Eric P. Fox – Chief Economist, Veros Real Estate Solutions

Drew Rumfola – Economics Intern, Veros Real Estate Solutions

The 2021 Hurricane Season is in full swing with 13 named storms thus far in the Atlantic with 3 storms currently active. Hurricanes are one of the costliest natural disasters due to the significant impact and property damage on the areas that are hit. One question that naturally arises is how do hurricanes impact home prices after they hit? The answer may be surprising.

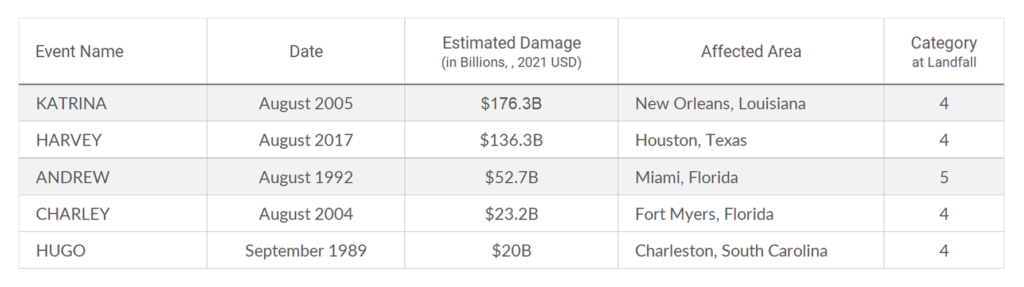

To investigate, we looked at a list of the 20 most expensive hurricanes on record (adjusted for inflation) in the US from the last 32 years. We then narrowed the list to the most powerful hurricanes that were either category 4 or 5 storms. Finally, to best assess the subsequent impact on house prices, the list was further reduced to those storms making landfall near large population centers. From these criteria, five Hurricanes were selected: Katrina, Harvey, Andrew, Charley, and Hugo. The details for each of these five storms are shown in the Table below:

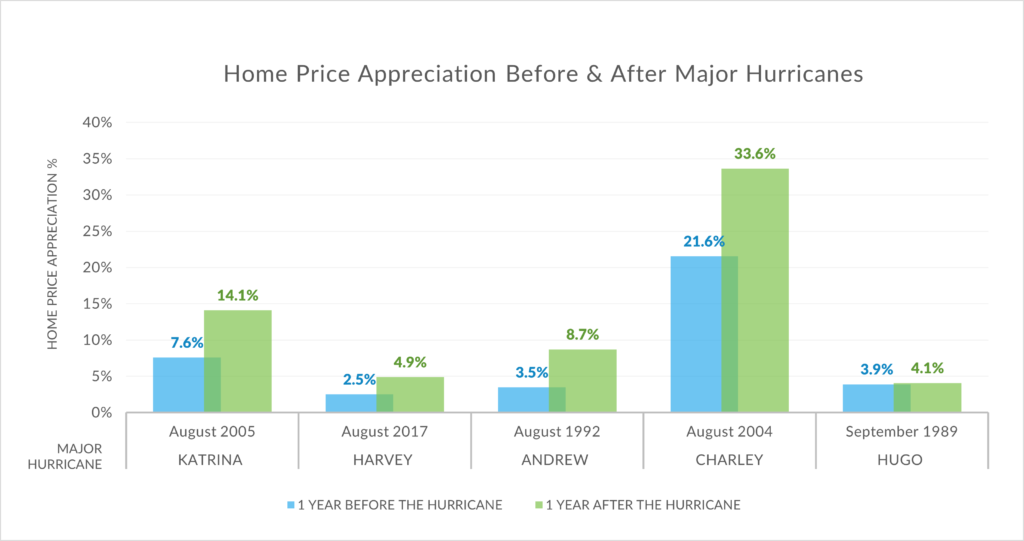

We evaluated the appreciation of house prices in the respective cities that were impacted, which led to some interesting conclusions. All the cities that experienced these massive hurricanes experienced higher levels of home value appreciation in the year after the storm than the year before. For example, the year prior to Katrina hitting New Orleans, the city experienced 7.6% appreciation, whereas the year following the storm, appreciation soared to 14.1%, according to VeroHPI. Likewise, after Hurricane Andrew, Miami’s appreciation went from 3.5% annually prior to the storm to 8.7% the year following. For these five storms, the post hurricane annual appreciation ranged from a low of 0.2% to a high of 12% more than the annual appreciation in those markets prior to the storm. On average, the “boost” in appreciation for these five markets in the year following the hurricane was 5.3%.

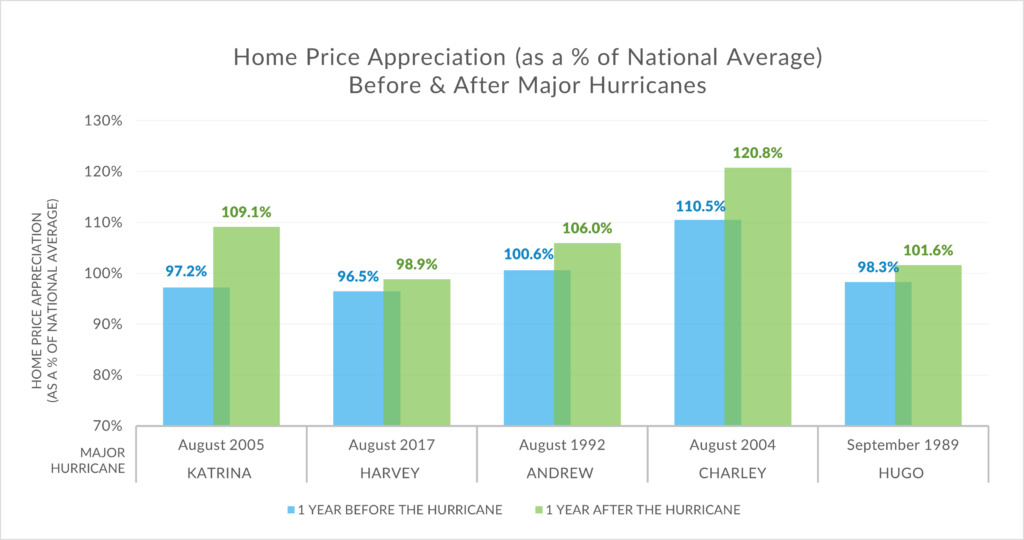

There may have been other factors impacting house prices in the year prior to and the year following the hurricanes that were unrelated to the hurricane itself. For example, house prices might have been going up rapidly in a given market simply due to an overall seller’s market in that city at the time of the storm. This was certainly the case with Ft. Myers in 2004 during Hurricane Charley. To mitigate the effect of other factors outside of the hurricane and to normalize the appreciation statistics, the appreciation of each city pre- and post-hurricane was taken as a percentage of the US national average appreciation during the same timeframes. Overall, the same trend is observed. For example, in the year prior to Katrina, New Orleans had appreciation of 97% of the US average appreciation. In the year after Katrina, the average appreciation skyrocketed to 109% of the US average – an increase of 12%! For these five storms, the post hurricane annual appreciation (as a percentage of average US house price appreciation) ranged from a low of 2.4% to a high of 11.9% more than the annual appreciation in those markets prior to the storm. The average increase was 6.6% Thus, both methods of analyzing the data show the same results.

At first blush, this may seem like a surprising result, but it all comes down to supply and demand. People whose homes have been severely damaged have to find a new place to live in the short term while their home is being repaired. This causes demand to increase for an existing pool of housing inventory. Likewise, some of the inventory of homes to purchase will have been damaged by the storm thereby reducing the supply. Increased demand and reduced supply for an asset means (all other things being equal) that there will be upward price pressure. Thus, post-hurricane housing markets follow classic economic theory.