The once-sizzling housing market of 2020-21 seems like a distant memory as 2024 unfolds. What was a frenzy of bidding wars and record-low inventory has morphed into a more cautious landscape, marked by high mortgage rates and stubbornly low supply. This shift presents a complex challenge for both homebuyers and sellers.

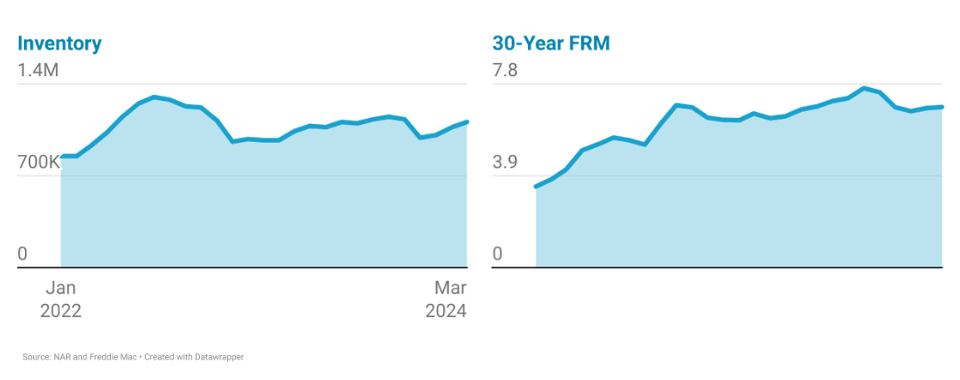

The Federal Reserve’s efforts to combat inflation have led to a significant rise in mortgage rates. In April 2024, the 30-year fixed-rate mortgage averaged above 6.9%, according to Freddie Mac®. This is a stark contrast to the historic lows of sub-3% rates witnessed in 2020-21. Elevated rates have constrained both housing supply and demand. Many homeowners purchased or refinanced their homes during the period of historically low mortgage rates, often below 3%, and are hesitant to sell because if they buy a new home, they will need to secure a mortgage at a much higher rate, leading to a significant increase in their monthly payments. This reluctance to sell keeps the available housing inventory well below pre-pandemic levels, although it increased from 0.97 million in March 2023 to 1.11 million in March 2024. While life-stage moves, job relocations, and financial pressures can still prompt some sellers into the market, the overall number remains low compared to a more balanced environment, keeping inventory tight.

Moreover, new construction has slowed as builders contend with escalating material costs and labor shortages. This dynamic exacerbates the imbalance between demand and supply, perpetuating elevated prices in the housing market.

Despite increasing unaffordability, there are buyers in the market, who remain competitive for available options, even at higher prices and interest rates. The healthy job market, characterized by low unemployment, provides confidence to potential buyers in their ability to afford a home, albeit with some being priced out of the market due to elevated rates and prices.

Forecasts of mortgage rate decreases in 2024, driven by expectations of Federal Reserve rate cuts, have not materialized. Uncertainty surrounds the Fed’s rate cut timeline, with analysts delaying expectations amid persistent inflation and a robust labor market. Inflation has remained stubbornly high above the Federal Reserve’s target rate throughout 2023 and into 2024. The Federal Reserve’s main objective is to achieve price stability, and until they see inflation falling closer to their target rate, they are unlikely to consider lowering interest rates. The US job market has remained robust, with unemployment rates staying below 4%. This indicates strong economic activity and upward pressure on wages, which can further contribute to inflation. Consequently, the likelihood of a rate cut in 2024 has diminished, with little indication of mortgage rates dipping below current levels.

Furthermore, according to Freddie Mac, mortgage rates increased from 6.62% in early January to 7.10% on April 18, 2024. This increase comes as the spring 2024 buying season is unfolding, when typically, the number of homes listed for sale increases. With not much change expected in rates or home prices, the current stagnant housing market is likely to carry on through 2024.

About Reena Agrawal, Senior Research Economist

Reena Agrawal received her PhD in Economics from Vanderbilt University and MA in Economics from The Ohio State University and has several years of industrial experience in economic research and analysis.