- Residents and businesses continue recovery after tornado activity on March 2-3, 2020

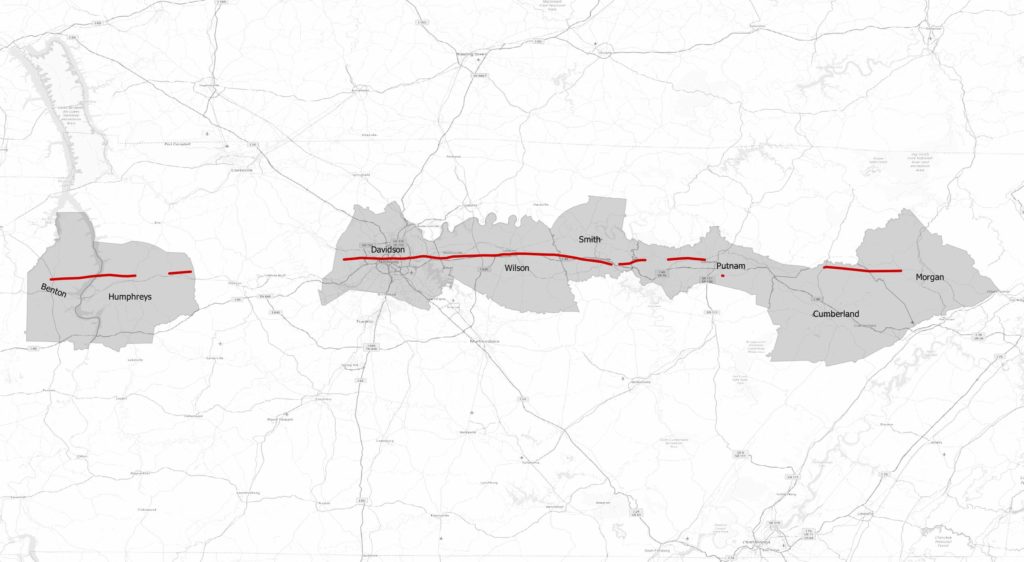

- Property level impact occurred in eight counties: Benton, Cumberland, Davidson, Humphrey’s, Morgan, Putnam, Smith & Wilson

- The estimated market value of the potentially damaged properties exceeds $3.5B

SANTA ANA, Calif., March 19, 2020—Veros Real Estate Solutions, an industry leader in enterprise risk management and collateral valuation services, today released data analysis showing 11,519 single-family homes in Nashville, Tenn. and surrounding areas which have likely been impacted by the destruction of the recent tornadoes in the area. Utilizing public records, proprietary data and mapping technology, combined with the predictive analytics of its VeroVALUESM AVM, the Veros Disaster Data solution identified the potential impact of this natural disaster down to the individual parcel-level. This information is now available in an Impact Brief to lenders, servicers, and investors who must make determinations about possible damage to impacted properties in their portfolio.

Since the tornadoes struck Tennessee on March 3, Veros performed its analysis that indicates the total market value of the homes impacted could reach $3.529B.

Tornadoes of this magnitude, EF-2, EF-3 and EF-4, can cause significant property damage when they impact neighborhoods and business districts in their path. The resulting exposure may include disruption of access, full or partial loss of occupancy, and temporary degradation of the home value until the property can be restored. Because of the disparate path that a tornado can travel, the damage can be devastating to some properties while others are spared entirely. Understanding the difference from an economic perspective can mean thousands of dollars spent, or saved, on property inspections.

“The Tennessee tornadoes were devastating to human life, properties and businesses,” said Darius Bozorgi, President and CEO of Veros. “Veros is committed to providing the data-driven insight that identifies the potential impact on people and properties so that servicers can direct their outreach to those most in need.”

Tennessee was not the only state that experienced weather-related damage in recent weeks. Between February 10 -14, damage occurred in other Southern states as a result of flooding along the Pearl River, with the most significant damage in Mississippi. Veros is on the forefront to also offer this data and insight, so those impacted can be rapidly supported.

Click Veros Disaster Data Solution for more information.

About Veros Real Estate Solutions

A mortgage technology innovator since 2001, Veros is a proven leader in enterprise risk management and collateral valuation services. The firm combines the power of predictive technology, data analytics, and industry expertise to deliver advanced automated solutions that control risk and increase profits throughout the mortgage industry, from loan origination to servicing and securitization. Veros’ services include automated valuation, fraud and risk detection, portfolio analysis, forecasting, and next-generation collateral risk management platforms. Veros is the primary architect and technology provider of the GSEs’ Uniform Collateral Data Portal® (UCDP®). Veros also works closely with the FHA to support its Electronic Appraisal Delivery (EAD) portal. The company is also making the home buying process more efficient for our nation’s Veterans through its appraisal management work with the Department of Veterans Affairs. For more information, visit www.veros.com or call 866-458-3767.

Media Contact

Brian Fluhr

Vice President of Marketing

bfluhr@veros.com or communications@veros.com