HAS YOU COVERED

impacted with Veros's Disaster Vision.

VEROS HAS YOU COVERED

with Disaster Vision.

VEROS HAS YOU COVERED

Disaster Vision

The Property & Portfolio Insight You Need

When Natural Disasters Strike.

It’s not a question of if a natural disaster will strike, but when. Is your business—and your customers—truly prepared to withstand the impact? Disaster Vision provides critical real estate property and portfolio insights, helping you assess potential risks and navigate recovery with confidence. With our data, you can mitigate damage, strengthen resilience, and emerge even stronger after a disaster

The Property-Level Insight

Mortgage Originators & Servicers Need

Mortgage Origination

- Pinpoint properties where appraisals and the mortgage origination workflow has already started

- Prioritize origination opportunities within Federal Emergency Management Agency (FEMA) declared counties

- Base origination decisions at the property-level

Mortgage Servicing

- Prioritize property inspections based on their location to the core and buffer zone of the disaster

- Enhance property owner relations by proactively identifying at-risk loans and rapidly initiating contact

- Instantly assess portfolio impact based on data

Identify Commercial Property Losses Quickly

Veros Now Offers Commercial Property Insight Following a Natural Disaster

Actionable data is now available to commercial builders and commercial real estate owners to identify losses more quickly after disaster strikes

Disaster Vision Fills the FEMA Gaps To Pinpoint Properties Likely Impacted.

When disaster strikes – be prepared with the parcel-level information on how much – if at all – a specific property and your portfolio is impacted by a hurricane, wildfire, earthquake, flood or other disaster. Having access to this property level disaster provides you with a distinct advantage. When natural disasters strike, FEMA declares “disaster areas” to help speed assistance to impacted homeowners. But disaster area designations cover entire counties and flag every property in them, even though the disaster may have affected a small portion of properties. Sorting through the fog of disaster to get to the actual properties impacted results in loan-funding delays and necessitates costly property inspections at the portfolio level.

The Disaster Vision Advantage

Veros’s Disaster Vision solution reports disaster impact at the parcel level, quickly leveraging geospatial data to map a core disaster polygon and surrounding buffer zone. It then locates the impacted properties within the polygon by lot boundary, zip code, and by physical address. So, you’ll know exactly which properties are likely impacted. And armed with this information, you will have the insight you need to:

- Identify potentially damaged and high-risk properties

- Prioritize property inspections based on their location to the core and buffer zone of the disaster

- Accelerate clear-to-close time for unimpacted properties in the flagged disaster area counties

- Base risk-based decisions on the most current disaster status information

- Enhance property owner relations by proactively identifying at-risk loans and rapidly initiating contact

- Maintain compliance with the Government Sponsored Enterprises’ (GSEs) disaster policy regulations

Disaster Vision is available on a “match and append” basis. It can also be delivered as a supplementary data set within our VeroVALUE AVM reports on a per-property basis.

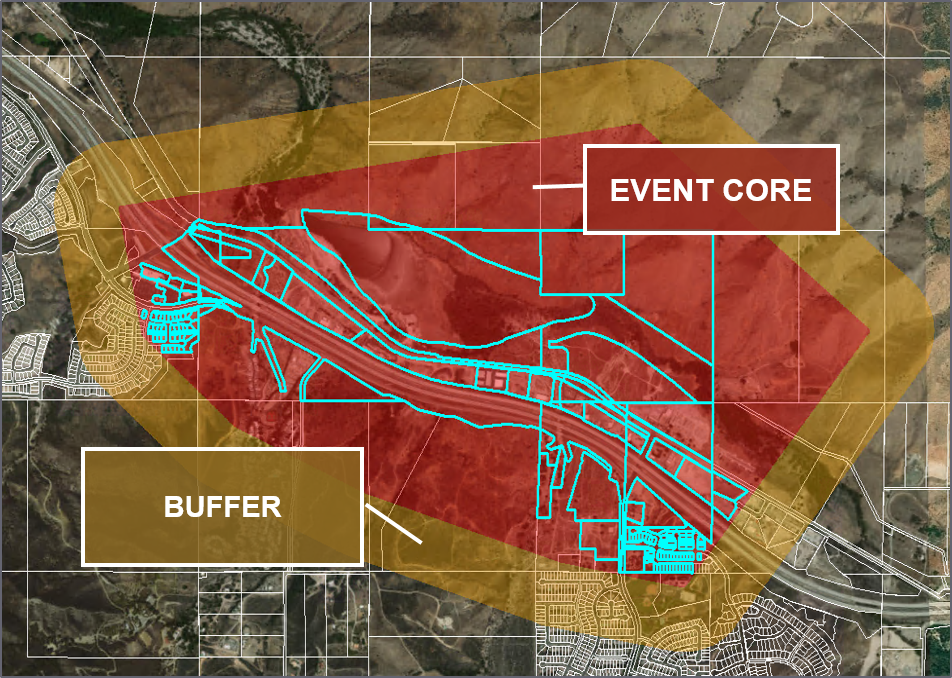

The Core and Buffer Zones

The disaster data set from Veros combines data and satellite imagery from multiple sources in near real-time, indicating whether or not a specific parcel has been affected by the disaster. This disaster data provides accuracy more precise than Federal Emergency Management Agency (FEMA), which uses county boundaries for its designations. Using parcel boundaries, latitude and longitude, address information and more, Veros creates two geographic areas that pertain to a disaster event: residential and commercial properties in the Core (inside the event) and properties in the Buffer (within ½ mile outside of the core). If a property is located within the core or the buffer, it is not implicit that there is damage, but rather, an indication of the likelihood that a property may have experienced damage. The total VeroVALUE is based on the total market value of the impacted residential properties.

The Disaster Vision Difference

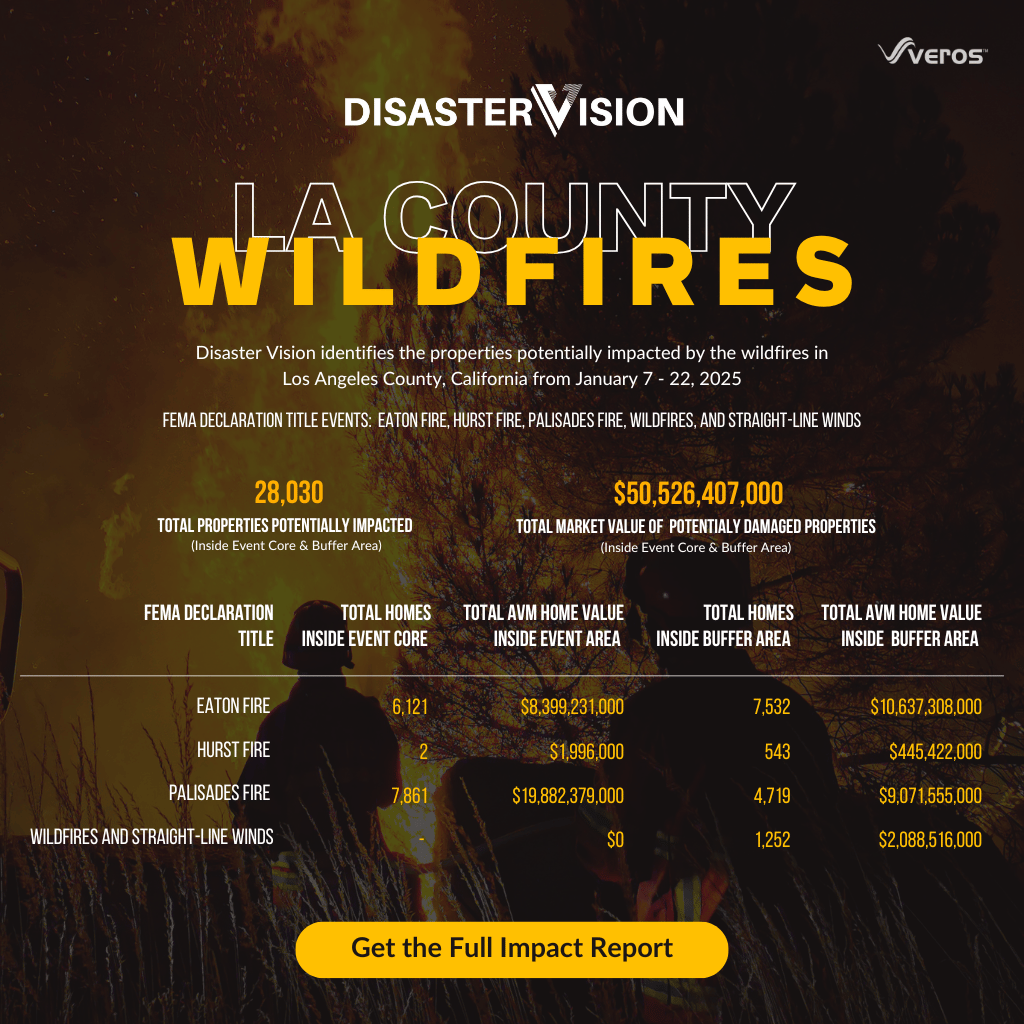

The aftermath of the devastation in Palisades, Eaton, and Hurst wildfires in Los Angeles County, highlights the importance of disaster preparedness. The Disaster Impact Review of these fires highlights the potentially impacted properties in detail, so you know what you’re up against.

With Disaster Vision, we provide lenders and investors with critical data, helping them navigate the aftermath and emerge stronger.

Veros Real Estate Solutions identified over 28,030 residential properties potentially impacted by the LA fires, and of that 13,984 were identified to be inside the event core. The damage to these homes resulted in an estimate total market value of $50.5 billion based on the predicative analytics available through the VeroVALUE AVM. Download the full report to learn more.

Four Ways to Access Disaster Vision

VeroSELECT

Disaster Vision is available to order one property at a time through the VeroSELECT API or as an add-on to Veros’ VeroVALUE™ AVM via the VeroSELECT UI.

Monitoring

A portfolio of properties is provided to Veros and monitored daily, pushing alerts to the client on any potentially impacted properties via an agreed-upon location.

Match & Append

Provide a list of potentially impacted property addresses to run through Disaster Vision. Veros returns data on potentially impacted properties via an agreed-upon location.

Snowflake® Data Marketplace

Easily access Disaster Vision residential and commercial real estate property-specific disaster data for most declared natural disasters through the Snowflake Data Marketplace, which offers a seamless data-sharing experience with no data transfer or integration requirements, enabling users to access live, ready-to-query data for informed decision-making. To learn more, visit Veros’ Disaster Vision listing on Snowflake.

When Disaster Strikes…

How Strong is Your Portfolio?

Veros Knows. Now You Can Too.

Plus, once you discover if a property is within the actual disaster area and may be affected, you will want to know if any actual damage occurred. Valligent’s ValINSPECT Disaster is the perfect solution to obtain a property’s.

Don’t wait for a natural disaster to strike.

Veros is prepared to help you today.

To Speak To Our Sales Team

866-458-3767 Option 2

Disaster Vision Impact Reports

Disaster Vision Tracking

Veros Disaster Vision is actively tracking and working to pinpoint the residential and commercial properties at risk with Veros’ Disaster Vision—an essential tool providing mortgage originators and servicers with property-level insights when natural disasters occur.