Make Mission-Critical Housing Finance Decisions with Advanced Valuation & Risk Management Solutions

Property Valuations | Data & Analytics | Risk Management

Efficient, Cost-Effective, Data Driven

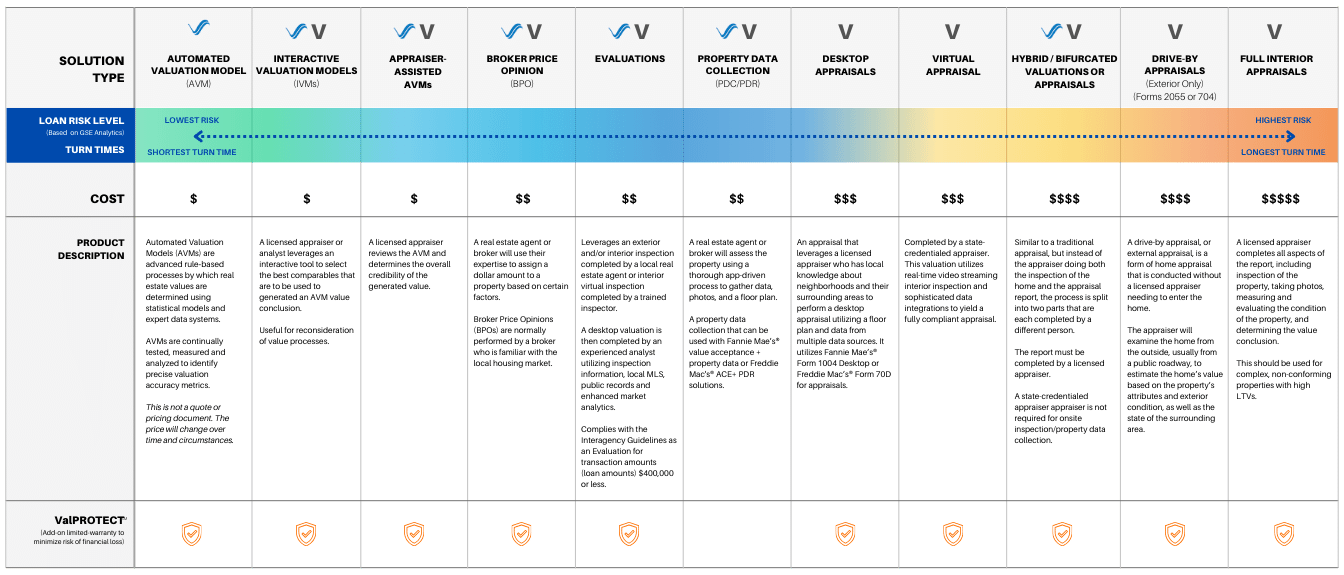

Comprehensive end-to-end solutions tailored for housing finance professionals, ensuring support throughout the entire valuation process.

Home Equity Lenders:

Reduce Risk, Cut Valuation Costs

Learn what high-impact home equity valuation solutions there are to use for home equity lending. Everything from traditional and alternative, to cutting-edge tools.

Tools to Help Drive Home Equity Lending Excellence

Valligent offers reliable and timely valuation tools that empower home equity lenders to make pivotal decisions. Here’s a quick look at some of the top-rated solutions.

VeroVALUE + ValINSPECT

eVAL

ValPRAZE

Virtual Valuations

VeroVALUE + ValINSPECT

eVAL

ValPRAZE

Virtual Valuations

Simplify ROV Research with iVALUATION

Transform how you handle property valuations with iVALUATION—a dynamic platform designed for swift, accurate property analysis. Effortlessly assess valuation complexity to choose the best method and streamline Reconsideration of Value (ROV) claims with up-to-date, reliable data.

- Easily navigate through up to one hundred comparables.

- Edit or add missing data to refine comps and values.

- Access listings, public records, analytics, and AVM confidence scores.

VeroVALUE AVM: Fair, Accurate and Compliant

New AVM Compliance Guide

AVM Study on Bias

AVM Study on Historical Redlining

Nationwide Appraisals You Can Trust

Valligent provides reliable appraisal services nationwide for all real estate lending needs. The AMC excels in valuing rural and unique properties with precision. 1004 appraisal reports undergo rigorous quality checks, combining human review with Veros’ BiasCHECK tool. Valligent upholds the highest standards and quality of customer service.

Rural & Unique Properties

Human Review + BiasCHECK

ValPROTECT Warranty

Natural Disaster Real Estate Intelligence

Curious about how to prioritize properties for post-disaster inspections and quickly assess damage to keep loan closings on track or estimate repair costs? You’re in the right place. Explore three powerful post-disaster tools below.

Disaster Vision

ValINSPECT Disaster

Virtual 1004D

Get the Latest Housing and Economic Insights with RiskWire.com

Learn what high-impact home equity valuation solutions there are to use for home equity lending. Everything from traditional and alternative, to cutting-edge tools.