Empowering Confident Real Estate Decisions

with a Full Suite of Valuation Solutions

Property Valuations | Data & Analytics | Risk Management

Risk and Loss Mitigation Solutions for Mortgage Servicing

Designed for Efficient Portfolio Surveillance and Reviews

Amidst the dynamic landscape of mortgage servicing, Veros Real Estate Solutions (Veros®) and Valligent offer comprehensive valuation products and data analytics tailored to meet the needs of mortgage servicers.

Reduce Costs, Identify Opportunities and Mitigate Risks

Veros’ and Valligent’s innovative solutions play a pivotal role in lowering costs, uncovering opportunities, and mitigating risk for mortgage servicers. The mortgage servicing suite of solutions provide:

Current Condition Assessment

Gain actionable insights into the current condition of residential properties, enabling informed decision-making.

Accurate Property Values

Receive updated and accurate property values reflective of today's market dynamics, ensuring precision in assessment.

Market Analysis

Identify markets deserving attention for opportunities or risks, allowing proactive portfolio management.

Cost Reduction and Risk Mitigation

Harness the power of data-driven insights to lower costs and fortify risk mitigation strategies.

Tailored Solutions for Mortgage Servicing Needs

Mortgage servicers looking to enhance their loan management choose Veros and Valligent for:

Automated Valuation Models (AVMs)

Quickly obtain accurate home value estimates, reducing turnaround times and optimizing decision-making.

Collateral Risk Analysis

Assess and mitigate risks associated with collateral properties, ensuring portfolio stability and resilience.

Property Valuation Delivery

Receive timely and comprehensive valuation reports to expedite loan servicing processes.

Home Price Trends and Forecasts

Anticipate market shifts with in-depth home price trend analysis and reliable forecasts.

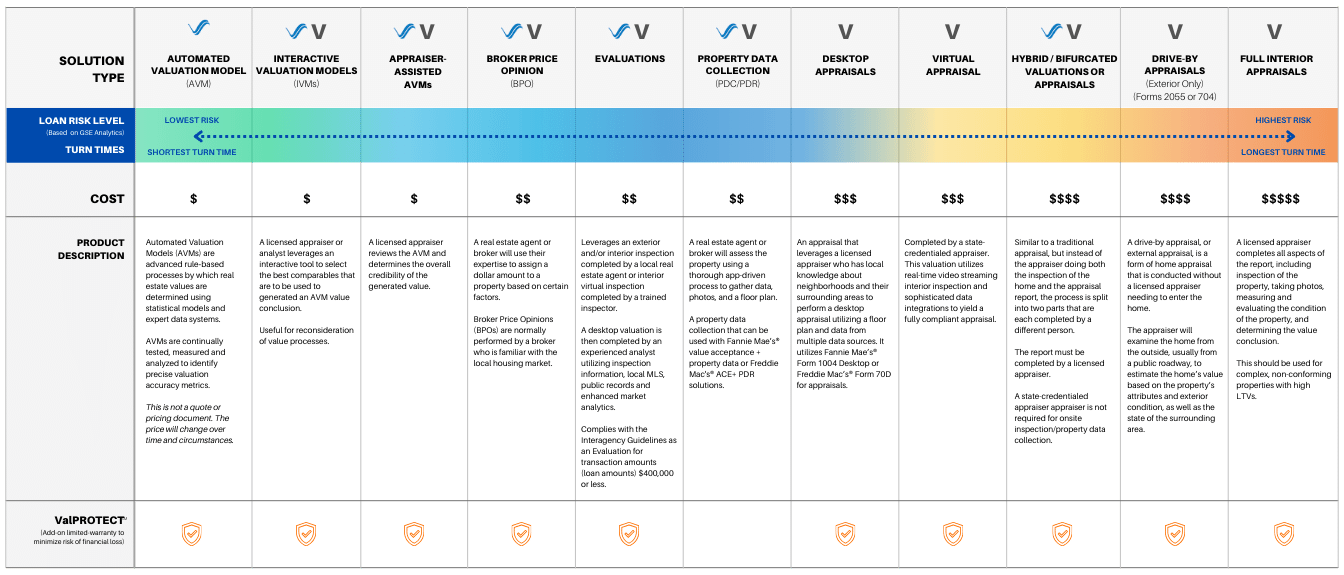

Diverse Array of Automated Valuation Models (AVMs)

Choose from a range of automated valuation solutions tailored to meet your specific needs:

VeroVALUESM AVM

Proprietary, on-demand AVM offering national coverage with consistent accuracy and meaningful confidence scores.

AVM Cascades

Customized AVM workflows, allowing for simple or highly sophisticated cascades.

VeroVALUESM Portfolio

Industry-leading tool for fast, accurate property valuation across a portfolio of properties.

VeroVALUESM REO

Essential for distressed properties, optimizing disposition timelines, and maximizing recoveries.

Innovative and Efficient Property Valuation Services

Maximize efficiency with valuation services that cater to diverse mortgage servicing needs:

Virtual Property Valuation Suite

From a property inspection to a comprehensive valuation report, this suite offers fast, accurate and convenient solutions with virtual inspections.

Broker Price Opinion (ValBPOSM)

A network of nationwide licensed professionals fulfills BPO’s faster and cheaper than traditional appraisals to assess residential property selling estimate.

Evaluation (eVALSM)

Property valuations for loan amounts under $400,000, aiding in loan modifications, meeting bank regulator requirements, and minimize financial risks.

Traditional Appraisals

Nationwide coverage for appraisals, including rural areas, meeting industry guidelines. Rigorous quality control includes BiasCHECKSM on 1004 reports.

Home Price Trends and Forecasts

Stay informed about home price trends and insights across the nation that may impact a loan portfolio.

VeroFORECASTSM

Gain pinpoint accuracy in forecasting home price changes at the zip code level, aiding strategic planning and decisions.

VeroHPISM (Home Price Index)

Access robust trending home price logic at national and local levels, facilitating informed decision-making.

Mitigate Risk of Financial Loss with ValPROTECT

Adding ValPROTECTSM to specific Valligent property valuation solutions provide guardrails to the potential financial loss on a defaulted loan due to flawed valuation.

Learn More Today!

Navigate challenges with confidence, optimize processes, and mitigate risks effectively.

Contact us today to discover how Veros and Valligent can support your servicing operations.