Lenders Benefit from Speed, Accuracy and Interagency Compliance

While most home equity evaluations are exterior-only, video allows analysts to see inside the home, so borrowers can show interior updates that should result in the most accurate home valuation.

Virtual inspections reduce the time needed to collect home data while still meeting the lender’s underwriting requirements.

Homeowners Benefit Too!

Homeowners benefit from direct involvement in the property information collection process. The homeowner/borrower connects with an experienced analyst through their mobile device from a simple text and directly provides all the important information about the property via video.

Veros and Valligent Elevate the Home Evaluation Process To New Levels!

A process that used to take days now only takes hours for lenders to get a detailed report after connecting with their borrowers. The decreased turnaround time significantly improves convenience for everyone involved. With many people continuing to work remotely or hybrid, homeowners benefit because the evaluations can be done anytime while they are home.

In the Time It Takes to Watch A 4 Hour Netflix Series, You Can Have a Complete Evaluation

Order Evaluation Now

Virtual Inspection Scheduled (1 Hour)

Virtual Inspection Conducted (1 Hour)

Compliant Evaluation Completed (2 Hours)

eVAL-4 Hour Virtual Inspection is the fast, convenient way for lenders to make a collateral decision with the most comprehensive, accurate, interagency-compliant Evaluation available. You will be able to:

Increase your pull-through rate of closed loans

Solidify customer and member commitment to the loan

Provide an amazing customer and member experience

Save Time. Save Money. Create a Better Connection with Homeowners/Borrowers. Find out more about the eVAL-4 Hour Virtual Inspection today.

To Speak To Our Sales Team

866-458-3767 Option 2

Featured News & Insights

Reconsideration of Value Reality Check Heading into 2026

Reconsiderations of Value (ROVs) have evolved from occasional issues to ongoing compliance priorities for lenders. With new interagency guidance and transparency requirements reshaping operations, managing ROVs efficiently is essential. Discover how tools like iVALUATION help lenders strengthen compliance, reduce delays, and stay ahead heading into 2026.

AVMs Explained: How Machines Value Homes

In Episode 7 of RiskWire: On the House, Veros’ Economists discuss a topic not covered before on the podcast – Automated Valuation Models (AVMs). They explain what AVMs are, how they are used across the industry, and what the future looks like for these valuation models.

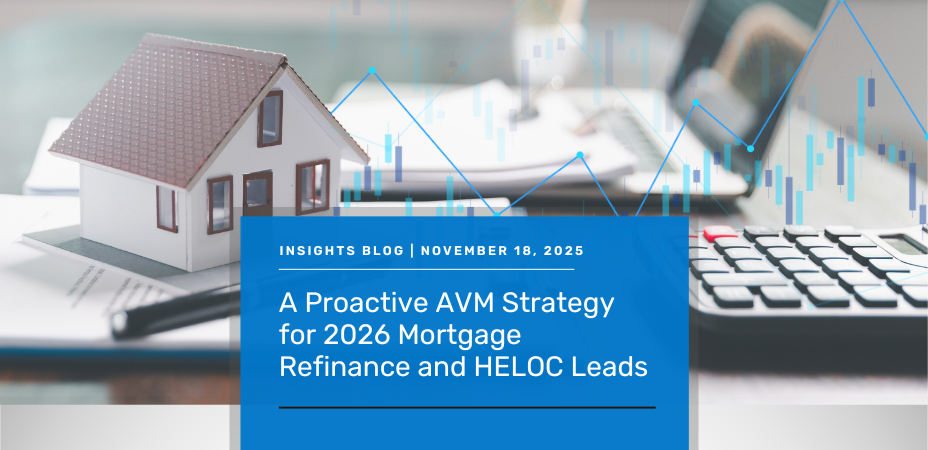

A Proactive AVM Strategy for 2026 Mortgage Refinance and HELOC Leads

As traditional marketing costs rise, the smartest lenders are moving past reactive lead generation. They’re using AVM data at scale to anticipate refinance and HELOC opportunities, turning equity into actionable insight. Learn the three key ways to build a stronger, more efficient pipeline for 2026.